Executive Takeaway

Tax technology is no longer a discretionary upgrade. It is a measurable productivity engine that reduces compliance hours, lowers error and penalty risk, accelerates cash and strengthens the control environment while giving CFOs decision-quality data. Governments’ own numbers now quantify the upside: UK’s Making Tax Digital (MTD) program estimates 30 to 47 hours saved per VAT business per year for users of fully compatible software, equivalent to 40 million hours saved in 2022–23 across participating businesses.

Why is the ROI Compelling Now

Regulatory digitalization is here. The EU’s VAT in the Digital Age (ViDA) program is rolling out e-invoicing and digital reporting to reduce fraud and simplify cross-border trade, with mandatory elements phasing in over the decade. The Commission’s VAT Gap analysis shows the EU compliance gap at ~7% of VAT liability in 2022, a material efficiency opportunity that digital reporting aims to shrink.

Proven revenue impacts from e-invoicing. Public development banks and regional tax bodies report tangible gains. For example, in Mexico, declared revenues increased 14% over three years after e-invoicing became mandatory.

Tax administrators themselves are digital. Across 58 administrations in the OECD Tax Administration Series (TAS), the use of e-channels and automated verification has expanded, and most administrations improved their cost-of-collection ratios after the pandemic spike – evidence that digital operations scale efficiently.

Scale matters. The US IRS processed 266.6 million returns and forms in FY2024, volumes that are only workable through digital rails. E-filing, pre-validation and analytics are not optional at this scale; similar principles apply inside large corporate tax functions.

A Practical ROI Framework for CFOs and Heads Of Tax

When we model ROI with clients, we quantify benefits across four levers:

-

-

- Time Saved (Labour Cost & Cycle Time)

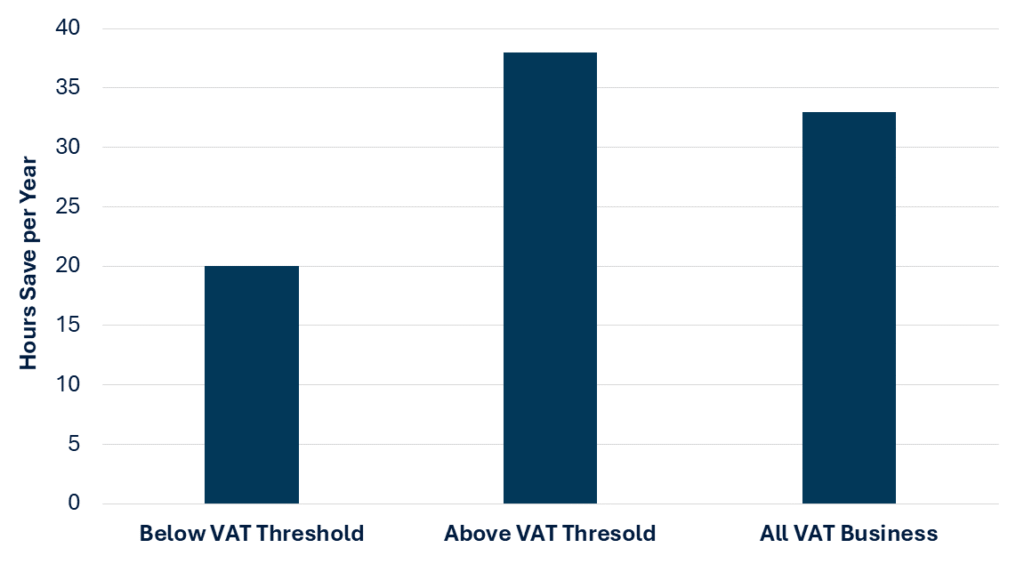

- UK MTD evaluation: 33 hours per VAT business per year on average; 39 hours for businesses above the VAT threshold. Translate hours to fully loaded cost and multiply by the in-scope population.

- Comparable metrics from other jurisdictions reinforce the scale of potential efficiency gains. New Zealand’s small businesses now spend a median of 32 hours per year managing tax obligations, down from 36 hours in 2021, reflecting the effect of digital lodgement systems.

- In United States, corporate taxpayers devote roughly 60 to 100 hours per return, depending on entity type, providing a reliable baseline for automation-driven time savings.

- Across the OECD, governments implementing Standard Business Reporting and e-invoicing frameworks have documented 5 to 10 percent reductions in administrative burden, confirming that digitization translates into measurable cost and time efficiencies at scale.

- Error and Penalty Avoidance

- EU ViDA’s case for digital reporting is explicitly tied to reducing reporting errors and fraud – closing part of the €89bn VAT gap. A small reduction in your own assessed penalties or audit adjustments typically repays a sizable portion of a tax-tech business case.

