Key Takeaways for Senior Executives

-

-

- The composites revolution is accelerating driven by aerospace, defense, and energy transitions but most firms are underprepared for the cost and scalability challenges ahead.

- Winners will separate from losers in the next 3 to 5 years based on three strategic bets:

- Partnerships with OEMs in aerospace/EVs

- Breakthroughs in low-cost carbon fiber

- Closed-loop recycling solutions

- Margins are at risk unless production shifts toward automated, and large-scale manufacturing.

-

The Strategic Landscape: Where Are the Real Pockets of Growth?

1. Aerospace & Defense: The High-Stakes Game

-

-

- Boeing and Airbus now allocate 50%+ of material budgets to composites, up from 30% a decade ago.

- Critical vulnerability: Only 4 suppliers control 80% of aerospace-grade carbon fiber. If you’re not locked into long-term contracts with Hexcel or Toray, you’re already behind.

-

Our Recommendation:

-

-

- For Tier 1 suppliers: Secure multi-year offtake agreements now as spot market pricing is volatile.

- For new entrants: Target UAVs and regional jets where certification barriers are lower.

-

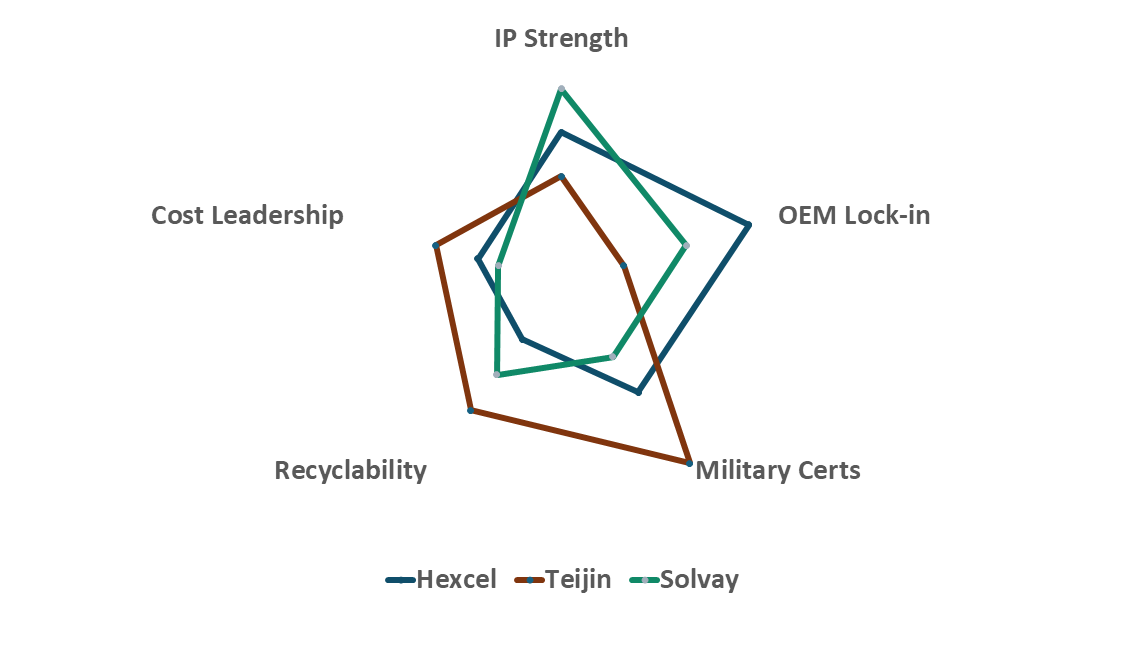

Strategic positioning of key players in aerospace composites

|

Company |

Key Advantage |

|

Hexcel |

Airbus sole-source contracts |

|

Teijin |

Military UAV dominance |

|

Solvay |

Engine components leadership |

2. Automotive: The Coming Inflection Point

The Reality Check:

-

-

- While carbon fiber use in EVs grows at 18% CAGR, most automakers will not pay a >15% premium over aluminum.

