Executive summary

Nuclear power is back at the center of utility and sovereign strategy for decarbonization and energy security. The sector is transitioning from a focus on life-extension of legacy plants to a two-track market: (a) large, standardized new builds in countries with existing industrial capability and state support; and (b) an emerging factory-driven market for small modular reactors (SMRs) and modular components. This creates differentiated opportunities across reactor pressure-vessel fabrication, steam-turbine/BOP supply, instrumentation & control (I&C), fuel-handling systems, and long-duration services (refurbishment, decommissioning).

Market snapshot

-

-

- Global operating fleet: 416 reactors in operation with ~376 GW net installed capacity as of September 2025.

- Under construction: 63 reactors (~66 GW) with concentration in Asia.

- Generation and emissions impact: nuclear produced a record year in 2024 with ~2,667 TWh of electricity equivalent to avoiding roughly 2.1 billion tons CO₂ compared with coal displacement benchmarks.

- Share of global electricity: nuclear provides roughly 9–10% of global electricity, remaining the world’s second-largest source of low-carbon baseload.

-

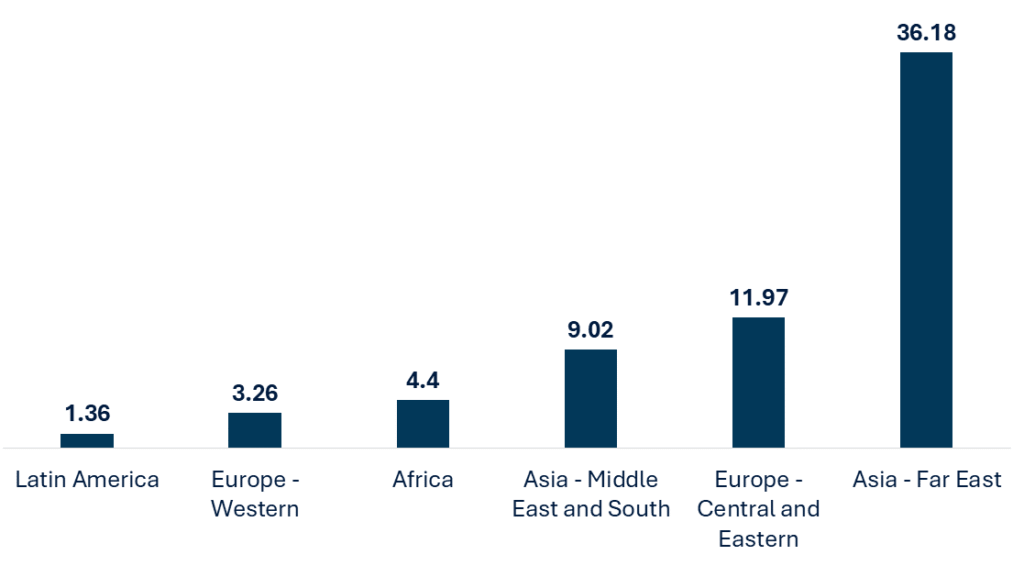

Nuclear Power Plant Capacity Under Construction by Region in GW (as of September 2025)

Market structure & equipment segmentation

From procurement perspective, the market splits into four buying blocks:

1. Reactor Island Major Equipment

It includes systems such as reactor pressure vessels (RPVs), steam generators, primary circuit pumps/valves, and containment structures. Segment has high technical barriers, long lead times, and is dominated by a few tier-1 fabricators and OEMs.

2. Balance-of-Plant (BOP) & Turbine / Generator Systems

Segment consists of conventional power-island equipment and has larger addressable market but competitive in nature where legacy OEMs can achieve modularization gains.

3. Digital & Safety Systems (I&C, Cybersecurity, Remote Diagnostics)

Rising share of procurement due to life-extension and SMR controls; quicker margins and repeatable retrofit opportunities.

4. Fuel Cycle & Services

It includes fuel fabrication, handling, storage, waste management, and decommissioning – providing steady revenue streams with strong government/regulatory oversight.

SMRs/BWRX-300, CAP1000 and other modular designs create a parallel supplier chain i.e. more factory assembly, standardized subcomponents, and potential for supply-chain scale if orders are aggregated.

Market Dynamics: A Tale of Two Geographies and Three Investment Pathways

The global market is not monolithic. It is essential to segment the opportunity geographically and by project type to formulate a coherent strategy.

