Value-based Pricing

For decades, the cost-plus pricing model has been the default, comfortable choice for countless B2B businesses. It’s simple: calculate your cost of production and add a standard markup to ensure a profit. It feels safe, defensible, and straightforward.

But in today’s hyper-competitive and value-driven market, comfort is the enemy of profitability. Relying solely on cost-plus is a silent profit killer that leaves massive revenue opportunities on the table. It ignores the most critical factor in any commercial transaction: the perceived value your solution delivers to your customer.

The most sophisticated and profitable B2B companies have made a strategic shift. They have moved from internally focused cost-plus pricing to externally focused value-based pricing.

The Comfortable Trap: The Limitations of Cost-Plus Pricing

Cost-plus pricing calculates price based on an internal formula:

Cost of Production + Fixed Markup % = Price

While its simplicity is attractive, its flaws are profound:

-

-

- It Leaves Money on the Table: If your product delivers exceptional value that customers are willing to pay a premium for, cost-plus doesn’t capture it. You’re rewarding your efficiency, not your value.

- It Punishes Innovation: Investing in higher-quality materials or advanced R&D simply raises your cost base, forcing you to either raise your price (potentially making you less competitive) or absorb the cost, shrinking your margin. Innovation becomes a penalty, not a reward.

- It Fosters a Cost-Cutting Mentality: The only way to increase profit within this model is to cut costs, which can often compromise quality, customer experience, and long-term brand equity.

- It Makes You Vulnerable: If a competitor with a lower cost structure enters the market, they can easily undercut your price, leaving you with no strategic differentiator.

-

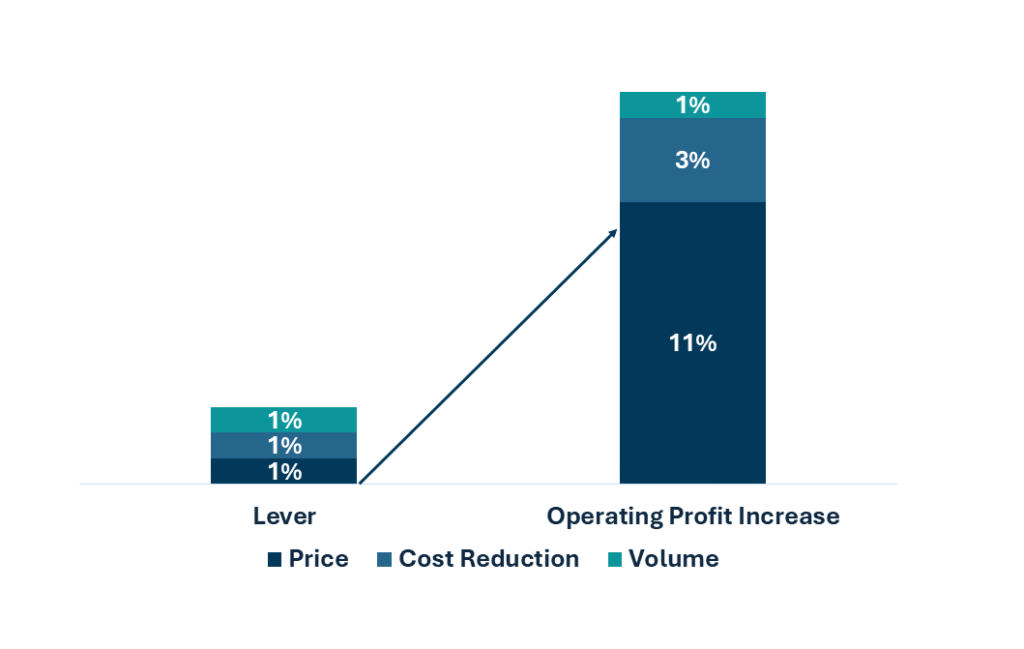

Our pricing experts found that a 1% price improvement, on average, translates to over 10% increase in operating profit, assuming volume remains constant. This leverage effect is far greater than similar improvements in variable cost (1% improvement → 3.3% profit increase) or volume (1% improvement → 1% profit increase). Cost-plus pricing fundamentally limits your ability to achieve this powerful price improvement.

The Profit Leverage Effect: Price vs. Cost & Volume

The Value Imperative: What is Value-Based Pricing?

Value-based pricing flips the script. Instead of looking inward at your costs, you look outward at your customer’s business.

