Executive Mandate: Why This Can’t Wait

The global energy sector is facing a seismic shift, driven by decentralization, digitization, and decarbonization. At the heart of this transformation lies Grid Edge Analytics Software, a critical enabler for utilities, grid operators, and energy service providers to optimize distributed energy resources (DERs), enhance grid reliability, and unlock new revenue streams.

Grid Edge Analytics refers to software solutions that process real-time data from grid endpoints – smart meters, solar inverters, EV chargers, and battery storage systems – to enhance visibility, predictive maintenance, and demand response.

Across the boardrooms of Europe’s utilities, Asia’s national grid operators, and the Americas’ energy regulators, one question dominates: How do we turn grid edge chaos into competitive advantage? The answer isn’t in another pilot program or vendor demo – it’s in treating grid edge analytics as the new operational backbone of your business.

The companies winning in this space aren’t just adopting technology – they’re rewriting market rules. If you’re leading an energy company in 2024 and aren’t actively deploying grid edge analytics, you’re not just behind the curve – you’re risking stranded assets, regulatory penalties, and eroded margins. The grid edge is no longer a future discussion – it’s over USD 4 billion operational necessity by 2030.

The Global Fracture Lines Demanding Action

1. The Asymmetrical Disruption Map

|

Region |

Critical Pressure Point |

2024 Tipping Point |

|

EU |

72GW of solar curtailment expected by 2025 |

ENTSO-E’s new imbalance pricing model |

|

APAC |

280 million new smart meters by 2027 (China + India) |

India’s RDSS program mandates analytics |

|

MENA |

40% DER penetration in GCC grids by 2030 |

Saudi’s WEC 2024 grid code revisions |

|

LATAM |

USD 23 billion in grid modernization commitments |

Brazil’s CPFL penalty structure changes |

2. The Cost of Being a Follower

-

-

- European utilities delaying edge analytics face €14/MWh imbalance penalties under revised ENTSO-E rules

- Japan’s TOPIX Electric Power Index shows 28% valuation gap between analytics adopters vs laggards

- Brazil’s ANEEL now claws back major unplanned outage costs from distributors

-

The regulatory frameworks you helped shape are now turning against the unprepared.

Strategic Plays by Region

1. Europe’s €9 billion Lesson in Proactive Adaptation

Case: Enel’s Grid Futurability Matrix

-

-

- Deployed edge analytics across 8 countries simultaneously

- Reduced SAIDI by in Italy while integrating 18GW of new renewables

- Key move: Pre-empted EU DSO Entity guidelines by 18 months

-

Actionable Takeaway:

In Europe, analytics isn’t about efficiency – it’s about maintaining your license to operate as a DSO.

2. Asia’s Great Analytics Divide

Winning Move:

-

-

- Tata Power’s Mumbai Leap

- Deployed edge-based fault detection

- Cut outage response from 47 minutes to 9 minutes

- Result: 23% increase in allowed ROE from MERC

- Tata Power’s Mumbai Leap

-

Losing Move:

-

-

- Jakarta’s 2-Year Pilot Trap

- 14 overlapping analytics proofs-of-concept

- Zero production deployments

- Now facing $120 million in penalty risks under new MEMR rules

- Jakarta’s 2-Year Pilot Trap

-

3. The Americas’ Hidden Battleground

Strategic Insight:

While the U.S. debates DERMS, Chile’s CEN has already:

-

-

- Automated 89% of DER dispatch decisions

- Reduced renewable curtailment by 62%

- Done so with 1/3 the IT budget of California IOUs

-

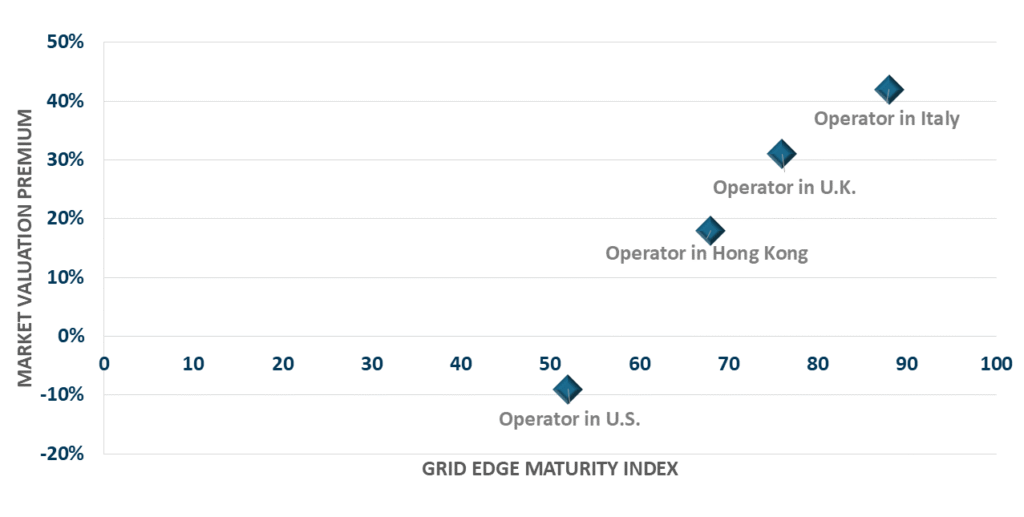

The Grid Edge Maturity Index vs. Market Valuation Premium

The Three Global Make-or-Break Decisions

Decision 1: Build, Buy, or Ally?

