Executive Perspective: Navigating a Market in Transition

The pickup truck segment represents one of the most dynamic and strategically complex arenas in the global automotive industry. Having advised C-suite leadership across OEMs, fleet operators, and investment firms, we observe three critical truths that demand executive attention:

-

-

- Market boundaries are dissolving – The traditional segmentation between commercial and personal use is becoming obsolete

- Profit pools are shifting – Electrification and connectivity are creating new revenue streams while threatening legacy businesses

- Regional strategies require recalibration – Growth opportunities now exist in unexpected geographies

-

This analysis provides senior leaders with actionable insights to position their organizations for success in this transforming landscape.

Core Strategic Challenges

1. The Identity Crisis: Utility Vehicle or Lifestyle Product?

The fundamental value proposition of pickup trucks is being redefined:

-

-

- Commercial users demand durability, worksite integration, and total cost of ownership

- Personal users prioritize technology, comfort, and brand prestige

- Emerging hybrid users expect both in a single package

-

Leadership imperative: Develop flexible product architectures that can serve these divergent needs without compromising cost structure.

2. The Electrification Paradox

While EV adoption in pickups lags PVs, the strategic implications are more profound:

-

-

- Regulatory pressure: CAFE standards and Euro 7 will make ICE portfolios increasingly costly

- Economic reality: Battery costs must decline 30% by 2027 for true TCO parity

- Strategic window: Early movers in commercial EV pickups are capturing fleet mindshare

-

Critical insight: Electrification cannot be treated as a compliance exercise – it requires rethinking the entire product lifecycle.

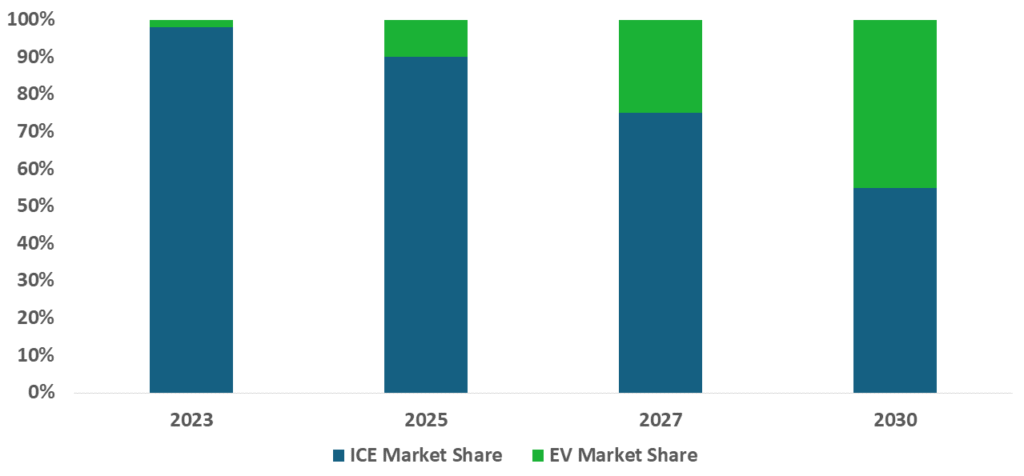

Global Pickup Truck Market: ICE vs. EV Adoption Projections (2023-2030)

3. The Global Opportunity Matrix

|

Market |

Growth Driver |

Strategic Consideration |

|

North America |

Premiumization |

Protect core while developing EV ecosystem |

|

Asia-Pacific |

Emerging commercial use | Localize or partner to overcome tariff barriers |

|

Europe |

Last-mile logistics |

Right-size vehicles for urban environments |

| LATAM/MEA | Rugged reliability |

Balance feature content with price sensitivity |

Execution priority: Market-specific product strategies will outperform global platform approaches.

Challenges and Strategic Risks: Navigating the Pitfalls

The pickup truck market’s growth trajectory is not without obstacles. Industry leaders must contend with three critical challenges that could disrupt profitability and market positioning:

-

-

- Supply Chain Volatility: Semiconductor shortages and rising material costs (e.g., lithium, steel) continue to squeeze margins. In 2023, automakers faced a 15% production shortfall, delaying key model launches.

- Regulatory Pressure: Stricter emissions standards (Euro 7, U.S. CAFE) and safety mandates are increasing compliance costs. ICE models may face up to USD 2,500/unit cost penalties by 2027.

- EV Adoption Hurdles: While electric pickups promise long-term savings, high upfront costs and charging infrastructure gaps remain barriers. Fleet operators report 30% higher acquisition costs for EVs versus diesel equivalents.

-

Beyond these macro challenges, strategic missteps could prove even more damaging:

-

-

- Failing to Differentiate: With SUVs encroaching on pickup demand (Over 20% of buyers defect to SUVs), bland “me-too” designs will lose market share.

- Underestimating Fleet Needs: Telematics and TCO analytics are now table stakes – over 50% of fleets prioritize integrated digital tools over raw vehicle specs.

- Lagging in Emerging Markets: Asia-Pacific’s over 6% CAGR growth demands localized strategies, not just exported North American models.

-

Proactive risk mitigation, not reactionary fixes, will separate winners from also-rans in this high-stakes market.

Actionable Recommendations

For OEM Leadership Teams

-

-

- Reconfigure product development

- Implement modular architecture with shared EV/ICE components

- Develop proprietary worksite technology integrations

- Reengineer the commercial model

- Shift from vehicle sales to fleet productivity solutions

- Pilot subscription models for seasonal users

- Secure critical supply chains

- Lock in battery materials through 2030

- Diversify semiconductor sourcing

- Reconfigure product development

-

For Fleet Operators

-

-

- Demand lifecycle guarantees from OEM partners

- Pilot EV adoption in predictable route applications

- Invest in telematics to optimize utilization

-

For Investors

-

-

- Focus on enabling technologies: charging infrastructure, V2G systems

- Monitor regulatory arbitrage opportunities across regions

- Evaluate ICE-to-EV transition risks in legacy players

-

Strategic Conclusion: Winning the Pickup Truck Market’s High-Stakes Transformation

The pickup truck sector stands at a pivotal crossroads – one where traditional strategies will no longer suffice. As this analysis has demonstrated, the pickup truck market is being reshaped by three irreversible forces: the blurring of commercial and personal use cases, the inevitability of electrification, and the globalization of demand.

For industry leaders, the path forward requires bold, decisive actions:

-

-

- Reinvent Product Strategy – Move beyond the “workhorse vs. lifestyle” dichotomy by developing modular platforms that serve both segments profitably.

- Accelerate Ecosystem Plays – Treat vehicles as connected platforms, not standalone products, by embedding telematics, productivity tools, and energy solutions.

- Regionalize for Growth – Tailor offerings to local market needs, from rugged reliability in emerging markets to premium electrification in mature ones.

-

The coming 24 to 36 months will determine market leadership for the next decade. Companies that hesitate, whether on electrification, fleet digitization, or global expansion, risk becoming footnotes in an industry they once dominated.

Final Recommendation: Conduct an urgent strategic audit of your:

-

-

- EV transition timeline (Are you ahead or behind cost curves?)

- Fleet value proposition (Are you selling trucks or productivity?)

- Supply chain resilience (Can you withstand another disruption?)

-

For a confidential assessment of your strategic position in this transforming market, contact our automotive practice for an executive briefing.