The Paradigm Shift: From Recall to Revenue

The traditional automotive model is fraught with inefficiency. A software bug discovered post-production historically necessitated a costly and brand-damaging recall campaign, involving dealership networks, parts logistics, and significant customer inconvenience. OTA updates elegantly dismantle this paradigm.

Consider this: a typical physical recall can cost an OEM between $50 to $500 per vehicle, factoring in logistics, parts, and labor. In contrast, an OTA update addressing the same issue costs a fraction of that amount. The strategic value is immense. Beyond cost savings, OTA capabilities enable:

-

-

- Enhanced Customer Satisfaction: Rapid resolution of issues and continuous feature improvement keep the vehicle fresh and customers engaged.

- New Revenue Streams: OEMs can offer feature-on-demand services (e.g., advanced driver-assistance systems (ADAS) upgrades, performance boosts, subscription-based comforts).

- Data Monetization: Aggregated, anonymized data from update cycles provide invaluable insights into feature usage and customer preferences, informing future R&D.

-

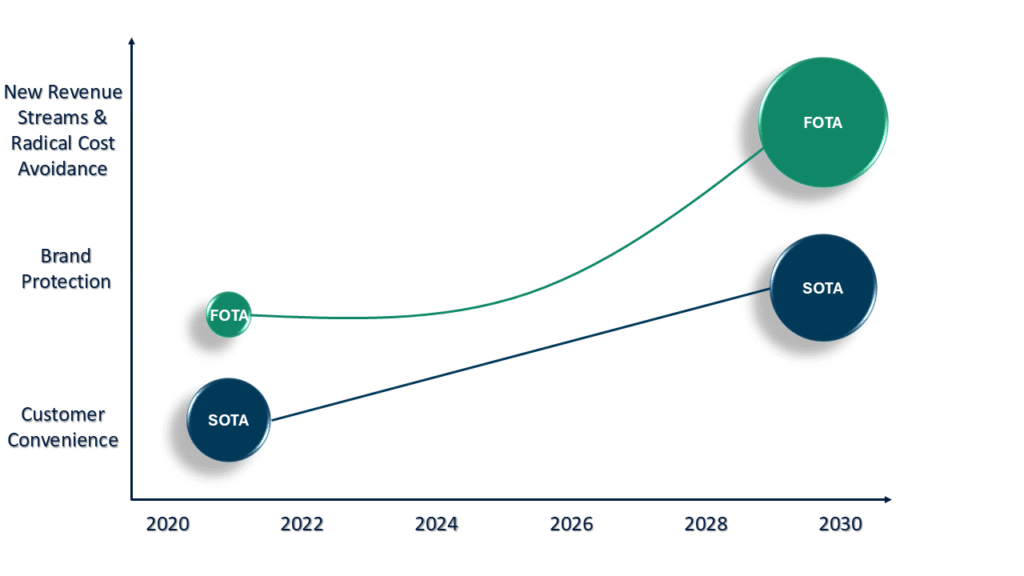

OTA updates encompass two primary technology types: Firmware Over-The-Air (FOTA) and Software Over-The-Air (SOTA). FOTA focuses on updating embedded systems, such as Electronic Control Units (ECUs), while SOTA enhances user-facing features like infotainment and Advanced Driver-Assistance Systems (ADAS).

The Strategic Evolution of Automotive OTA Updates

Why OTA is non-optional now

Regulatory Pull

-

-

- In Europe and across UNECE contracting parties, UN R155 (cybersecurity) and R156 (software update/SUMS) became mandatory for new vehicle types from July 2022 and for all new vehicles from July 2024 – formalizing secure update processes throughout the vehicle lifecycle.

- China raised the bar with GB 44496-2024 (General Technical Requirements for Software Update of Vehicles): new models must comply from Jan 1, 2026; all existing models by Jan 1, 2028. In 2025, regulators also mandated approvals for AD/ADAS-related OTA upgrades that remedy defects, treating many as recalls. Expect stronger documentation, reporting and pre-release test plans.

- India has introduced AIS 189 (CSMS) and AIS 190 (SUMS) aligned to UN R155/R156, with type approval checks before the first OTA—practically forcing OEMs to institutionalize evidence-based update management.

-

Scale Proof Points

-

-

- BMW crossed 10 million Remote Software Upgrades installed by end-September 2024 – evidence that fleet-wide OTA at scale is operationally viable.

- In China, 11.08 million passenger cars shipped with OTA capability in Jan–Sep 2024 (installation rate 71.7%); analysts expect >90% by 2030.

- NHTSA increasingly accepts OTA as a recall remedy; e.g., a Dec 2024 Tesla campaign (5.1M vehicles) implemented the fix via software. The practical implication: software quality and release governance are now safety-critical processes.

