Executive Brief

Usage-Based Insurance (UBI) is moving from pilot to policy – enabled by on-board data, smartphone telematics, and tightening governance of how driving data can be collected and used. In Europe, regulatory changes (e.g., Intelligent Speed Assistance and event data recorders becoming standard on new vehicles) expand the volume and reliability of vehicle data. In parallel, regulators in United States and India are clarifying guardrails and permissions for UBI and telematics-linked pricing. As a result, UBI is no longer just a pricing experiment, it’s a capability stack where data, analytics, consent, and customer engagement can reshape combined ratios and retention in motor lines.

Reframing UBI as a Strategic Imperative: Models and Maturity Pathways

UBI redefines risk assessment by harnessing real-time telematics to supplant demographic proxies with behavioral telemetry, yielding loss ratio improvements of 10-20% through targeted interventions. Core variants include Pay-As-You-Drive (PAYD), which calibrates costs to odometer readings; Pay-How-You-Drive (PHYD), scoring acceleration and cornering; and Manage-How-You-Drive (MHYD), delivering gamified coaching for sustained habit shifts.

Strategically, UBI counters the non-life sector’s underwriting pressures, where data reveals claims growth outpacing premiums by 4.2% in 2023 across 40 jurisdictions. For executive teams, this manifests in actuarial uplift where analysis links telematics adoption to a 20-30% reduction in at-fault incidents among participants, correlating with USD 200 billion in annualized societal savings from fewer crashes. Amid 39,345 U.S. traffic fatalities in 2024, a 3.8% decline from 2023, UBI’s behavioral nudges amplify regulatory mandates like the EU’s eCall, embedded in 95% of new vehicles by 2025.

PHYD’s lead reflects its synergy with smartphone ecosystems, where 30% of global UBI deployments now leverage apps, empowering insurers to harvest anonymized data for portfolio-wide refinements.

Why UBI Now

-

-

- Safety & loss economics: Road traffic deaths remain ~1.19 million per year globally; safer driving has material societal and insurance impacts. UBI programs that coach drivers and align premiums to actual risk can support loss-frequency reduction.

- Real supply-side adoption: In Europe, 17% of insurers already offer telematics-based motor products – evidence that UBI has moved into mainstream product portfolios.

- Data availability step-change: EU General Safety Regulation (EU) phases in Intelligent Speed Assistance (ISA) and Event Data Recorders (EDR) for new vehicles, increasing the standardization of in-vehicle data streams (with privacy rules intact).

- Clearer guardrails: In U.S., the NAIC sets expectations for AI/telematics governance, while the FTC’s 2025 action underscores consent and permissible data use, accelerating “privacy-by-design” UBI architectures.

- New market permissions: India’s IRDAI formally permitted Pay-As-You-Drive/Pay-How-You-Drive add-ons in 2022, creating a national pathway from sandbox pilots to scaled UBI offerings.

-

What Winning UBI Looks Like (Operating Model)

1) Consent-centric data strategy

-

-

- Treat consent and purpose limitation as product features, not paperwork. U.S. enforcement actions show the cost of weak disclosures; design opt-ins that are granular, revocable, and comprehensible.

-

2) Dual-track telematics ingestion

-

-

- OEM/embedded + smartphone SDK to maximize coverage and quality. EU mandates (ISA/EDR) improve standardization on newer vehicles; smartphone telematics sustains inclusivity in mixed fleets.

-

3) Pricing & portfolio management

-

-

- Start with “Try-Before-You-Buy” scoring (discounts on conversion), then graduate to PHYD/PAYD with dynamic renewal factors. Tie earned premium to measured risk exposure and distance.

-

4) Claims & fraud

-

-

- Event-level telemetry and crash reconstruction shorten cycle times and help contain opportunistic fraud. EU EDR mandates improve post-crash data fidelity and dispute resolution.

-

5) Safety outcomes & ESG

-

-

- WHO’s road-safety burden justifies a formal safety-coaching KPI (e.g., harsh-brake rate ↓, night-driving risk ↓) in product governance, aligning customer benefit with loss performance.

-

Strategic Challenges and Implementation Hurdles

Despite the substantial opportunities, UBI implementation presents significant challenges that require strategic management:

-

-

- Data Privacy and Security: The extensive collection of driving data, including location, speed, and behavior patterns, raises legitimate privacy concerns. Insurers must implement robust security protocols, transparent data usage policies, and compliance with regulations such as GDPR and CCPA to maintain consumer trust. The psychological barrier of continuous monitoring represents a related challenge, requiring careful communication of benefits and protections.

- Technology Infrastructure and Costs: Implementing UBI programs requires substantial investment in telematics devices, mobile applications, data storage, analytics capabilities, and cybersecurity measures. Additionally, ongoing maintenance, updates, and customer support contribute to the total cost of ownership.

