Executive Summary

Microfinance represents a crucial segment of the global financial ecosystem, providing small loans, savings accounts, insurance, and other financial products to individuals and businesses typically excluded from traditional banking services. This sector primarily serves low-income populations who lack collateral, steady employment, or credit history, offering them a pathway to financial stability and economic participation.

Unlike conventional banking, microfinance employs innovative lending methodologies such as group lending programs, where communities guarantee each other’s loans, and progressive lending models that increase loan sizes based on repayment history. The sector has expanded beyond microcredit to include diverse financial products such as micro-savings, micro-insurance, payment solutions, and financial literacy programs, creating a comprehensive ecosystem for financial inclusion.

Microfinance remains a foundational tool of financial inclusion — reaching tens of millions of underserved clients and catalyzing small enterprise activity. Recent data estimate roughly over 173 million microfinance borrowers globally and show that microfinance clients are disproportionately women (about 66% of clients). While digital payments and improved data are enlarging reach, MFIs face profitability, client protection and regulatory challenges that need strategic repositioning to unlock scalable, resilient growth.

The Current State of the Global Microfinance Market

Globally, the sector serves as a bridge to financial inclusion, with account ownership reaching 79% of adults in 2024, up from previous benchmarks. However, significant gaps persist where approximately 742 million women worldwide lack access to formal financial services, equivalent to the population of Europe. This exclusion underscores microfinance’s role in addressing a nearly USD 5 trillion financing gap for micro and small enterprises (MSEs) in emerging markets.

Outreach has expanded markedly, with nearly half a billion MSEs in emerging economies relying on microfinance for livelihoods. In developing economies, savings through formal accounts surged to 40% in 2024, the fastest rise in over a decade. This trend highlights microfinance’s evolution from credit-centric models to comprehensive ecosystems incorporating digital financial services (DFS), which enhance efficiency and scalability.

Market Dynamics — What’s Changing and Why It Matters

-

-

- Digital payments and identity are expanding addressable markets. Mobile money growth and digital ID programs materially reduce onboarding costs and raise credit-scoring possibilities for remote clients — improving unit economics for MFIs when paired with risk analytics. This is a structural enabler of scale.

- Women remain the core constituency — but product gaps persist. Although women make up the majority of borrowers, product design (loan size, flexible repayment, savings and insurance) and digital access gaps limit upward mobility. Closing the gender product gap is both a commercial and social priority.

- Regulation and macro cycles matter more. Large borrower bases concentrated in emerging markets make MFIs sensitive to macroeconomic shocks, interest rate cycles and tightening prudential norms. Prudent capital planning and stress testing are now central to sustainable expansion.

- Shift from microcredit to integrated financial services. Evidence shows the most resilient MFIs are expanding beyond credit into savings, microinsurance and payments, both to deepen client relationships and to diversify fee and float income.

