Executive Summary: The Paradigm Shift to Software-Defined Mobility

The automotive industry’s center of gravity is irrevocably shifting from mechanical engineering to software architecture. The vehicle is transitioning from a collection of discrete electronic control units (ECUs) to an integrated, high-performance computing platform. This evolution, central to the concept of the Software-Defined Vehicle (SDV), is creating a new, high-margin revenue landscape and redefining competitive dynamics.

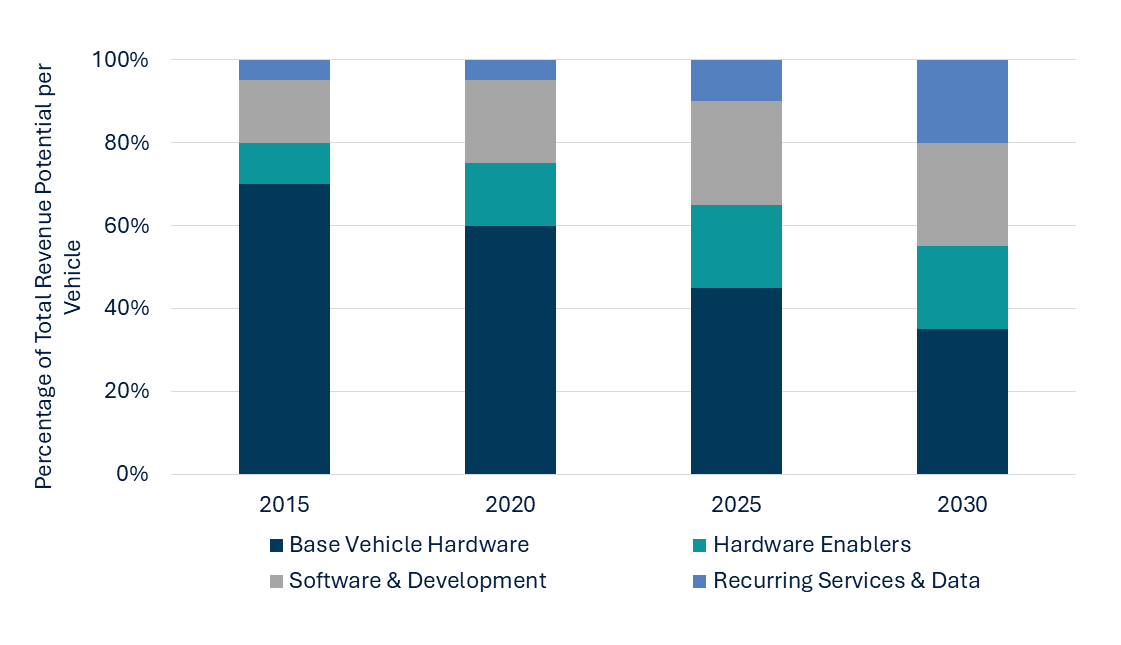

The integration of software in automotive systems is accelerating, with projections indicating that by 2030, software could constitute over 40% of a vehicle’s value, up from approximately 20% in 2022. This transformation, fueled by the twin forces of digitalization and sustainability, presents both unparalleled opportunities and strategic risks for OEMs, suppliers, and ecosystem partners worldwide.

The Shifting Value Pool: From Hardware to Software and Services

Core Drivers of Automotive Software Evolution

1. Advanced Driver-Assistance Systems (ADAS): A Safety and Differentiation Imperative

-

-

-

- Market Penetration: In U.S., by 2023, ADAS features such as forward collision warning and automatic emergency braking achieved over 90% adoption across approximately 98 million vehicles, encompassing 80% of the passenger market.

- Global Regulatory Push: The EU’s Directive 2010/40/EU has accelerated ADAS deployment, with projections indicating that Level-3 and higher autonomous capabilities could account for one-third of vehicle sales by 2035.

- Impact: AI-processed sensor data enhances safety by reducing collisions, positioning software as a critical differentiator for risk mitigation and performance optimization.

-

-

2. Electrification: Software as the Backbone of EV Performance

-

-

-

- Market Momentum: Global electric vehicle (EV) sales have surged, representing over one-quarter of total car sales in 2024, with continued growth expected.

- Software’s Role: Advanced battery management and powertrain optimization software drive efficiencies, such as extended range through predictive algorithms and over-the-air (OTA) updates.

- Efficiency Gains: Modular software architectures can reduce development cycles by 20-30%, enabling faster innovation and cost savings for OEMs.

-

-

3. Connectivity: Unlocking New Revenue Streams

-

-

-

- Adoption Forecast: By 2025, nearly half of vehicles in the EU and U.S. will be connected, supporting services like real-time navigation and vehicle-to-everything (V2X) communication.

- Future Outlook: By 2030, 95% of new vehicles globally are expected to integrate connectivity and partial autonomy, generating data streams for monetization opportunities such as personalized insurance and predictive maintenance.

- Strategic Advantage: Connected ecosystems enable recurring revenue models, transforming vehicles into platforms for service-based innovation.