- User Adoption and Engagement: Successful UBI programs require active policyholder participation, whether through device installation, app usage, or behavior modification. Insurers must develop compelling value propositions, user-friendly interfaces, and effective engagement strategies to drive participation.

- Regulatory Compliance: As UBI programs expand globally, insurers must navigate diverse regulatory frameworks across jurisdictions. Compliance requirements related to data privacy, pricing fairness, and consumer protection vary significantly and require ongoing monitoring and adaptation.

-

Future Outlook: Strategic Implications for Industry Leaders

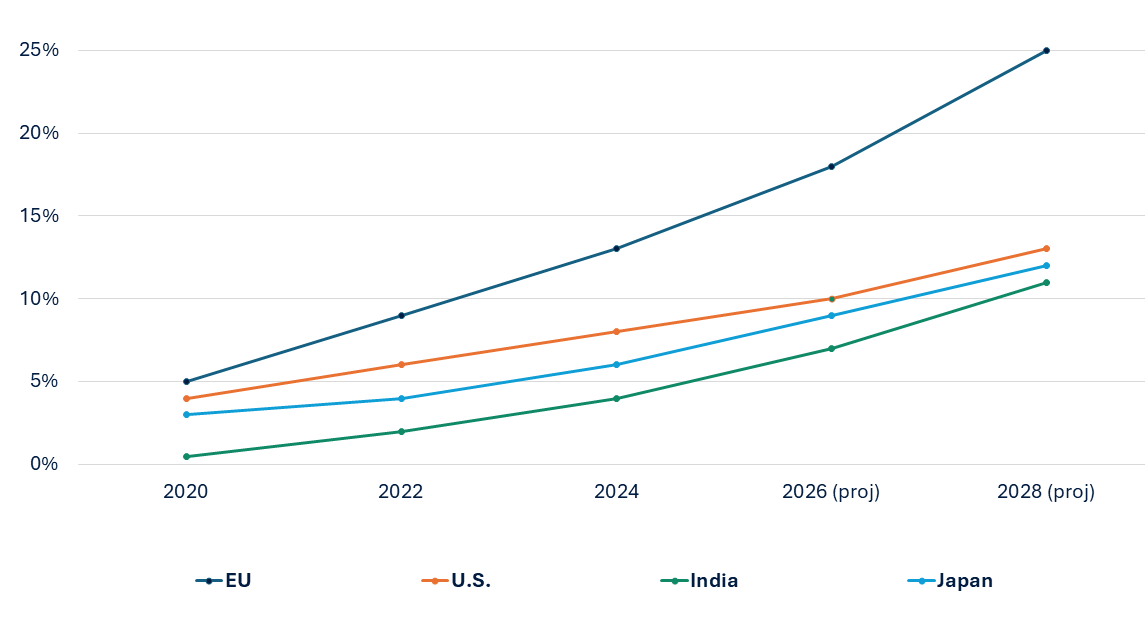

By 2030, UBI will transition from niche differentiator to foundational architecture, with projections indicating nearly 789 million active telematics-enabled policies worldwide, a 29.6% CAGR from 2025 levels. This surge aligns with the proliferation of connected vehicles, where the European Commission’s eCall mandate and China’s MIIT telematics standards will drive 95% factory-fit adoption in new registrations.

For executives, the imperative lies in orchestrating AI-blockchain hybrids: generative models will enable sub-second risk scoring, while distributed ledgers cut claims disputes by 60%. Insurers must prioritize edge-computing investments i.e. 5G latency below 1 ms unlocks hyper-local pricing and position them as mobility-as-a-service enablers rather than mere risk carriers.

With Asia-Pacific’s over 30% regional CAGR through 2030, emerging markets will dictate pace and demand OEM-insurer consortia to embed UBI at manufacture. North American carriers should target 35% penetration in commercial fleets via predictive maintenance bundles, yielding 15-20% loss-ratio compression. European leaders must navigate the EU Data Act’s 2026 enforcement, federating datasets across borders to comply with GDPR while monetizing anonymized insights. Failure to act risks ceding ground to tech-native entrants; proactive firms will capture 20% incremental revenue through ecosystem orchestration.

Executive Imperatives: Forging UBI’s Competitive Moat

Precision pricing, behavioral nudges, and ecosystem orchestration can deliver 15-20% incremental value, while countering claims inflation and protection gaps. Insurers who integrate telematics with AI governance and privacy-by-design frameworks will not only compress loss ratios but redefine customer trust in a data-driven future. Leaders must act decisively: conduct telematics maturity audits, establish regulatory war rooms, and launch cross-border AI pilots within the next 12 months.

Contact us to secure a strategic session and convert behavioral data into enduring UBI market leadership.