Executive Summary

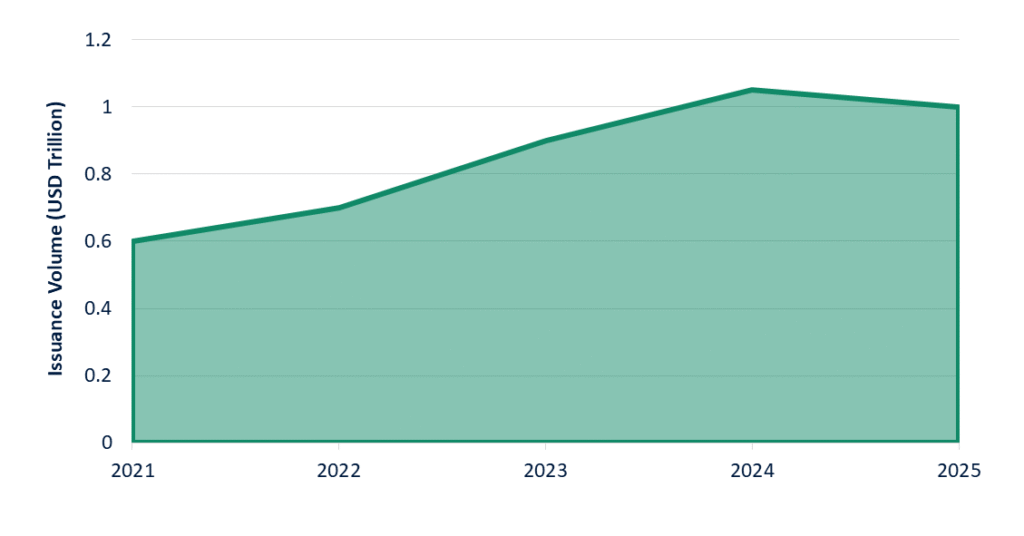

In an era where capital allocation must balance profitability with planetary stewardship, the ESG bond market stands as a cornerstone of sustainable finance. As of mid-2025, the global stock of aligned green, social, and sustainability (GSS) bonds exceeds $6 trillion, with 2024 new issuances reaching $1.05 trillion, a testament to institutional investors’ pivot toward impact-driven portfolios. Yet, amid moderating growth and geopolitical headwinds, issuers and investors face a pivotal inflection point.

We project steady issuance at approximately $1 trillion in 2025, underscoring opportunities in transition financing while highlighting risks from regulatory fragmentation. Our recommendations emphasize portfolio resilience through diversified ESG allocations, positioning clients to capture alpha in a market projected to underpin $2 trillion annually in climate investments by decade’s end.

Market Overview: A Maturing Ecosystem Amid Measured Expansion

The ESG bond market encompassing green bonds for environmental projects, social bonds for equity-focused initiatives, and sustainability bonds blending both has evolved from niche instrument to mainstream asset class. Launched in 2007 with the European Investment Bank’s inaugural green bond, the sector now channels trillions toward UN Sustainable Development Goals (SDGs). By end-2024, cumulative GSS-aligned debt hit $5.7 trillion, with green bonds comprising $3.5 trillion, social $1.1 trillion, and sustainability-linked variants nearing $1 trillion.

Annual issuance surged 5% in 2024 to $1.1 trillion in labeled sustainable bonds, reversing a 2023 dip amid rising interest rates. This resilience reflects supranational and sovereign issuers’ dominance, accounting for 40% of volumes, as multilateral development banks (MDBs) like the World Bank mobilized $85 billion in Q1 2025 alone, despite a 27.5% quarter-over-quarter decline from 2024 highs. Green bonds, funding renewable energy and biodiversity, captured 64% of 2024 flows, growing 14% year-over-year, while social bonds stabilized at 20-25% amid post-pandemic equity demands.

Global GSS Bond Issuance Volumes from 2021 to 2025 (projected)

Key Trends: Regulatory Tailwinds and Innovation Imperatives

Global regulatory convergence is accelerating ESG bond adoption, yet disparities persist. The European Union’s Sustainable Finance Disclosure Regulation (SFDR) and Taxonomy, effective since 2021, have propelled Europe to 40% of 2024 issuances, with €388 billion in green bonds alone. In U.S., the Securities and Exchange Commission’s (SEC) 2024 climate disclosure rules mandate enhanced ESG reporting for public issuers, boosting transparency and investor confidence – evident in a 20% expansion of U.S. ESG debt universe to $7.3 trillion by year-end.

