For many portfolio company managers, the term “carbon accounting” evokes images of cumbersome compliance, complex reporting, and a cost center with no clear ROI. This view is not just outdated; it is financially detrimental. In the modern investment landscape, a sophisticated understanding of a company’s carbon footprint has transcended its regulatory origins to become a powerful tool for value creation, risk mitigation, and strategic advantage.

Forward-thinking private equity firms are shifting their perspective. They are moving from seeing ESG and carbon accounting specifically as a box-ticking exercise to leveraging it as a core component of their operational value creation playbook. The data derived from measuring emissions uncovers inefficiencies, identifies cost savings, and future-proofs assets against escalating regulatory and market pressures.

The Impetus for Change: More Than Just Investor Pressure

The drive for robust carbon accounting is being fueled by powerful, tangible market forces that directly impact valuation and exit potential.

By the Numbers: The Market Mandate

-

-

- LP Demand: Nearly 80% of Limited Partners now consider ESG factors when making investment decisions, a figure that has nearly doubled in four years.

- The Regulatory Tide: The EU’s Corporate Sustainability Reporting Directive (CSRD) and California’s SB 253 are forcing thousands of companies to report emissions. Non-compliance means fines and market exclusion.

- The Cost of Capital: Companies with high ESG ratings typically enjoyed lower costs of capital compared to their lower-rated peers.

- Valuation Impact: Companies with strong sustainability performance often command valuation premiums of up to 10-15% at exit, as they are seen as less risky and more future-proof.

-

The Three Layers of Value Creation

Carbon accounting creates value across three critical dimensions: operational, strategic, and financial.

1. Operational Value: Uncovering Hidden Inefficiencies

Carbon emissions are often a direct proxy for waste and inefficiency. Measuring them is the first step to eliminating them.

-

-

- Scope 1 & 2 Emissions (Direct & Energy Indirect): These emissions are a direct line into energy consumption and process efficiency.

- Example: A manufacturing portfolio company conducting a carbon inventory might discover that a significant portion of its emissions (and energy costs) comes from outdated, inefficient HVAC systems. The capital invested in upgrading this system has a clear dual return: a reduction in both carbon footprint and operational expenses, improving EBITDA.

- Example: Mapping emissions from a logistics fleet can identify routes with excessive fuel consumption, leading to optimized routing that saves on both diesel costs and carbon output.

- Scope 1 & 2 Emissions (Direct & Energy Indirect): These emissions are a direct line into energy consumption and process efficiency.

-

2. Strategic Value: De-risking the Asset and Building Resilience

A thorough carbon accounting framework mitigates long-term risks that can cripple an investment.

-

-

- Regulatory Risk: Proactively complying with existing and future carbon regulations avoids future penalties and costly last-minute scrambles.

- Market Risk: Consumer and B2B purchasing decisions are increasingly influenced by sustainability credentials. A company that cannot accurately report its footprint may be locked out of key markets or supply chains.

- Reputational Risk: Greenwashing accusations are a major threat. Robust, data-backed carbon accounting provides authenticity and protects brand value.

-

3. Financial Value: Enhancing Exit Multiple and LP Appeal

This is where the value creation narrative culminates. A portfolio company with a mature carbon strategy is a more valuable asset.

-

-

- The Exit Multiple Premium: Strategic acquirers, especially corporates with public net-zero commitments, are willing to pay a premium for assets that can demonstrably lower their overall carbon footprint. This is known as “acquisitive decarbonization.”

- IPO Readiness: For a public market exit, a strong ESG narrative, backed by hard data, is critical for attracting ESG-focused funds and analysts.

- LP Reporting & Fundraising: GPs with a proven ability to improve the ESG performance of their portfolio can more easily raise subsequent funds from increasingly stringent LPs.

-

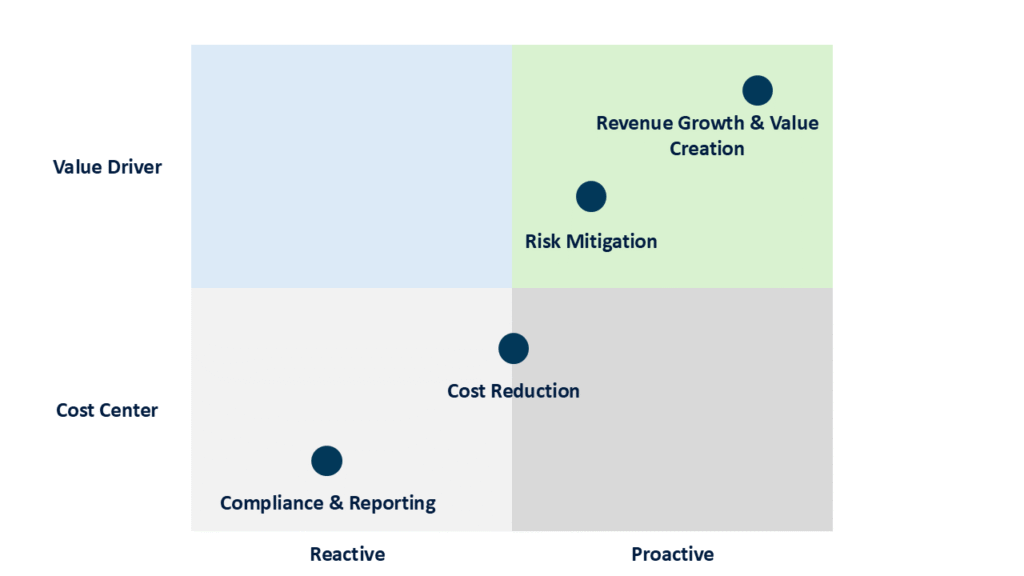

The Journey from Burden to Tool: A Maturity Model

The transition doesn’t happen overnight. Portfolio companies move through a clear maturity curve, as illustrated below.

The Carbon Accounting Value Maturity Model

The graph shows the evolution from a reactive compliance exercise (bottom-left) to a proactive strategic function that drives revenue and value (top-right). The goal for PE firms is to move their portfolio companies along this curve as quickly as possible.

Implementing a Value-First Carbon Strategy: A Blueprint for GPs

For private equity firms, the approach must be pragmatic and value driven.

-

-

- Baseline with Materiality: Start by measuring the carbon footprint (Scope 1, 2, and material Scope 3) of each portfolio company. Use this as a baseline.

- Integrate with Operational Initiatives: Don’t create a separate “ESG strategy.” Embed carbon reduction goals into the existing value creation plan. Link emissions data to operational KPIs managed by the COO and CFO.

- Invest with a Dual ROI: Evaluate capex decisions through a dual lens: financial return and carbon abatement. Projects like energy efficiency upgrades often clear investment hurdles easily when both factors are considered.

- Weave into the Exit Narrative: From day one, document the carbon journey. Prepare a data-backed story on how the company has become more efficient, less risky, and more valuable because of its carbon management. This narrative is a key differentiator during the exit process.

-

Conclusion: Reframing the Investment Thesis

Carbon accounting is no longer a peripheral concern for the ESG department. It is a critical business intelligence function that provides unparalleled insight into how a company truly operates. For private equity firms, the ability to harness this data is what separates top performers from the rest.

By reframing carbon accounting from a compliance burden to a value creation tool, GPs can unlock operational efficiencies, build more resilient businesses, and ultimately, command premium valuations at exit. The question is no longer if you should invest in carbon accounting, but how quickly you can leverage it to create a competitive advantage.

Schedule a call with our ESG value-creation experts to build your carbon investment thesis.