As Pillar Two (the 15% global minimum tax) moves from policy to production in 2024–2026, tax teams face a dual mandate: stand up compliant GloBE processes and protect the monthly/quarterly close. The opportunity is real – as per estimates USD 155 – 192 billion in additional corporate income tax (CIT) raised annually once Pillar Two is fully effective, equal to 6.5 – 8.1% of global CIT; roughly a third of the gains are from reduced profit shifting.

What’s Live Now and Why the Close Is at Risk

-

-

- EU: The Minimum Tax Directive (2022/2523) entered into force in Dec-2022; Member States had to transpose by 31 Dec 2023, with application of the IIR from 2024 and UTPR from 2025.

- UK: HMRC’s Multinational Top-Up Tax implements IIR for periods beginning on/after 31 Dec 2023 and UTPR for periods beginning on/after 31 Dec 2024.

- Australia: ATO confirms IIR + domestic minimum tax from 1 Jan 2024; UTPR from 1 Jan 2025.

- Switzerland: QDMTT from 1 Jan 2024; IIR from 1 Jan 2025 per the Federal Council.

- Singapore: Domestic Top-Up Tax and IIR from FYs starting on/after 1 Jan 2025.

- Japan: IIR applicable from FYs beginning on/after Apr 2024; UTPR/QDMTT planned in later reforms.

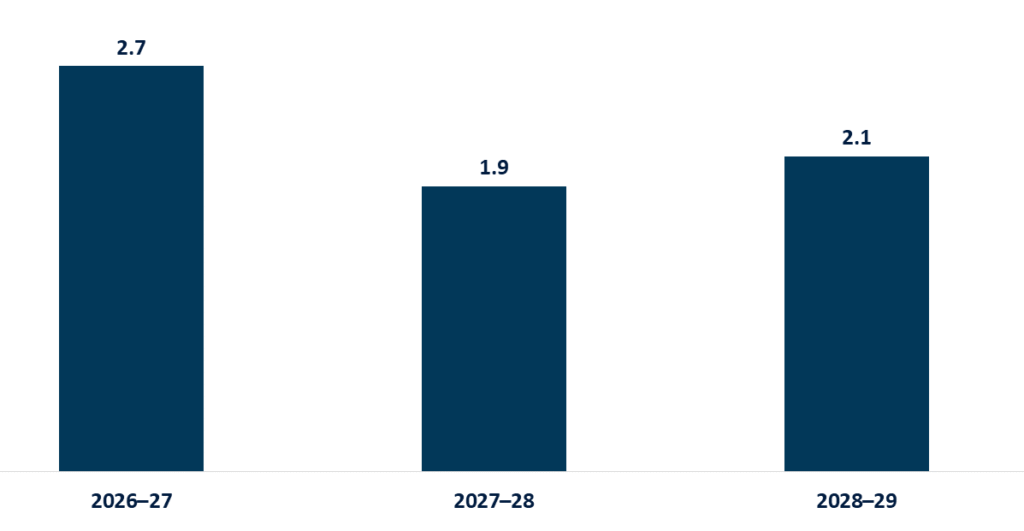

- Canada: Department of Finance projects CAD 6.6 billion extra revenue over FY 2026–27 to FY 2028–29 as Pillar Two phases in.

-

Close risk: GloBE introduces new entity scoping, ETR calculations, safe harbours, and disclosures that sit on the critical path of consolidation. Without design changes, teams extend cycle time, multiply reconciliations, and invite audit challenges.

A Fast-track Operating Model

1. Scope and Materiality in Week 1

Create a single global scoping register aligned to your legal-entity hierarchy: which entities are in scope, which safe harbours could apply, and which jurisdictions have QDMTTs. Reconcile scoping once, centrally then lock it for the period (changes via controlled CRs).

2. Data-by-design

Map GloBE data elements to consolidated financial reporting systems first (the OECD Implementation Handbook explicitly encourages leveraging the accounting backbone), then to local ledgers only where gaps remain. Use evidence-grade lineage.

3. Calculation Engine that Preserves Auditability

Whether you build or buy, insist on:

-

-

- Transparent formula logic;

- Versioning of rules and rate tables by jurisdiction;

- Automated tie-outs to the consolidation pack;

- Role-segregated approvals (preparer/reviewer) and immutable logs.

-

4. Close-compatible Workflow

Insert GloBE steps inside the group close calendar, not after it:

-

-

- T-3 to T-1: Preliminary scoping + safe-harbour screening;

- T0: Trial ETRs by jurisdiction and QDMTT interactions;

- T+2: Final top-up computation, disclosures, and posting;

- T+3: Variance analytics and root-cause fixes to feed next month.