-

Regional Perspectives: A Comparative Lens

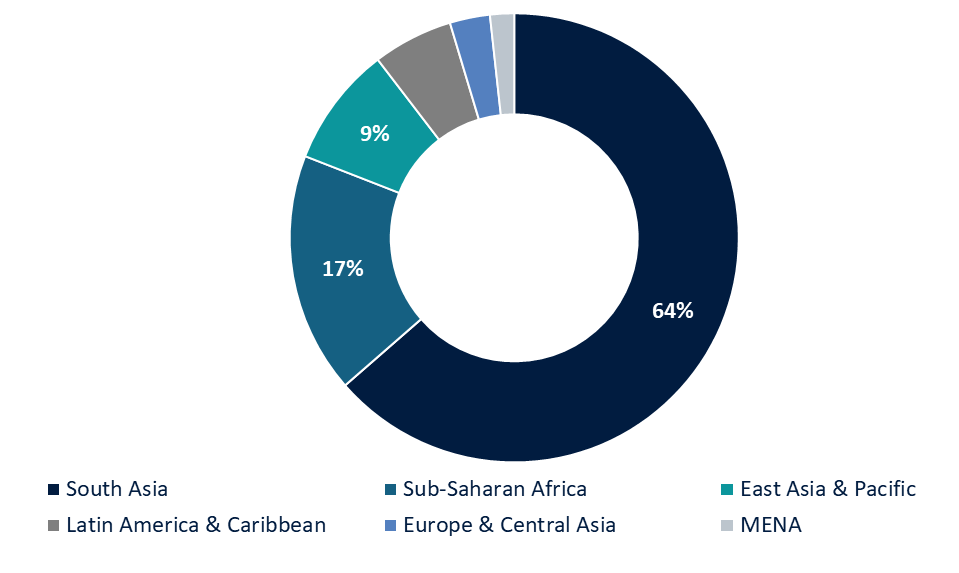

From a global vantage, microfinance exhibits varied maturity across regions, influenced by economic structures, regulatory environments, and cultural factors. In Asia, home to pioneers like Bangladesh’s Grameen Bank, the sector thrives with high penetration; for instance, South Asia accounts for a significant share of global borrowers, supported by government-backed initiatives.

Africa presents both opportunities and hurdles, with sub-Saharan institutions often reporting lower profitability but strong social impact, serving rural populations amid infrastructure challenges. Latin America demonstrates resilience, with an inventory of institutions showing sustained outreach to urban and semi-urban MSEs.

In fragile contexts like Gaza and Lebanon, microfinance aids reconstruction, while in West Africa, consumer protection labs address DFS risks. Strategically, stakeholders should prioritize region-specific strategies i.e. in Asia, scaling digital models.

Regional Distribution of Microfinance Borrowers in 2024

Emerging Trends in the Global Microfinance Sector: A Forward-Looking Analysis

Digital financial services (DFS) are transforming microfinance, with the data showing mobile penetration has driven 68% of adults to use digital payments, cutting transaction costs by up to 90% and enabling remote access. Yet, 31% of unbanked adults lack mobile phones, underscoring the need for hybrid models combining digital and physical outreach. MFIs must invest in digital public infrastructure (DPI) to sustain growth and resilience.

Strategic priorities to seize emerging opportunities include:

-

-

- Digital Scale-Up: Use DPI to enable real-time lending and reduce costs, targeting underserved rural and informal MSEs.

- Gender & Rural Inclusion: Address the 742 million women without access, unlocking $300 billion in economic value through tailored products.

- Climate Integration: Embed environmental risk tools to protect 3.3 billion climate-vulnerable people and support green transitions.

- Smart Funding: Leverage independent commitments over $10 billion to prioritize innovation and consumer protection.

-

With 163 economies now reporting financial access data, evidence-based strategies can drive microfinance toward 2030 goals of inclusion and sustainability.

Critical Challenges and Risk Mitigation

Key challenges include:

-

-

- Over-indebtedness: Aggressive growth in saturated markets can lead to client over-indebtedness. Mitigation requires robust credit information sharing systems, often facilitated by central banks.

- Operational Sustainability: High operational costs can threaten sustainability. The solution lies in the strategic adoption of automation and digital channels to lower the cost-to-serve.

- Interest Rates: Balancing financial sustainability with client-affordable rates remains a delicate act. Transparency and efficiency gains are key to justifying rates.

-

Strategic Recommendations for Stakeholders

-

-

- For Microfinance Institutions: Accelerate digital adoption. Partner with FinTechs to develop mobile-first platforms, utilize AI for credit assessment, and automate back-office functions. Shift from a credit-only to a holistic financial service provider model.

- For Investors (DFIs & Impact Investors): Allocate capital to institutions with strong ESG (Environmental, Social, and Governance) frameworks and proven technology integration. Focus on funding for green microfinance and climate-resilient products.

- For Policymakers & Regulators: Continue to develop enabling regulatory sandboxes for financial innovation. Invest in public infrastructure like digital ID systems and credit bureaus to de-risk the entire sector.

-

Conclusion: The Path Forward

The global microfinance market is at an inflection point. The convergence of proven social impact, technological enablement, and clear, data-backed demand creates a compelling growth narrative. Success will be determined not by the volume of loans disbursed, but by the ability of stakeholders to build efficient, scalable, and client-centric ecosystems.

The institutions that embrace data-driven decision-making, strategic partnerships, and digital innovation will be best positioned to capture value, drive financial inclusion, and generate sustainable returns in this dynamic and critically important market.

Engage with our consulting team today to design a tailored microfinance strategy that drives inclusion, resilience, and measurable impact.