1. Established Markets (North America & Europe)

The focus here is on Lifecycle Extension & Modernization. The existing fleet represents a colossal asset. In United States, the Nuclear Regulatory Commission (NRC) has already granted 20-year license extensions to over 90 reactors, with many now operating for 60 years. This creates a sustained, high-value market for equipment suppliers specializing in reactor vessel heads, steam generators, turbines, and advanced digital control systems. The business model is one of servicing and upgrading a critical existing infrastructure base.

Data-center growth and electrification increase baseload demand; several governments (France, US, China, India) are actively supporting reactor programs through loans, fast-track licensing or capacity expansion. Examples: state loan packages in France for new reactors and expedited regulatory action in US.

2. Growth Markets (Asia, notably China & India)

The focus is unequivocally on New Build. China leads the world in nuclear construction. This represents a primary market for Engineering, Procurement, and Construction (EPC) firms and large equipment manufacturers. The demand is for new, large-scale Generation III/III+ reactors, creating a pipeline of projects for decades.

3. Emerging & Re-emerging Markets (Eastern Europe, Middle East, Africa)

The focus is on Program Initiation and SMR Adoption. Countries like Poland, Egypt, and Kenya are actively developing nuclear programs. For them, the emerging technology of Small Modular Reactors (SMRs) offers a potentially more manageable entry point due to lower upfront capital commitment and enhanced safety features.

Strategic Recommendations

-

-

- Prioritize modular product lines – invest in manufacturing cells for repeatable modules (containment segments, modular I&C racks, turbine rotors) to target SMR and serial large-unit programs.

- Lock strategic forgings capacity – long lead times for RPVs/forgings are a primary project bottleneck. Secure supply via JV, long-term contracts or backward integration.

- Offer EPC-light + performance guarantees – differentiate by packaging equipment with schedule/liability collars; utilities buying new builds favor providers who reduce turnkey risk.

- Build aftermarket/service arms – retrofit controls, predictive maintenance, and long-term spare-parts contracts deliver steady margin and de-risk revenue cyclicality.

- Navigate financing & local content – align bids with sovereign financing and local-content rules; co-finance or partner with national champions to win state-backed programs.

-

Strategic Outlook

The nuclear power plant and equipment market is at an inflection point. The macro-environment is more favorable than it has been in a generation. For senior leadership, the imperative is to move from observation to action.

-

-

- For Utilities & Developers: Conduct a strategic audit of your asset portfolio. For existing fleets, prioritize lifecycle extension investments that maximize ROI. For new builds, rigorously evaluate the technology partner and EPC consortium, with a laser focus on proven project delivery capabilities.

- For Equipment Suppliers (OEMs): Align your R&D and product roadmap with the industry’s trajectory. Forge long-term partnership agreements rather than pursuing transactional contracts. Invest in digital service offerings to create sticky, recurring revenue streams.

- For Investors: Look beyond the reactor technology itself. The adjacent opportunities in fuel cycle services, waste management, decommissioning, and digital infrastructure represent high-margin, less-capital-intensive avenues for exposure to the nuclear renaissance.

-

The window for establishing a leadership position in this evolving market is open. The organizations that succeed will be those that combine deep technical rigor with sophisticated strategic planning and a proactive engagement with the complex regulatory and financial landscape.

Conclusion

The global nuclear power plant and equipment market is entering a decisive decade shaped by energy security imperatives, decarbonization targets, and technological evolution. With more than 60 reactors under construction and several governments committing to long-term fleet renewal, the sector is transitioning from isolated megaprojects to standardized, serial-build programs and an emerging SMR-driven modular ecosystem. Equipment suppliers, investors, and service providers that align with this shift will be well-positioned to capture both short-term and enduring opportunities.

For executives and decision-makers, success in this market will depend on strategic clarity and operational agility. Winning players will not only deliver high-quality equipment but also integrate financing, risk-sharing, and long-term service solutions. The market’s resilience is underscored by strong public policy backing and growing acceptance of nuclear’s role in net-zero strategies, making it a competitive domain where scale, partnerships, and innovation define the winners.

Strategic imperatives to act on now:

-

-

- Secure supply-chain resilience in critical components (forgings, RPV, I&C systems).

- Build modular product capabilities tailored for SMRs and repeatable large-unit builds.

- Expand aftermarket and service portfolios to capture recurring revenue.

- Partner with governments and utilities on financing and localization strategies.

-

Position your organization today to lead in the nuclear equipment value chain of tomorrow.