-

5. Control Framework

Minimum viable controls that external auditors recognize:

-

-

- Entity scoping: signed attestation per period;

- Data quality: exception thresholds on covered taxes and deferred tax;

- Calculation: independent recomputation on a risk-based sample;

- Disclosure: checklist tied to jurisdiction-specific rules.

-

Technology Decisions that Actually Move the Needle

-

-

- Start with your accounting hub. The OECD favours consolidated financial systems as the primary data source—this cuts manual rework.

- Automate safe-harbour screening. Transitional CbCR-based tests can remove low-risk jurisdictions from full computation – significant cycle-time relief in 2024–2026. (Use a gated workflow: if failed, route to full GloBE calc.)

- Build a jurisdiction rules library. Parameterize effective dates (e.g., EU IIR 2024 / UTPR 2025; AU UTPR 2025; CH IIR 2025; SG 2025) and maintain it centrally.

- Evidence-first Design. Every number in the top-up tax should be traceable to a signed-off dataset (with snapshots). This reduces late-cycle disputes.

-

Where the Money Is: Quantifying Benefits And Costs

-

-

- Revenue impact (macro): USD 155–192 billion annual CIT uplift when Pillar Two is mature.

-

Pillar Two Incremental Revenue Estimates for Canada in CAD Billion

Cost-to-comply levers you control:

-

-

- Reduce “data chase” hours via standardized GloBE data packs;

- Avoid rework by freezing scoping and automating tie-outs;

- Cut audit time with pre-built workpapers and control testing.

-

Execution Pitfalls We See Most Often (and How To Avoid Them)

-

-

- Late scoping creates rework: Run scoping as a standing control on day 1 of every close.

- Spreadsheet dependency: Move to governed models with check-in/out and automated testing.

- Underestimating QDMTT interactions: Model domestic top-ups first; only then apply IIR/UTPR mechanics.

- Local divergence: EU, UK, AU, CH, SG, JP all differ at the margins – parameterize rules and keep a single source of truth.

- Close calendar collision: Embed “T-milestones” and hold the line; no ad-hoc work after T+3 without CFO sign-off.

-

Quick-start 30-day Blueprint

-

-

- Days 1–5: Stand up the global scoping register; map 100% of data fields to consolidation and identify gaps.

- Days 6–15: Configure a calculation engine with EU/UK/AU/CH/SG/JP parameters; implement safe-harbour screening.

- Days 16–25: Dry-run two jurisdictions end-to-end; build the audit trail and workpapers.

- Days 26–30: Move into the close calendar; lock controls; publish executive dashboard (exposure by jurisdiction, critical data gaps, on-time %).

-

Snapshot: Selected Jurisdictions & First Effective Year

|

Jurisdiction/Rule |

First effective year |

Note |

|

EU – IIR |

2024 | Directive 2022/2523; Member States apply IIR from 2024. |

| EU – UTPR | 2025 |

Applied by Member States from 2025. |

|

UK – IIR (Multinational Top-Up Tax) |

2024 | For periods beginning on/after 31 Dec 2023. |

| UK – UTPR | 2025 |

For periods beginning on/after 31 Dec 2024. |

|

Australia – IIR/DMT |

2024 | IIR & domestic minimum tax from 1 Jan 2024. |

| Australia – UTPR | 2025 |

From 1 Jan 2025. |

|

Switzerland – QDMTT |

2024 | Swiss supplementary tax in force 1 Jan 2024. |

| Switzerland – IIR | 2025 |

In force 1 Jan 2025. |

|

Singapore – DTT/IIR |

2025 | Applies to FYs starting on/after 1 Jan 2025. |

| Japan – IIR | 2024 |

Applicable to FYs beginning on/after Apr 2024. |

What Leadership Should Ask this Quarter

-

-

- Are we using the consolidation system as the primary GloBE source, with a documented lineage?

- Do we have a single, governed rules library for jurisdictions and dates?

- Have we embedded GloBE milestones inside the close calendar?

- Can we prove safe-harbour eligibility with evidence, not spreadsheets?

- What is our quantified exposure and the run-rate cost-to-comply?

-

How RNG Strategy Consulting Helps

RNG Strategy Consulting combines technical expertise with digital execution to help you:

-

-

- Assess readiness and exposure through rapid diagnostics and data mapping.

- Design compliant operating models embedded within the financial close.

- Implement calculation engines and safe-harbour automation aligned with local rules.

- Deliver audit-ready documentation and control frameworks that withstand scrutiny.

-

Our integrated approach connects policy intelligence, process design, and technology — helping organizations achieve Pillar Two compliance ahead of deadlines while turning tax data into a strategic business asset.