Executive Summary

In an accelerating transition toward clean energy and advanced technologies, rare earth elements (REEs), a group of 17 metals critical for magnets, catalysts, and electronics, stand at the crossroads of opportunity and vulnerability. Global production reached 390,000 metric tons of rare earth oxide (REO) equivalent in 2024, up ~4% from 2023, driven by surging demand in electric vehicles (EVs) and renewable energy systems. Yet, with over 70% of output concentrated in China, supply chain fragility looms large, exacerbated by recent export restrictions and environmental imperatives. By 2040, REE demand could surge 50-60%, underscoring the urgency for proactive portfolio reconfiguration.

Hence, global REE market is not a conventional commodity space. It is a strategic arena where geopolitics, advanced technology, and supply chain security converge. For corporate leaders and policymakers, a nuanced understanding of this market is no longer a niche concern but a critical component of long-term strategic resilience.

The Strategic Imperative: Why Rare Earths Matter

Rare Earth Elements are a group of 17 metals with unique magnetic, phosphorescent, and catalytic properties. Contrary to their name, they are relatively abundant in the Earth’s crust, but economically viable concentrations are rare, and their extraction and separation are complex and environmentally challenging.

Their indispensability stems from their application in modern, high-growth technologies:

-

-

- Permanent Magnets (NdFeB): The largest and most critical application, powering everything from electric vehicle (EV) traction motors and wind turbines to hard disk drives and consumer electronics.

- Catalysts: Used in automotive catalytic converters and petroleum refining.

- Phosphors: For LEDs and display screens.

- Defense Technologies: Critical for precision-guided weapons, satellites, and communication systems.

-

The global push for decarbonization is the primary demand-side driver. To meet net-zero emissions by 2050, the world will need a six-fold increase in rare earth mineral consumption by 2040. This is not a cyclical trend but a structural shift in global demand.

Navigating the Global Production Landscape

The REE market’s foundational dynamics are rooted in uneven geological endowments and processing capabilities, rendering it a quintessential case for supply chain scrutiny. In 2024, worldwide mine production climbed to 390,000 tons REO equivalent, reflecting a 3.7% year-over-year increase, primarily fueled by expansions in China, Nigeria, and Thailand.

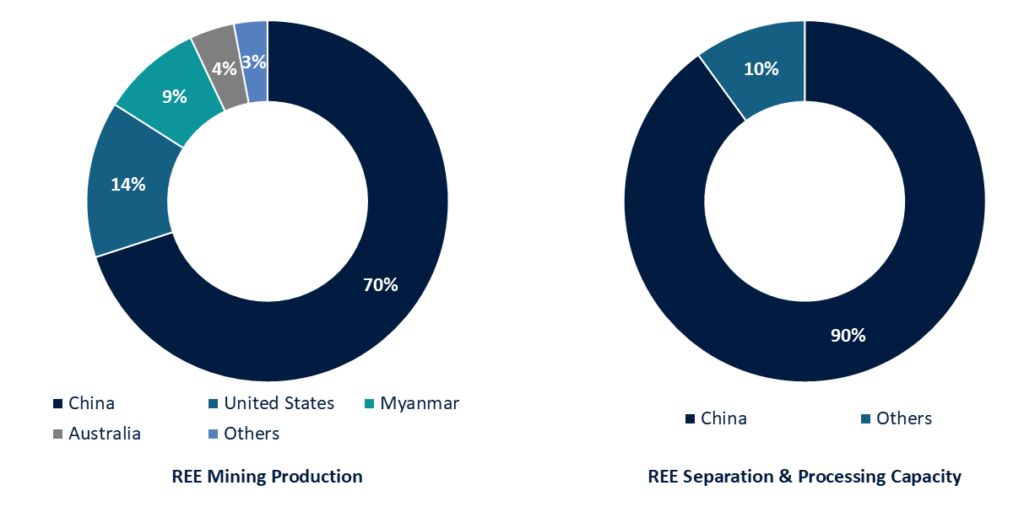

Global Share of Rare Earth Production and Processing

This growth masks stark asymmetries where China alone accounted for nearly 70% of the total, leveraging its integrated mining-to-refining ecosystem to maintain dominance. This concentration, particularly in mid-stream separation and magnet manufacturing, grants a single nation outsized influence over global availability and pricing. The 2010 “Rare Earth Crisis,” where China temporarily restricted exports, causing price spikes of over 2,000% for some elements, serves as a historical precedent for the market’s volatility and strategic risk.