-

-

Key Segments: Where Value is Being Created

The market can be deconstructed into interdependent layers, each with distinct strategic implications.

1. Operating Systems & Middleware: The New Battleground

This foundational software layer manages hardware resources and enables communication between applications. It is the strategic core of the SDV. The competition is between:

-

-

- Adapted Legacy Systems: QNX Neutrino (BlackBerry), a proven, safety-certified real-time operating system (RTOS) dominant in instrument clusters and ADAS domains. BlackBerry’s annual report cites deployments in over 215 million vehicles.

- Open-Source Platforms: Android Automotive OS (Google), a full-stack, open-source platform gaining rapid traction in infotainment. Its integration by major OEMs like Volvo, GM, and Ford signals a major industry shift.

- Proprietary OEM Platforms: Volkswagen’s VW.OS (part of its CARIAD division) and Tesla’s Linux-based OS represent the vertically integrated model, offering control but requiring massive internal investment.

-

2. Autonomous Driving (ADAS/AD): The High-Compute Frontier

This segment encompasses complex algorithms for perception, path planning, and vehicle control. Progress is closely tied to regulatory advancements. The UNECE’s World Forum for Harmonization of Vehicle Regulations (WP.29) has established binding international regulations for Automated Lane Keeping Systems (ALKS), creating a clear pathway for deployment. This regulatory certainty is unlocking investment in this R&D-intensive segment.

3. Connectivity & Vehicle-to-Everything (V2X): The Safety and Efficiency Layer

Software enabling communication between vehicles and infrastructure is critical for next-generation safety and traffic management. The U.S. Department of Transportation and the European Commission have actively funded and promoted V2X deployment. The software that facilitates these communications, often based on Dedicated Short-Range Communications (DSRC) or C-V2X standards, is becoming a key differentiator for urban mobility and fleet management solutions.

Automotive Software Market Segmentation & Strategic Profile

|

Software Segment |

Core Function | Strategic Imperative | Key Data Point |

| Operating Systems | Hardware abstraction, resource management | Control the central architecture. Decide on “Build, Partner, or Acquire”. |

BlackBerry QNX: 215M+ vehicle deployments |

|

Autonomous Driving |

Sensor fusion, path planning, decision-making | Achieve regulatory compliance for L2+/L3 systems. Long-term R&D bet. | UNECE WP.29 ALKS regulation active in over 50 countries, including EU and Japan. |

| Connectivity & V2X | External communication (V2V, V2I, V2N) | Enable safety features and future mobility-as-a-service (MaaS) models. |

U.S. DOT allocated $60M for V2X deployment in 2022. |

|

Powertrain/Battery Management |

Optimizing performance, range, and battery life | Critical for EV competitiveness and total cost of ownership. |

Software-driven efficiency gains can extend EV range by 5-10% |

Strategic Implications for Corporate Leadership

The shift to software-defined vehicles demands fundamental changes to business models and organizational structures.

1. The OEM Strategic Dilemma: Vertical Integration vs. Strategic Partnership

OEMs face a critical architectural choice. Developing a full-stack proprietary OS (like Tesla) offers ultimate control and differentiation but requires a deep, sustained software competency that is foreign to most traditional manufacturers. The alternative such as partnering with a tech provider (like GM with Google) can accelerate time-to-market but risks ceding control of the user experience and valuable data, potentially reducing the OEM to a hardware assembler. The hybrid model, controlling the top-level architecture while sourcing best-in-class components, appears to be the emerging consensus.

2. The Non-Negotiable Enabler: Over-the-Air (OTA) Updates

The ability to update vehicle software remotely is the defining feature of an SDV. It transforms the product from static to dynamic, enabling continuous improvement, new feature activation, and proactive security patching. As per recalls monitored by bodies like the U.S. National Highway Traffic Safety Administration (NHTSA), the ability to rectify issues via OTA is becoming a critical differentiator in cost and customer satisfaction.

3. The Foundational Priority: Cybersecurity

With increased connectivity comes increased vulnerability. Regulatory bodies are making cybersecurity a prerequisite for market access. The UNECE WP.29 R155 regulation on cybersecurity, effective since 2022, mandates a certified Cybersecurity Management System (CSMS) for all new vehicle types. This makes robust, security-by-design software development a legal requirement, not just a technical best practice.

Conclusion: The Strategic Roadmap

The evidence from regulatory filings, corporate investment, and international standards bodies is unequivocal: software is the new engine of value in the automotive industry. The market is not a discrete sector, but an integral, high-growth layer embedded within the vehicle’s entire lifecycle.

The strategic mandate for leadership is threefold:

-

-

- Architect for the Future: Decide on a software platform strategy that balances control, cost, and capability.

- Cultivate New Competencies: Aggressively invest in software talent, agile development processes, and cybersecurity expertise.

- Embrace Ecosystem Collaboration: Forge strategic partnerships to access specialized expertise and accelerate innovation.

-

The transition to software-defined mobility is already underway. Success will be determined by the strategic choices made today.

Schedule your strategic briefing to define your software roadmap.