Microgrids and Distributed Energy Resources (DER) are no longer niche engineering solutions – they are strategic infrastructure assets that intersect resilience, decarbonization and access objectives. Rapid renewable buildouts, grid congestion and persistent energy access gaps are creating simultaneous demand for localized generation, storage and intelligent controls.

Distributed Energy Resources encompass small-scale, localized technologies such as rooftop solar photovoltaics (PV), battery energy storage systems (BESS), electric vehicles (EVs) as grid assets, and demand response mechanisms. These resources, often situated at or near consumption sites, empower consumers to generate, store, and manage energy autonomously or in concert with the central grid. Microgrids, in turn, represent integrated ecosystems of DERs, forming self-contained networks capable of islanding from the main grid during disruptions while optimizing performance in connected mode.

|

Value Stream |

Description |

Primary Beneficiary |

|

Enhanced Resilience |

Ability to “island” from the main grid during outages, ensuring continuous power for critical operations. | Industrial Facilities, Data Centers, Hospitals, Campuses |

|

Cost Arbitrage |

Using on-site storage to draw power from the grid when prices are low and use it when prices are high. | Commercial & Industrial users in regions with time-varying rates. |

|

Carbon Reduction |

Displacing grid power, often from fossil fuels, with on-site renewable generation. | Any organization with ESG/Sustainability commitments. |

|

Grid Services |

Providing services like frequency regulation or voltage support to the main grid for a revenue stream. | Microgrid owners in advanced electricity markets. |

Global Adoption Dynamics: Trajectories and Disparities

Adoption patterns vary starkly across regions, reflecting divergent policy maturity, investment flows, and infrastructure legacies. In advanced economies like United States and European Union, DER penetration is fueled by incentives such as U.S. Inflation Reduction Act, which has catalyzed a doubling of renewable expansions to nearly 500 GW by 2030. The DOE reports over 458 operational microgrids in the U.S. as of 2023, with more than 225 slated for commissioning by 2025, representing ~10 GW of capacity – 1% of the national grid but disproportionately impactful for resilience.

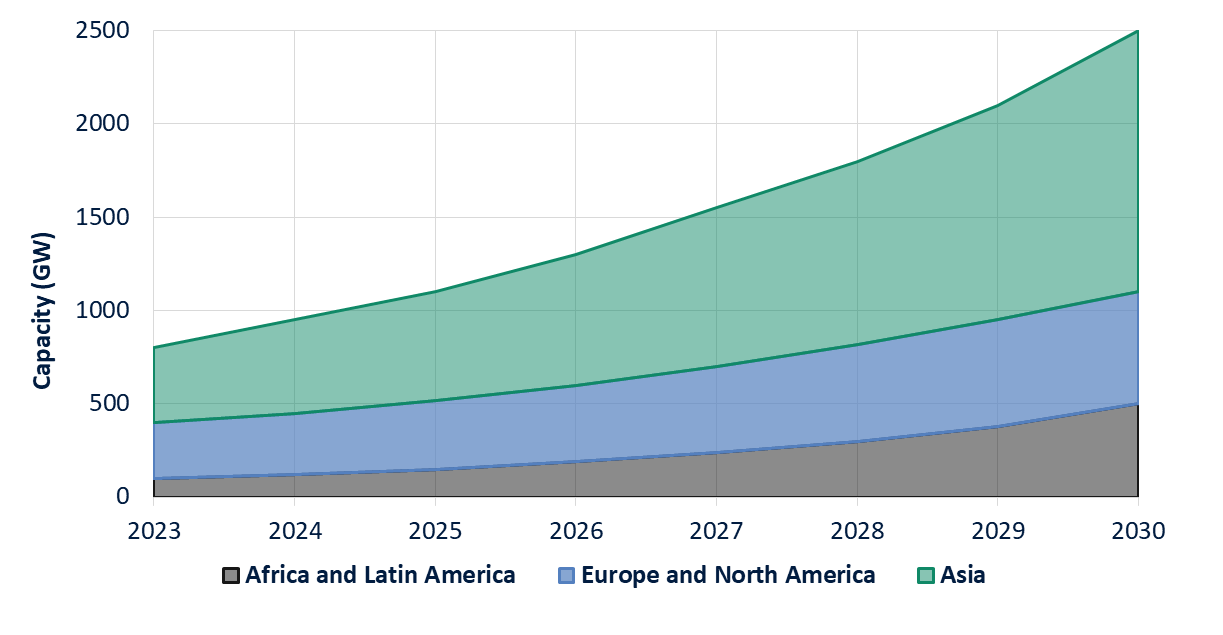

Emerging markets, however, present the most compelling growth corridors. Asia, led by China and India, accounted for 72% of 2024’s 585 GW renewable additions, with DERs comprising over 40% in distributed solar alone. China’s microgrid deployments, often hybrid solar-storage systems, exemplify scalable models for urban-rural integration, supporting the forecast of over 3,100 GW in national renewable additions by 2030.