Geopolitical Dynamics and the “Friend-Shoring” Imperative

The current market structure is untenable for many advanced economies from a national security and industrial competitiveness standpoint. In response, United States, European Union, Japan, and Australia have classified rare earths as “Critical Raw Materials.”

This has triggered a multi-pronged strategic response:

-

-

- Onshoring & Friend-Shoring: U.S. is actively supporting the re-development of its domestic supply chain, from the Mountain Pass mine in California to nascent separation facilities. The EU’s Critical Raw Materials Act aims to extract, process, and recycle at least 10% of its annual consumption domestically by 2030.

- Strategic Alliances: Initiatives like the Minerals Security Partnership (MSP), a collaboration of 13 nations including the U.S., Canada, Australia, and several European countries, are designed to catalyze public and private investment in secure critical mineral supply chains globally.

- Investment in Alternatives: Significant R&D funding is being allocated to magnet recycling technologies and the development of reduced- or no-rare earth permanent magnets.

-

The G7’s Critical Minerals Action Plan, unveiled in 2025, targets 50% non-Chinese sourcing by 2030, spurring investments in Australian and Canadian projects. Concurrently, recycling emerges as a disruptor: recovering REEs from e-waste could offset 10-20% of virgin demand by 2030, aligning with circular economy mandates from the United Nations Environment Programme (UNEP).

Strategic Recommendations

For corporations whose products and operations depend on a stable REE supply, a passive approach is a significant risk. We advise a proactive, multi-faceted strategy:

1. For Mining and Project Development Companies:

For mining companies, the REE market presents a unique set of challenges and opportunities that require a paradigm shift from bulk commodity strategies.

-

-

- Develop a “Mine-to-Magnet” Business Model: The greatest value and strategic leverage lies not in mined concentrate, but in separated oxides and manufactured alloys. A forward-integration strategy is critical.

-

-

-

-

-

- Phase 1:Produce a high-purity, mixed REE concentrate.

- Phase 2:Build or partner to develop separation capacity for critical heavy and light REEs. This is capital-intensive but captures exponentially more value.

-

-

-

Strategic Option: Explore joint ventures with established magnet manufacturers or government-backed entities to de-risk this vertical integration.

-

-

- Secure Capital Through Strategic Partnerships, Not Just Debt: The high CAPEX for separation facilities is a barrier. Mitigate this by:

-

-

-

-

-

- Pursuing non-dilutive funding from government programs (e.g., U.S. DoD Defense Production Act Title III loans, EU Innovation Fund).

- Securing pre-paid offtake agreements from major OEMs or consortia, which can be used as collateral for project financing.

- Positioning the project as a strategic asset to attract investment from sovereign wealth funds within the Minerals Security Partnership (MSP) network.

-

-

-

-

-

- Optimize for the Basket, Not the Bulk: The economic viability of a REE project is determined by its “basket value.” A deposit rich in high-value, critical HREEs like Dysprosium and Terbium is significantly more economically resilient than one focused on more common Light REEs.

-

-

-

-

-

- Leverage advanced mineral processing and metallurgical techniques to maximize the recovery of these critical elements.

- Continuously monitor the market dynamics for individual elements to optimize production and inventory strategies, much like a specialty chemical company.

-

-

-

2. For Industrial End-Users

-

-

- Supply Chain Mapping and Stress Testing: Conduct a granular audit of your REE exposure, tracing it back to the magnet and processor level. Model the financial and operational impact of a 6-12 month supply disruption or a 300% price spike in key elements like Dysprosium or Neodymium.

- Diversify the Supplier Base: Do not rely on a single geography or supplier. Actively engage with emerging projects in allied nations (e.g., Lynas in Australia/Malaysia, potential projects in Canada and Scandinavia). This may involve paying a premium for security of supply.

- Embrace Circularity: Develop a strategic roadmap for recycling REEs from end-of-life products. This not only mitigates supply risk but also enhances ESG (Environmental, Social, and Governance) credentials, which are increasingly tied to financing and market valuation.

- Engage in Policy Advocacy: Work with industry consortia to ensure that government policies, such as the U.S. Defense Production Act or EU funding mechanisms, are aligned with industry needs and accelerate the build-out of non-Chinese capacity.

-

Conclusion

The Rare Earth Elements market is a microcosm of 21st-century economic statecraft. The trajectory is clear: demand will surge, driven by the global energy transition. The current supply chain concentration presents a clear and present danger to corporate and national security. The organizations that will thrive are those that treat REEs not as simple commodities to be procured, but as strategic assets to be managed with diligence, diversification, and a long-term view. The time to build resilient and transparent supply chains is now.

Secure your strategic rare earths action plan now to future-proof your operations and outmaneuver supply chain disruption.