|

Approach |

Strategic Implications |

Best For |

|

In-House Build |

• Full IP control • 5-7 year roadmap alignment • Heavy legacy system dependencies |

National champions with: |

|

Vendor Suite |

• Faster compliance (NERC CIP, EU DSO Code) • Vendor lock-in risks • Higher TCO |

Regional players needing: |

|

Ecosystem Play |

• Pay-for-performance model • Limited customization • Dependency on partner roadmap |

Under-capitalized utilities requiring: |

Our Advisory Verdict:

-

-

- National champions → Build core competency

- Regional players → Partner with Siemens/Accenture

- Under-capitalized → Join OSGP or LF Energy collectives

-

Decision 2: The Cybersecurity Calculus

|

Global Threat Matrix |

||

|

Region |

Primary Risk | Leading Solution |

| EU | ENISA’s new OT protocols |

Airbus Cybersec DER Shield |

|

APAC |

State-sponsored attacks | Hitachi’s Quantum Encryption |

| Americas | Ransomware-as-a-service |

GE’s NERC CIP+ Suite |

Non-Negotiable: Must have real-time anomaly detection baked into procurement specs.

Decision 3: The Talent War Strategy

|

Global Salary Benchmarks (2024) |

|||

|

Role |

EU | APAC | Americas |

|

Edge Data Scientist |

€145k |

$98k |

$175k |

| DER Optimization Lead | €120k | $82k |

$155k |

Winning Moves We’re Seeing:

-

-

- ENGIE’s “Analytics Corps” rotation program

- JERA’s MIT Reverse Secondment model

- NextEra’s Acquisition-as-Hiring strategy

-

The Hidden Risk in Your Grid Edge Strategy

Most energy executives dramatically underestimate one critical factor: the coming data sovereignty wars. As grid edge deployments scale, regulators are quietly drafting rules that will determine:

-

-

- Who owns DER data (EU’s Data Act vs. India’s DPDP Bill)

- Where analytics must be processed (Brazil’s new in-country server mandates)

- How insights can be monetized (California’s proposed “community data trusts”)

-

What This Means for Your Organization:

✔ Compliance is becoming a competitive weapon

-

-

- E.ON’s German subsidiary gained 17% faster regulatory approvals by preemptively aligning with BNetzA’s edge computing guidelines

-

✔ Data localization requirements will reshape vendor selection

-

-

- Saudi’s SPPC now mandates on-premise analytics for all critical infrastructure – disqualifying cloud-only solutions

-

✔ The window for first-mover advantage is closing

-

-

- Australia’s AEMO is implementing increasingly stringent requirements for new virtual power plant (VPP) registrations in 2025 with real-time analytics thresholds

-

Immediate Action: Conduct a Data Sovereignty Stress Test across your operational markets. Our diagnostic has uncovered over $200 million in hidden compliance liabilities for a single Asian utility last quarter.

This isn’t just about avoiding penalties – it’s about turning regulatory constraints into market barriers against competitors. The utilities controlling this narrative will define the next decade’s energy rules.

Your 180-Day Global Playbook

Phase 1: The Brutal Prioritization (Days 0-30)

-

-

- Conduct Grid Criticality Heat Mapping (Satellite Load Profiling)

- Sunset any analytics project >18 months old without production impact

-

Phase 2: The Fast Path to Value (Days 30-90)

-

-

- Europe: Deploy dynamic line rating (see UKPN’s 19% capacity unlock)

- Asia: Implement AI-based theft detection (Philippines’ Meralco model)

- Americas: Launch regulatory sandbox (copy Chile’s quick-win approach)

-

Phase 3: The Long Game (Days 90-180)

-

-

- Negotiate vendor contracts with regulatory outcome clauses

- Establish cross-border knowledge hubs (modeled on Eurelectric’s DSO.AI)

- Place two contrarian tech bets (e.g., neuromorphic computing for edge AI)

-

Conclusion: The Strategic Inflection Point for Energy Leaders

The grid edge analytics revolution is no longer a question of if or when – it’s a matter of how decisively you act. The global energy landscape is bifurcating into winners and laggards, with analytics as the defining differentiator.

Key Imperatives for Leadership Teams:

-

-

- Move Beyond Pilots: The era of experimentation is over. Scale or risk regulatory penalties, customer defection, and stranded assets.

- Adopt a Global Lens: What works in Germany won’t suffice in India. Your strategy must be regionally precise but globally integrated.

- Treat Data as a Currency: The utilities dominating 2030 will be those that monetize grid edge insights, not just managing them.

- Rewrite Vendor Playbooks: Stop buying software – start buying guaranteed outcomes tied to KPIs like SAIDI reduction and DER ROI.

-

Will you be the disrupter – leveraging analytics to reshape tariffs, outmaneuver competitors, and lock in regulatory advantage? Or will you watch as nimbler players from Tokyo to Texas – redefine the rules of the game? The next 12 months will decide.

Request our proprietary Grid Edge Readiness Assessment or schedule an executive briefing to define your winning move.