- Tesla’s Cybertruck bet on ultra-hard stainless steel signals lingering cost skepticism.

-

Winning Moves:

-

-

- Hybrid material systems (e.g., carbon fiber + aluminum joints) for structural components.

- Pre-competitive collaboration – like Tata AutoComp Systems Ltd. and Katcon Global JV.

-

The Make-or-Break Challenges Most Boards Are Underestimating

1. The Precursor Problem

-

-

- 95% of carbon fiber relies on PAN precursor, with major control by Japan.

- Geopolitical risk: A Taiwan conflict could disrupt over 30% of global supply within weeks.

-

Strategic Response Required:

-

-

- Alternative precursors (lignin, textile waste) need 5-10x more R&D funding than currently allocated.

-

2. The Recycling Time Bomb

-

-

- By 2027, EU regulations may mandate over 50% recyclability in composites – today’s solutions achieve <30%.

- First-mover advantage: Companies are developing and protecting their proprietary pyrolysis technologies.

-

Aerospace Composites Competitive Moats

Emerging Threat: The China Factor in Composite Material Dominance

China is rapidly closing the technology gap in advanced composites, leveraging state-backed investments and aggressive IP acquisition. Consider these critical developments:

1. Military-Civil Fusion Strategy

-

-

- AVIC’s new CFRP plant in Chengdu will produce 12,000 MT/year of aerospace-grade carbon fiber which is enough to supply majority of China’s fighter jet demand.

- Export controls evasion: Chinese firms are acquiring European pyrolysis tech via shell companies.

-

2. Cost Warfare Tactics

-

-

- State-subsidized dumping: A Chinese supplier’s PAN precursor is priced ~ 30% below market.

- Forced IP transfer: COMAC’s supplier contracts mandate tech sharing with domestic partners.

-

Strategic Responses Required

-

-

- Defense contractors: Audit Tier 2+ suppliers for undisclosed Chinese material inputs.

- Material producers: Lobby for CFIUS blocks on Chinese acquisitions of recycling IP.

- Automakers: Preempt EU anti-dumping duties by diversifying beyond China-dependent precursors.

-

China isn’t just competing, it’s rewriting the global rules. Ignoring this risks strategic dependency by 2030.

Three Non-Negotiable Actions for Leadership Teams

1. Reshape Your Supply Chain Now

-

-

- Dual-source precursors: South Korea’s Hyosung now offers PAN at lower cost than Japanese incumbents. Hyosung has invested heavily to expand carbon fiber production capacity with annual output to 24,000 tons by 2028.

- Onshore/nearshore production

-

2. Force the Cost Curve Down

-

-

- Robotic automated fiber placement (AFP) reduces labor costs by 50% in wing production.

- Alternative chemistries: Arkema’s Elium resin enables 30% faster curing vs. epoxies.

-

3. Play the Sustainability Card Harder

-

-

- Bio-based epoxy resins already command 12% price premiums in EU tenders.

- Waste-to-fiber partnerships: HRC and Airbus Lifecycle Services Center (ALSC) collaborated to increase material recovery, and lessen environmental impact for an aircraft dismantling and recycling project.

-

Conclusion: The Composites Revolution Demands Action Now

The advanced composites market is no longer about incremental innovation but it’s a high-stakes reconfiguration of global supply chains, defense readiness, and sustainable manufacturing. Here’s what leadership teams must internalize:

The New Rules of Competition

-

-

- Recyclability is no longer optional – EU and other mandates will blacklist non-compliant suppliers by 2027.

- Dual-sourcing is existential – Hyosung’s PAN discount proves Asia’s cost dominance, but geopolitical risks demand redundancy.

- Military contracts now hinge on circularity

-

The Cost of Inaction

-

-

- Margin erosion: Firms relying on virgin carbon fiber face over 30% cost penalties vs. recyclers.

- Obsolescence risk: Traditional epoxy formulations won’t qualify for next-gen aerospace/EV programs.

- Shareholder backlash: ESG funds are divesting from linear material producers.

-