Introduction

Fraud has become one of the most pressing threats in today’s digital-first banking ecosystem. A global retail bank operating across 25 countries with more than 120 million customers was facing a steady increase in fraud attempts. With mobile and online transactions growing at 20% annually, fraudsters were exploiting vulnerabilities in legacy detection systems.

The bank’s rule-based fraud monitoring infrastructure could not keep pace with evolving schemes such as synthetic identity fraud, phishing, and cross-border money laundering. In just two years, the bank reported a 38% YoY increase in fraud-related losses, alongside reputational damage due to false positives that often froze legitimate customer accounts.

The executive team turned to a consulting-led digital transformation initiative focused on AI-powered fraud detection to curb losses, enhance regulatory compliance, and rebuild customer trust.

Challenge

-

Rising Fraud Losses

-

Fraud-related losses had risen to nearly $1.2 billion annually, accounting for 0.7% of total revenue leakage.

-

Transaction volumes were doubling every 18–24 months, but the fraud detection process had not scaled accordingly.

-

-

High False Positives & Customer Dissatisfaction

-

Nearly 27% of flagged transactions turned out to be false positives, leading to blocked accounts and disrupted customer experiences.

-

Customer satisfaction (measured by NPS) had dropped by 11 points in one year.

-

-

Regulatory Pressure

-

Regulators demanded stronger Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, with hefty penalties for lapses.

-

Manual reporting processes increased operational costs by 20%.

-

-

Operational Inefficiencies

-

Fraud investigation teams were overloaded, handling over 50,000 alerts per month, many of which were repetitive and low-risk.

-

Solution

The consulting engagement designed a comprehensive AI-powered fraud detection ecosystem, which included:

-

Machine Learning & AI Models

-

Developed predictive models using supervised and unsupervised learning to identify suspicious transaction patterns in real time.

-

Leveraged anomaly detection to track unusual login behaviors, device changes, and geolocation mismatches.

-

-

Behavioral Biometrics & Analytics

-

Established customer-specific behavioral baselines. For example, if a customer who typically transacted domestically suddenly initiated multiple overseas wire transfers, the system flagged it instantly.

-

-

Cloud-Based Scalable Infrastructure

-

Migrated fraud detection to a cloud-native platform for low-latency monitoring of millions of daily transactions.

-

Integrated APIs with payment processors, credit bureaus, and external fraud databases.

-

-

Regulatory Compliance Automation

-

Automated suspicious activity reporting (SAR) workflows to comply with AML directives.

-

Integrated fraud monitoring with the bank’s enterprise-wide KYC database.

-

-

Human-AI Collaboration

-

Designed a workflow where AI filtered low-risk alerts, enabling fraud analysts to focus on high-priority cases, improving efficiency.

-

Results

-

Fraud Loss Reduction

-

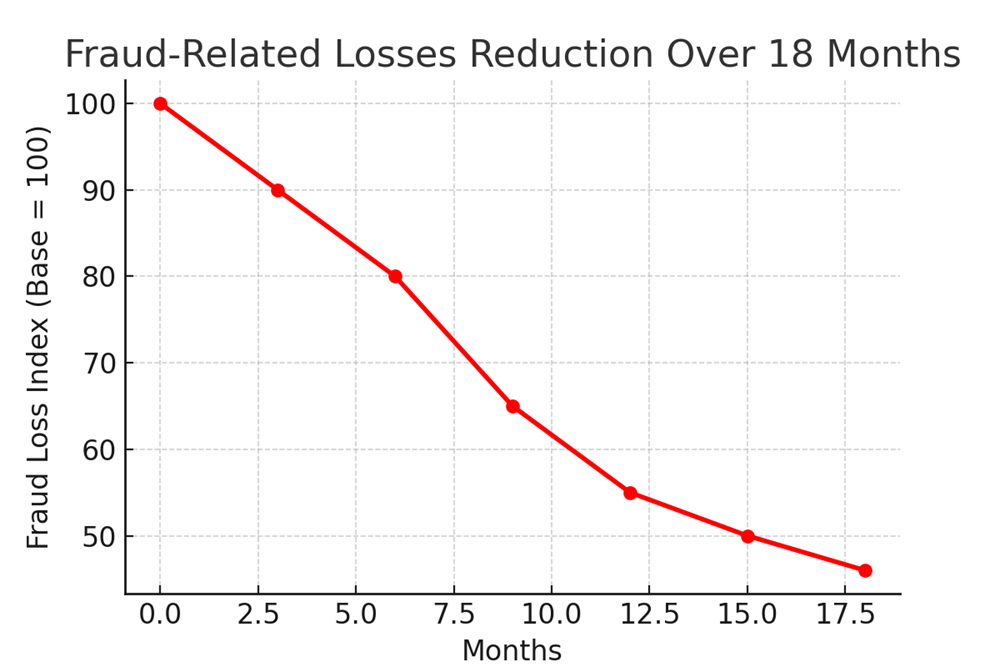

Within 18 months, fraud-related losses declined by 54%, translating into savings of nearly $650 million annually.

-

-

False Positive Optimization

-

False positives dropped from 27% to 9%, leading to a significant improvement in customer experience and account security.

-

-

Operational Efficiency

-

Fraud team productivity improved by 46%, reducing manual investigations by half.

-

-

Customer Trust Restored

-

Net Promoter Score improved by 14 points within a year due to reduced account lockouts.

-

-

Regulatory Compliance

-

Avoided multi-million-dollar fines by achieving real-time AML compliance reporting.

-

Strategic Insights & Recommendations

-

Future-Proofing Against Fraud: Continuous model training with new fraud datasets ensures adaptability.

-

Collaborative Data Sharing: Banks can participate in cross-industry fraud intelligence exchanges to further mitigate risks.

-

Customer Education: AI-driven fraud alerts can be paired with customer awareness campaigns to strengthen trust.