Sub-Saharan Africa and Southeast Asia highlight access imperatives: 600 million people in sub-Saharan Africa lacked electricity in 2023, yet mini-grids, a microgrid subset, connected record numbers in 2024, averting reliance on diesel and slashing CO2 emissions by up to 1.5 billion tons globally if solar-powered at scale. In Latin America, UNDP-backed initiatives in remote communities demonstrate DER’s role in leapfrogging centralized grids, with EV-integrated microgrids emerging as dual-purpose assets for mobility and power.

Projected Regional DER Capacity Growth (GW)

Strategic Drivers and Commercial Implications

-

-

- Grid strain + distributed capacity = new value stacks. Rapid renewable additions drive variability and local congestion; DER and microgrids can relieve bottlenecks, supply ancillary services and defer transmission upgrades. This changes the revenue model: developers can monetize resilience, energy services, and capacity value — not only energy sales.

- Resilience premium is real for high-risk customers. Data centers, hospitals, critical infrastructure and climate-vulnerable communities assign a measurable willingness to pay for guaranteed uptime. For utilities and developers that can offer verified islanding and black-start capabilities, the resilience premium is a new commercial lever.

- Policy and Regulatory Momentum: The European Union’s Green Deal and REPowerEU plan are channeling massive public investment into energy resilience and decarbonization, explicitly promoting citizen energy communities and renewable integration. In Asia, Japan’s Ministry of Economy, Trade and Industry (METI) has been actively promoting microgrids for regional resilience for years.

- Corporate Sustainability Goals: Over 4,000 companies globally are working with the Science Based Targets initiative (SBTi), committing to stringent emissions reductions. For them, on-site renewable generation and resilient microgrids are tangible assets for achieving these targets and mitigating Scope 2 emissions.

- Access markets are both social mandate and growth market. Mini-grids for rural electrification represent scalable business cases when paired with productive-use business models and blended finance. Public funders and DFIs can de-risk early projects to catalyze private capital.

- Regulatory & technical complexity is the bottleneck. Interconnection rules, tariff structures, and market participation frameworks often lag technology. Without changes, DER remains underpriced and under-leveraged despite technical readiness.

-

Strategic Implications and the Path Forward

For senior leadership, the question is no longer if but how to engage with this market. We advise a three-phased approach:

-

-

- Portfolio Assessment & Valuation: Conduct a granular analysis of your organization’s energy footprint. Identify critical loads, map current energy costs, and quantify the financial risk of downtime. Model the integration of specific DERs to calculate the potential for reduced energy costs, resilience benefits, and carbon abatement.

- Business Model Selection: The optimal approach depends on capital, risk tolerance, and regulatory environment.

-

- Ownership Model: Direct capital expenditure for maximum long-term ROI and control.

- Energy-as-a-Service (EaaS): Partner with a third-party developer who finances, builds, and operates the system. The client pays a predictable service fee, transferring operational risk.

- Public-Private Partnership: For municipal or campus-wide projects, this model shares costs and benefits between public entities and private developers.

-

- Implementation and Continuous Optimization: This is not a one-time capital project. Success requires selecting the right technology partners, ensuring interoperability, and implementing advanced energy management software (EMS) for real-time optimization and participation in grid service markets.

-

Conclusion: The Resilient, Decarbonized Future is Distributed

The convergence of economic, environmental, and geopolitical forces has made the transition to a decentralized energy model inevitable. Microgrids and DERs represent a fundamental shift from viewing energy as a mere utility cost to managing it as a strategic, value-generating portfolio. Organizations that proactively integrate these assets will not only shield themselves from volatility but will also gain a powerful competitive advantage through enhanced operational resilience, cost predictability, and demonstrable sustainability leadership.

Partner with us to architect a resilient, DER-powered energy future – contact our team today for a tailored strategic roadmap.