You’ve found the perfect target. The financials are stellar, the synergy model promises immense value, and the strategic fit seems impeccable. The deal team is energized, and negotiations move at a breakneck pace. Then, post-closing, the facade crumbles. The “perfect deal” unravels, revealing critical flaws that erode value, tank morale, and damage reputations.

What happened? In almost every case, the root cause lies not in the market’s unpredictability, but in a failure of due diligence. The process was either rushed, too narrow, or missed the hidden risks that truly determine success or failure.

Based on analysis of failed M&A transactions, here are the top five diligence oversights that turn great deals bad and a strategic guide on how to avoid them.

1. The Illusion of Cultural Fit

The Oversight: Focusing exclusively on financial and operational metrics while treating cultural integration as a “soft” issue for later. Our study found that cultural issues are the primary reason 30% of mergers fail to achieve their stated goals. You can have flawless synergy models, but if people won’t or can’t work together effectively, value evaporates.

How to Avoid It:

-

-

- Go Beyond the Surface: Don’t just host executive dinners. Conduct anonymous cultural assessments surveys comparing both organizations on dimensions like decision-making speed, risk tolerance, and communication styles.

- Embed Anthropologists: Include HR and operational leaders in the diligence team to observe interactions, review internal communications, and understand the “unwritten rules” of the target company.

- Quantify the Risk: Develop a Cultural Integration Index that scores compatibility and identifies specific, actionable friction points (e.g., “Our agile decision-making will clash with their hierarchical approval processes”).

-

2. The Black Box of Technology Integration

The Oversight: A high-level review of IT systems that misses the staggering cost and complexity of integration. Most diligence efforts confirm that systems exist, not that they can be integrated. Over 40% of acquirers discovered major technology-related problems only after the deal closed, often leading to integration delays that cost millions per week.

How to Avoid It:

-

-

- Conduct a Day-1 Readiness Assessment: Move beyond architecture diagrams. Demand access to conduct technical due diligence, testing data migration paths, API connectivity, and cybersecurity vulnerabilities.

- Focus on Data: The biggest IT cost isn’t the hardware; it’s the data. Assess the quality, structure, and cleanliness of the target’s core data assets. Incompatible CRM or ERP systems can require massive, unbudgeted investments.

- Plan for the Worst: Build a detailed, phased integration plan during diligence, not after. This plan should include contingency budgets for unexpected tech debt.

-

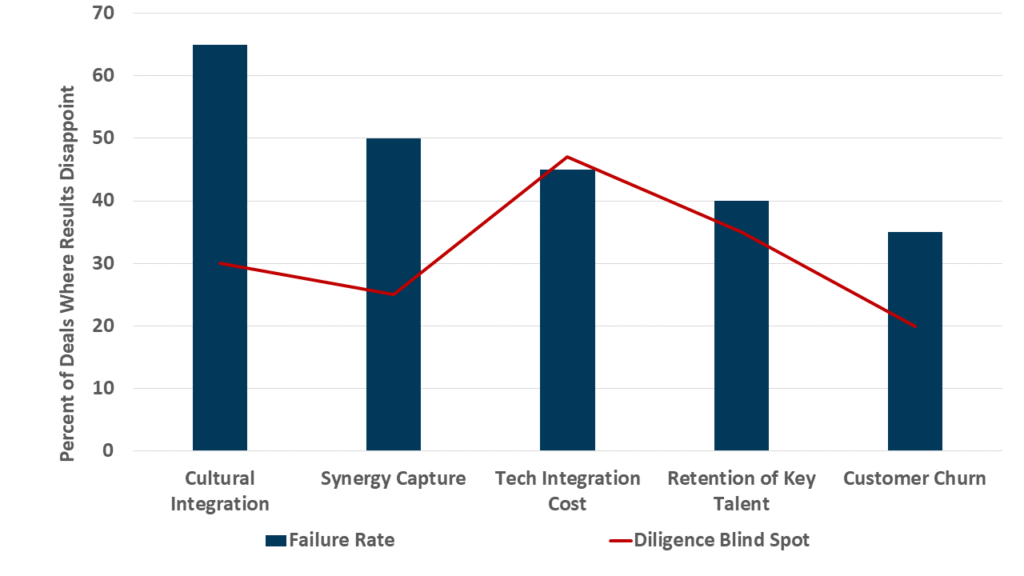

The following graph illustrates the most common and costly areas where post-deal realities disappoint compared to pre-acquisition expectations, highlighting where diligence most frequently fails.

The Diligence Disconnect: Pre-Deal Expectation vs. Post-Deal Reality

3. The Synergy Mirage

The Oversight: Treating synergy estimates as a financial exercise, devoid of operational reality. Teams often create ambitious synergy numbers to justify the deal price without a realistic plan to achieve them. Companies capture only 60% to 70% of the cost synergies they anticipate pre-deal.

How to Avoid It:

-

-

- Pressure-Test Every Assumption: For every claimed synergy, ask: Who is accountable? How many months will it take? What are the one-time costs to achieve it? What is the risk of disruption?

- Involve the Integrators: The M&A team that models the synergies should not be separated from the operational leaders who must deliver them. Involve functional heads (CFO, COO, CTO) in the diligence process to validate assumptions.

- Phase Your Targets: Create a tiered synergy model: “Base Case” (highly probable), “Stretch Case” (achievable with effort), and “Blue Sky” (used for investor presentations but not internal budgeting).

-

4. The Flight of Key Talent

The Oversight: Failing to identify and secure the critical human capital that drives the target’s value. The value of many modern companies, especially in tech and services, walks out the door every evening. In the 24 months following a merger, acquired companies lose an average of 20% of their key employees, double the rate of non-merged companies.

How to Avoid It:

-

-

- Identify the True Key Players: Go beyond the org chart. Use network analysis to identify the informal leaders, innovators, and experts critical to operations.

- Due Diligence on Retention: Review key employee contracts, equity agreements, and change-of-control clauses during diligence. Understand what it will truly take to retain them.

- Engage Early and Personally: Develop a retention plan before close. The acquiring company’s leadership must meet with key talent to articulate a compelling vision for their role post-merger.

-

5. The Customer Churn Time Bomb

The Oversight: Being so inwardly focused on the deal mechanics that you forget to assess the target through the customers’ eyes. Mergers create uncertainty for customers, who may fear product discontinuation, price hikes, or degraded service. This can trigger a silent exodus.

How to Avoid It:

-

-

- Customer Due Diligence: Conduct confidential interviews with the target’s largest customers to understand their perception of the deal. Are they likely to stay? What are their key concerns?

- Analyze the Contract Base: Scrutinize customer contracts for termination clauses related to change of control. Model the financial impact of losing even a small percentage of the top customers.

- Develop a Comms Plan Day -1: Have a robust, clear customer communication plan ready to execute the moment the deal is announced, reassuring them of value and continuity.

-

Conclusion: Diligence Reimagined

A successful acquisition isn’t about finding a great company; it’s about truly understanding what you are buying. The modern due diligence mandate must expand beyond financial audits and legal reviews. It must be a deep, operational, and human-centric investigation into the realities of integration.

The best way to avoid a deal going bad is to approach diligence not as a checkbox exercise to get the deal done, but as the first and most critical phase of integration. By rigorously addressing these five oversights, you move from asking “Can we afford to buy this company?” to the more vital question: “Can we afford to own it?”

Transform your M&A process from a risk to be managed into your greatest competitive advantage – let’s discuss how.