- Cash Flow and Working Capital

- E-invoicing enables faster invoice validation and earlier input-VAT recovery in many regimes; Latin America’s experience links e-invoicing with higher declared revenue and better control – proxies for improved cash discipline.

- Strategic Value from Analytics

- OECD TAS highlights the shift to automated checks, validations and matching – a backbone for near-real-time risk analytics, scenario modelling and forecast ETR management. This reduces surprises and supports board-level decision making.

- Time Saved (Labour Cost & Cycle Time)

-

What the Numbers Look Like

UK MTD benefit snapshot: Average hours saved per year for VAT businesses using fully functional software

Back-of-the-envelope: If your average fully loaded finance cost is £35/hour, 33 hours saved equates to ~£1,155 per entity per year, before counting reduced errors, faster close, or lower external advisor rework.

Cost Discipline and Controls: Why Technology Pays Back

Digital tax operations are cost-efficient at scale. HMRC’s cost of collection remained around 0.51 pence per £1 of revenue in 2023–24 and 2024–25 despite system complexity, an indicator that digital investments can hold unit costs flat while volumes rise. Inside corporates, the analogue is clear: automate recurring compliance to stabilize unit cost per return/filing as your entity count and jurisdictions expand.

Tax-tech ROI Levers, and Metrics

|

ROI lever |

What to measure | Typical data source | Public reference you can cite |

| Time saved | Hours per return/period; close timeliness | Time logs, workflow timestamps |

33h avg per VAT business; 40mn hours saved 2022–23. |

|

Error/penalty avoidance |

Adjustments, penalties, audit findings | Prior audit files, letters, ERP flags | EU VAT Gap ~7% of liability (2022) underscores error/fraud baseline digital aims to cut. |

| Cash-flow | Days to validate invoices; timing of input VAT recovery | AP metrics, tax calendars |

IDB/CIAT: LATAM e-invoicing linked to +14% declared revenue (Mexico), +3.7% collections (Uruguay). |

|

Control strength |

Evidence trail completeness; rework rate | Internal controls testing | OECD TAS documents the shift to automated checks & matching across administrations. |

| Scalability | Unit cost per filing/entity; staff stretch | Cost reports, headcount plans |

HMRC 0.51p per £1 illustrates digital scale economies in collection. |

Where to Invest First and What to Pause

-

-

- Digitize source data and e-invoicing where mandated or imminent (EU ViDA readiness, LATAM models). Automate validations at capture; don’t wait until return-prep.

- Standardize a governed tax-data layer tied to your consolidation/ERP. The OECD’s Tax Administration work shows that automated matching and validations deliver outsized control benefits – mirror that internally.

- Automate the recurring 80% (VAT/GST, WHT, routine corporate returns), then address analytics and forecasting (ETR, cash taxes) for strategic value.

- De-risk with evidence by design. Build audit trails (inputs, transformations, approvals) into the workflow, not as a period-end scramble.

- Pause bespoke spreadsheets for high-volume, rules-based work. Direct build to enterprise-grade calculation engines or governed notebooks with check-in/out and testing.

-

Implementation pitfalls to avoid

-

-

- Under-scoping jurisdictions and formats. ViDA will coexist with national e-invoicing rules – design for parameterized rule libraries, not hard-coding.

- Assuming benefits without measurement. HMRC’s quantified hours saved is a model: capture your own baseline and re-measure post-go-live.

- Leaving service design to IT alone. Pair tax policy expertise with digital workflow design – OECD TAS emphasizes the human/organizational side of digital transitions.

-

Conclusion: From Compliance Cost to Strategic Return

Tax technology is redefining the finance function — not as a back-office upgrade, but as a strategic lever for control, speed, and insight. The ROI is no longer theoretical; governments and corporates alike are quantifying real gains.

Key takeaways:

-

-

- Efficiency: Automation and e-invoicing free thousands of hours annually and cut reporting friction.

- Risk reduction: Digital workflows reduce manual errors, penalties, and audit exposure.

- Data intelligence: Structured tax data enables forecasting, ETR analytics, and ESG-linked reporting.

- Scalability: Standardized digital processes maintain compliance as entity and jurisdiction counts grow.

- Strategic value: Modern tax tech transforms compliance data into decision-ready intelligence for CFOs.

-

RNG Strategy Consulting helps organizations:

-

-

- Quantify tax technology ROI through diagnostics and benchmarking.

- Design scalable digital operating models integrated with the financial close.

- Implement compliant, auditable systems that deliver measurable cost and control benefits.

-

Connect with us to assess your ROI potential and fast-track your digital tax transformation.