Executive Summary

The emergence of the Renminbi’s digital form (e-CNY) and China’s rollout of cross-border settlement rails mark a profound shift in the architecture of global finance. Where the traditional SWIFT-dollar system has long dominated cross-border payments with days-long delays, hidden fees and reliance on intermediary banking chains, the Chinese digital-RMB infrastructure promises near-instant settlement, dramatically lower costs and sovereign control of the rails. For organizations, treasurers and strategists alike, this signals a major inflection point in currency strategy, payment-rail risk and global trade flows.

Comparative Metrics: SWIFT vs Digital RMB Rails

|

Parameter |

SWIFT System | Digital RMB Rail |

| Average Settlement Time | 2–5 days |

≤ 10 seconds |

|

Intermediary Banks |

4–6 on average | 0–1 (direct DLT connection) |

| Average Transaction Fee | USD 20–60 |

< USD 1 (≈ 98 % reduction) |

|

Currency Basis |

USD dominated | RMB / Programmable |

| Traceability | Partial (KYC overlay) |

Integrated via blockchain |

|

AML / Compliance |

Post-settlement checks |

Built-in smart compliance |

Context & Catalyst

Global cross-border payments infrastructure has long been built around the US dollar and SWIFT-based messaging systems. This system is efficient for many flows but it is not optimized for real-time settlement, cost-efficiency or sovereign control of rails. China’s central bank, People’s Bank of China (PBOC), has been building the digital RMB not just as a domestic retail instrument but as a strategic settlement rail for international flows.

Key recent milestones:

-

-

- In September 2025, the PBOC opened a “Digital Yuan International Operation Center” in Shanghai to manage cross-border digital-RMB infrastructure, signaling a move from pilot texture to strategic infrastructure.

- Trade settlement in RMB across cross-border flows is growing rapidly: e.g., China–ASEAN bilateral trade reported RMB payments representing 28% of trade flows in 2024, and cross-border RMB settlement volumes grew ~35 % year-on-year.

- Domestic regions of China show dramatic spikes in RMB-settlement adoption. For example, in Guangdong province in Q1 the RMB accounted for ~51.6 % of the total local & foreign-currency cross-border receipts/payments.

-

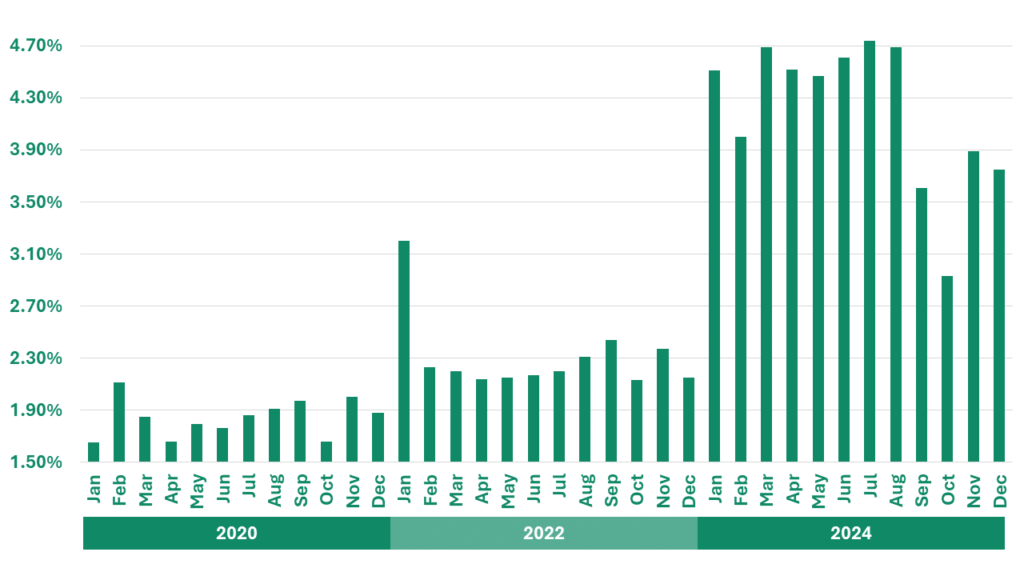

Global Share of RMB as Payment currency

These data points underscore that the digital-RMB thesis is not purely theoretical – it is gaining substantial traction.

Technology as a Strategic Weapon

At the heart of the shift is the programmable-currency infrastructure that combines digital-currency issuance, blockchain/distributed-ledger rails and centrally managed anti-money-laundering (AML)/compliance controls.