Emerging trends include the rise of transition bonds, targeting high-emission sectors’ decarbonization pathways. These comprised 10% of 2024 flows, up from 5% in 2022, aligning with the International Capital Market Association’s (ICMA) principles. Meanwhile, sustainability-linked bonds (SLBs), tied to KPI performance, grew modestly at 2% of volumes, reflecting scrutiny over “greenwashing” risks.

A Breakdown of 2024 Issuance by Bond Type

|

Bond Type |

Share of Total Issuance (%) | Volume (USD Billion) | Key Use Cases |

|

Green |

64 |

672 |

Renewables, energy efficiency |

| Social | 20 | 210 |

Affordable housing, education |

|

Sustainability |

10 | 105 | Blended ESG projects |

| Sustainability-Linked | 6 | 63 |

KPI-driven transitions |

Regional Dynamics: Opportunities in Divergent Landscapes

From a global vantage, regional variances shape strategic entry points. Europe leads with 40% market share, driven by sovereign issuances like Germany’s €12 billion green bond in Q1 2024. Asia-Pacific follows at 28%, with $145 billion from corporates, fueled by China’s carbon neutrality pledges and Japan’s ¥10 trillion green framework. Americas, at 20%, saw U.S. municipal bonds surge 47% in Q4 2024, targeting resilient infrastructure. Africa’s mere 2% share underscores infrastructure gaps, where blended finance could unlock $50 billion annually.

Europe has been the market’s structural leader in sovereign and corporate issuance, but 2024 and early 2025 showed revival in North America and continued strong issuance from China. The rise of sovereign green issuance (France, Germany and other EU sovereigns) has been a critical liquidity and pricing anchor; corporates can take strategic lessons from sovereign transactions about tenor, investor mix and order book mechanics. The role of supranational (World Bank, EIB) remains pivotal as both issuers and standard setters.

Navigating the Pitfalls: A Consultant’s View on Market Integrity

Despite its growth, the market faces challenges that require strategic navigation. The primary concern is greenwashing, the disingenuous practice of overstating the environmental or social benefits of a bond.

Mitigating this risk is non-negotiable for maintaining credibility. Key strategies include:

-

-

- Adherence to Recognized Frameworks: Building your bond framework on the foundation of the ICMA Principles (Green, Social, Sustainability Bond Principles) is a market standard.

- Second-Party Opinions (SPOs): Engaging a credible, independent third party to review and validate your framework and its alignment with market best practices is now considered essential.

- Robust & Transparent Reporting: Commit publicly to annual post-issuance allocation and impact reporting. Quantifying the tangible outcomes – megawatts of renewable energy generated, tons of CO2 avoided, number of individuals provided with affordable housing – is what builds lasting trust.

-

The Road Ahead: Strategic Recommendations

The ESG bond market is poised for continued evolution, driven by standardization, innovation in instruments, and an increased focus on the Global South. For organizations considering entry, the time for strategic planning is now.

For Potential Issuers:

-

-

-

- Conduct an ESG Materiality Assessment: Identify the ESG factors most critical to your business and stakeholders. This forms the bedrock of a credible strategy.

- Develop a Corporate Financing Framework: Integrate ESG bonds into your long-term capital planning, determining whether use-of-proceeds or performance-linked instruments better suit your transformation goals.

- Engage Early with Stakeholders: Dialogue with investors, rating agencies, and internal operational teams is critical to design an ambitious yet achievable bond framework.

-

-

For Investors:

-

-

-

- Move Beyond Tick-Box Exercises: Develop sophisticated, in-house capabilities for due diligence, focusing on the materiality and ambition of an issuer’s ESG targets and the robustness of their reporting mechanisms.

- Engage in Active Ownership: Use your position as a bondholder to encourage higher standards of transparency and ambition through direct engagement and voting policies.

-

-

Conclusion

The global ESG bond market is a powerful manifestation of capital being redirected to address the world’s most pressing challenges. It has matured from a symbolic gesture to a sophisticated, strategic lever for value creation. Forward-thinking organizations will not merely participate in this market; they will seek to lead it, using ESG bonds as a catalyst for operational transformation, enhanced risk management, and the building of a durable, future-proof enterprise. The convergence of investor capital, regulatory direction, and societal expectation is clear. The strategic question is how your organization will respond.

To discuss a tailored ESG bond issuance or investment strategy, contact our sustainable finance practice.