-

Operating model: what differentiates leaders

1. Productized OTA platform

Treat “update” as a product with a backlog, SLAs and KPIs (update success rate, rollback rate, time-to-remedy). Leaders separate content teams (features, calibrations, maps) from delivery teams (scheduler, delta packaging, A/B, safety gates).

2. Evidence-ready compliance

Build traceability for every campaign:

Requirements → Code → Tests → Safety Case → Cybersecurity Assessment → SUMS Artifacts (as per R156/GB 44496/AIS 190)

This makes regulatory audits routine, not fire drills.

3. Go-to-market for software

Don’t rely on “subscription by default.” Use tiered value, free trials, fleet bundles, and usage-based pricing for commercial customers. Some OEMs will monetize primarily through retention & residuals, not monthly ARPU – especially in price-sensitive markets having low subscription appetite.

4. Security as a release gate

A CSMS (R155) complement to SUMS (R156) is non-negotiable: threat modeling, SBOMs, key management, and in-vehicle rollback safety must be first-class checks before “promote to production.”

Market Structure and Where to Play

Segments with momentum (2025–2030)

-

-

- ADAS/AD calibrations and perception algorithm updates (tied to sensor aging and road-model refresh).

- Energy & thermal strategies for EVs (charging curves, pre-conditioning, V2X optimizations).

- Infotainment/OS layers (app stores, voice, maps), increasingly via proprietary stacks (e.g., MB.OS) or co-developed with big tech.

- Body/comfort & diagnostics (door modules, HVAC, failure mode fixes) where OTA can preempt service visits – an immediate cost win.

-

Key Market Segment Analysis & Strategic Implications

|

Segment |

Current Market Share | Growth Potential |

Strategic Implication for OEMs |

|

SOTA |

High (~60%) | Moderate | Focus on customer experience and infotainment app ecosystems. Lower risk, but also lower competitive barrier. |

| FOTA | Moderate | Very High |

The key battleground. Requires deeper vehicle architecture integration. Critical for EV performance and ADAS features. |

|

Passenger CV |

Dominant (~85%) | High | Core focus for brand differentiation and direct-to-consumer revenue generation via feature upgrades. |

| Commercial CV | Emerging | High |

High-value B2B play. Focus on demonstrable TCO reduction and fleet management integration for B2B sales. |

Regional Nuances

-

-

- Europe/UNECE: Enforcement is mature; suppliers must deliver audit-ready SUMS evidence into OEM type approvals.

- China: Compliance is tightening (approvals for ADAS/AD OTA, explicit user-interaction rules). Build local compliance playbooks and pre-brief regulators before high-impact campaigns.

- India: Alignment with UN regulations is advancing; plan for AIS 190 documentation in type approvals and early OEM-supplier joint audits.

- United States: No direct R156 equivalent, but recall governance is active; assume NHTSA scrutiny on safety relevance of OTA content and rollout controls.

-

Action agenda for OEMs & Tier-1s

-

-

- Industrialize SUMS/CSMS: make R156/GB 44496/AIS 190 evidence generation an automated artifact of CI/CD.

- Segment the software business: separate safety-critical updates (cost-avoidance KPI) from experience layers (revenue KPI). Align pricing to demonstrated value; avoid blanket subscriptions where market signals resistance.

- Design for approval in China: pre-define “recall-class OTA” playbooks with MIIT/SAMR approvals and customer comms templates.

- Prove value with fleets first: commercial customers convert faster to paid features (uptime, TCO); use these cohorts to refine consumer offers.

- Publish reliability SLOs: make OTA quality visible internally (success rate, install time, rollback) and tie bonuses to them.

-

Conclusion

The Automotive OTA Update Market is no longer an emerging trend but a core pillar of the software-defined vehicle era. From regulatory compliance to revenue generation, OTA is reshaping the way OEMs design, deliver, and monetize mobility. The winners of this transformation will be those who treat OTA not merely as a maintenance function but as a strategic platform, backed by disciplined governance, agile delivery, and clear commercial roadmaps.

Key imperatives moving forward:

-

-

- Compliance as a foundation: Build automated, audit-ready processes for R155/R156, GB 44496, and AIS 190 to de-risk operations.

- Customer-centric monetization: Prioritize value-driven software services, tiered pricing, and fleet-first deployments to drive adoption and recurring revenues.

- Operational excellence: Achieve industry-leading update reliability (>95% success) and rapid time-to-remedy for safety-critical fixes.

- Strategic ecosystem play: Partner selectively for platforms, security, and analytics to balance speed with control.

-

In short, OTA is where compliance, customer experience, and commercial strategy converge. For OEMs and suppliers alike, the next five years will determine who scales profitably in a market moving rapidly toward fully connected, continuously evolving vehicles.

Request a sample briefing or schedule an executive consultation with our automotive strategy experts to explore tailored OTA market insights for your business