Key differentiators:

-

-

- Latency & cost: Traditional cross-border systems often carry multi-day settlement (1-3 business days or more) and embedded fees. Pilot reports indicate digital-RMB rails may settle in seconds or minutes.

- Traceability & governance: Because the currency is issued by the central bank and the rails are designated, transactions are inherently traceable, which embeds compliance controls in the infrastructure rather than as overlays.

- Sovereign-rail sovereignty: By building the settlement rails, China controls not merely the currency but its infrastructure, enabling strategic leverage especially in regions seeking alternatives to dollar-dominated rails.

-

The combination of speed, cost, traceability and sovereign control elevates the digital-RMB initiative from a peripheral fintech play to a structural challenge to the USD-rail paradigm.

Implications for the Global Financial Order

1. Currency Strategy & Geo-economics

If large blocks of trade settle increasingly in RMB (or the digital-RMB rails), the dominance of the dollar as a settlement currency and vehicle of financial influence may erode. For example, trade corridors such as ASEAN-China already report substantial RMB-settlement share. For countries subject to dollar-based sanctions regimes, or seeking greater financial autonomy, the appeal of alternative rails becomes strategic.

2. Payment-Rail Architecture Shift

The shift is not merely currency-based but rail-based: a new settlement infrastructure layered on programmable digital currency potentially bypasses legacy SWIFT-channels and multiple intermediary banks. That raises structural questions for global banking and treasury operations.

3. Corporate & Financial Institution Exposure

Companies must now consider not only FX and settlement-cost risk but also the rail risk i.e., if emerging trade partners shift to alternative rails, treasury and payment-networks may need to adapt to remain competitive.

Corporate Readiness & Risk Framework

We propose a readiness framework in five steps:

-

-

- Map Your Payment-Flow Exposure

-

Identify trade-lanes (imports/exports) especially in Asia, Middle East, and Africa where RMB/alternative-rails adoption is rising. Estimate savings from faster settlement and lower fees.

-

-

- Review Banking & Payment Partner Capabilities

-

Are your banks and payment providers capable of engaging with digital-RMB rails or alternative settlement networks? Do they offer pilot access or connectivity?

-

-

- Update Your Treasury-Policy Architecture

-

Introduce “rail diversification” into your treasury policy: maintain traditional dollar/SWIFT rails while provisioning alternative-rail participation, liquidity-buffers and contingency plans.

-

-

- Compliance & Regulatory Due Diligence

-

Alternative rails may involve new governance, AML/CFT rules, data-sovereignty issues and country-risk (e.g., counter-party jurisdiction). Conduct legal and operational review before shifts.

-

-

- Scenario Plan for 2030

-

Develop strategic scenarios:

-

-

- Base-case: USD‐rail remains dominant, digital RMB network grows slowly.

- Dual-rail coexistence: Parallel USD and RMB rails dominate different corridors; competitive advantage to firms optimized for both.

- Digital-RMB momentum: Significant shift of major trade corridors to RMB rails; first-mover firms gain cost/time advantage and access to new networks.

-

For each scenario quantify impact on treasury cost, working-capital flow, FX exposure and strategic partnership.

Strategic Pathways to 2030

-

-

- Adopt a two-track approach: Maintain existing infrastructure while engaging early with digital-RMB opportunities, especially if you operate in regions like Southeast Asia, the Middle East or along the Belt & Road-connected corridors.

- Partnerships matter: Work with banks that are active in digital-RMB pilots (e.g., via the mBridge platform) and monitor regulatory/trade-policy shifts that reduce dependency on USD rails.

- Systems-upgrade readiness: Ensure your treasury, payments and ERP systems are capable of multi-rail settlement, real-time visibility, and FX-hedging flexibility.

- Competitive positioning: For firms supplying into Chinese / Belt & Road projects, offering RMB-settled terms may become a differentiator.

- Governance vigilance: As alternative rails gain traction, cyber-, regulatory- and geo-risk will increase. Maintain strong oversight of data flows, counter-party jurisdiction, AML controls and deposit-rail switching.

-

Conclusion

The digital RMB initiative is more than a currency innovation – it is an architecture play for global finance. For companies, the question is no longer if alternative payment rails will rise, but when and how fast. Those who anticipate and adapt will capture first-mover advantage in lower settlement cost, faster working-capital rotation and strategic alignment with evolving trade-networks. Those who remain reliant solely on the dollar–SWIFT rails risk being structurally disadvantaged. In the competitive arena of global finance and trade, control of the rail may prove as important as control of the currency.

Partner with RNG Strategy Consulting to future-proof your treasury and lead the digital currency transformation.