Value-Based Price = The quantified economic value your solution creates for the customer

This model prices your product or service based on the measurable outcomes it delivers i.e. increased revenue, reduced costs, saved time, mitigated risk, or improved productivity for your client.

Example: Imagine you sell a SaaS platform that automates a manual process for a logistics company. Your cost to host the software is minimal.

-

-

- Cost-Plus: Might price it at $50/user/month.

- Value-Based: You discover the automation saves the company $50,000 per year in labor costs and reduces errors that cost another $20,000. The quantifiable value you create is $70,000 per year. Pricing your annual license at $30,000 feels like an incredible ROI for the customer and is far more profitable for you than the cost-plus model.

-

Why Make the Shift? The Tangible Benefits of Value-Based Pricing

-

-

- Higher Profit Margins: This is the most direct benefit. You capture a fair share of the value you create, leading to significantly healthier margins.

- Stronger Customer Relationships: When you price based on value, you transition from a vendor to a strategic partner. Your conversations shift from “here’s our price” to “here’s the ROI you can expect.” This builds trust and aligns your success with your customer’s success.

- Improved Product Development: To understand value, you must deeply understand your customer’s pains and desired outcomes. This feedback loop provides invaluable insights that can guide your innovation roadmap toward features customers truly value and will pay for.

- Enhanced Competitive Immunity: Your value proposition becomes your differentiator. Competitors can’t easily undercut you on price because you’re not selling a commodity; you’re selling a proven, quantifiable result. You compete on value, not on cost.

-

Choosing the Right Model: It’s Not a Binary Switch

While value-based pricing is the north star for most B2B businesses, the reality is that most companies operate on a spectrum. The right model depends on your market, product, and customer profile.

|

Pricing Model |

Best Suited For |

Key Consideration |

|

Cost-Plus |

Commoditized markets, public sector tenders, low-complexity products. | Easy to implement but highly vulnerable to competition. |

|

Competition-Based |

Highly saturated markets with clear alternatives (e.g., CRM software). |

Requires you to have a lower cost structure or a superior product to win. |

|

Value-Based |

Specialized solutions, B2B software, professional services, differentiated products. | Requires deep customer insight and the ability to quantify value. |

A successful dynamic pricing strategy isn’t just about the tech; it’s about change management, customer communication, and ethical guardrails. This is where expert guidance is critical.

-

-

- A 2024 incident where Wendy’s had to walk back its dynamic pricing announcement serves as a critical case study. It demonstrates that even sound pricing strategies will fail without careful change management and a keen understanding of customer price perception.

- Airbnb’s move to all-inclusive pricing is a masterclass in value perception. By addressing backlash over hidden fees, they protected their brand equity and demonstrated that transparent pricing is essential to justifying a value-based model.

-

A practical approach is often a hybrid model:

-

-

- Use cost-plus to establish your absolute price floor—the minimum you need to charge to be viable.

- Analyze competitor pricing to understand the market’s current range.

- Conduct thorough value research through customer interviews, win-loss analysis, and ROI calculators to determine the value ceiling—the maximum a customer would pay based on the results you deliver.

-

Your optimal price sits somewhere between the floor and the ceiling, determined by your specific strategy.

The First Steps on Your Value Journey

Transitioning to value-based pricing is a cultural shift, not just a mathematical one. It requires deep customer insight and organizational alignment. Here’s how to start:

-

-

- Quantify Your Value Proposition: Can you articulate the economic impact of your solution in dollars and cents? Build an ROI calculator.

- Segment Your Customers: Different customer segments derive different value. A large enterprise may get more value from your product than an SMB. Your pricing should reflect that.

- Train Your Sales Team: Arm them with the tools and messaging to have value-based conversations, not price-based negotiations.

- Start with a Pilot: Apply value-based pricing to a new product launch or a specific customer segment where the value is easiest to quantify.

-

Conclusion: Price Based on Worth, Not Cost

Moving from cost-plus to value-based pricing is one of the most powerful levers a B2B company can pull to drive profitable growth. It requires more effort than simply adding a markup, but the financial rewards are exponential.

It forces you to truly understand your customer’s world and innovate around delivering measurable outcomes. In doing so, you build a more resilient, profitable, and customer-centric business that is defined by the value it creates, not the costs it incurs.

Are you ready to discover your true value? Our pricing and revenue management consultants specialize in helping B2B leaders like you diagnose their pricing strategy, quantify their value proposition, and implement models that unlock hidden profit.

Contact us today for a pricing diagnostic.