The siren song of the “unicorn” startup, a private company valued at over $1 billion, has defined the last decade of entrepreneurship. The narrative is seductive: disrupt a market, grow at any cost, acquire users voraciously, and prioritize valuation over profitability. This mindset of “viral hype” has seeped into the strategic plans of companies of all sizes, often with disastrous consequences.

The era of free money is over. Rising interest rates, investor skepticism, and a string of high-profile tech failures have exposed the profound weakness of the “growth at all costs” model. For astute finance and strategy leaders, the mandate is now clear: shift from chasing hype to building a resilient, sustainably growing enterprise.

This isn’t just a philosophical preference; it’s a data-driven imperative for long-term survival and value creation.

The High Cost of Hype

The “unicorn” model is fundamentally a bet on perpetual availability of capital. It assumes that future funding rounds will always cover today’s losses. This strategy collapses when the market tightens.

-

-

- The Downside of Burn Rate: A study on over 1,000 startups found that those with a burn rate greater than 20% of their cash reserves per month were 3x more likely to fail within 12 months if unable to raise new capital.

- The IPO Reckoning: Tech companies that went public between 2019 and 2021, over 40% were trading below their IPO price two years later, with many falling more than 50%. This indicates a severe market correction against unprofitability.

- The Layoff Cascade: Over 300,000 tech employees were laid off in 2022-2023. The vast majority came from venture-backed companies that prioritized aggressive user acquisition over sustainable unit economics and were forced to drastically cut costs to survive.

-

The lesson is stark: growth built solely on subsidized user acquisition and marketing spend is fragile. When funding dries up, the growth engine sputters and dies.

The Pillars of Sustainable Growth: A Framework for Resilience

Sustainable growth is not slow growth. It is efficient growth. It’s built on a foundation of economic rigor and strategic discipline that creates a defensible, valuable business, regardless of market conditions.

1. Unit Economics: The North Star

Before scaling anything, the fundamental question must be answered: Does each customer transaction ultimately generate profit?

-

-

- Key Metric: Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC) Ratio. A healthy, sustainable business typically has an LTV:CAC ratio of 3:1 or higher. A ratio of 1:1 or lower means you are losing money with every new customer.

- Action: Finance must own the unit economic model. Scrutinize CAC not as a vanity metric (how many users we got) but as an efficiency metric (how cost-effectively we acquired profitable users).

-

2. Efficient Growth Channels

Viral hype often relies on paid channels that become expensive and crowded. Sustainable growth leverages scalable, owned channels.

-

-

- Product-Led Growth (PLG): Building a product so valuable that it sells itself through freemium models, trials, and word-of-mouth. (e.g., Slack, Dropbox).

- Content & SEO: Creating valuable content that attracts organic traffic, building authority and a pipeline of leads at a low marginal cost.

- Customer Retention: It is 5-25x more expensive to acquire a new customer than to retain an existing one. Sustainable companies obsess over net revenue retention (NRR), aiming for rates above 100%.

-

3. Path to Profitability (P2P)

This is the central tenet of the sustainable model. Instead of a “vision” of future profits, it requires a clear, credible, and data-backed roadmap to profitability.

-

-

- Financial Modeling: Build detailed, bottom-up financial models that show exactly how and when growth investments will translate into bottom-line profitability.

- Scenario Planning: Stress-test your model. What if growth is 20% slower? What if CAC increases by 30%? A sustainable plan is resilient across multiple scenarios.

-

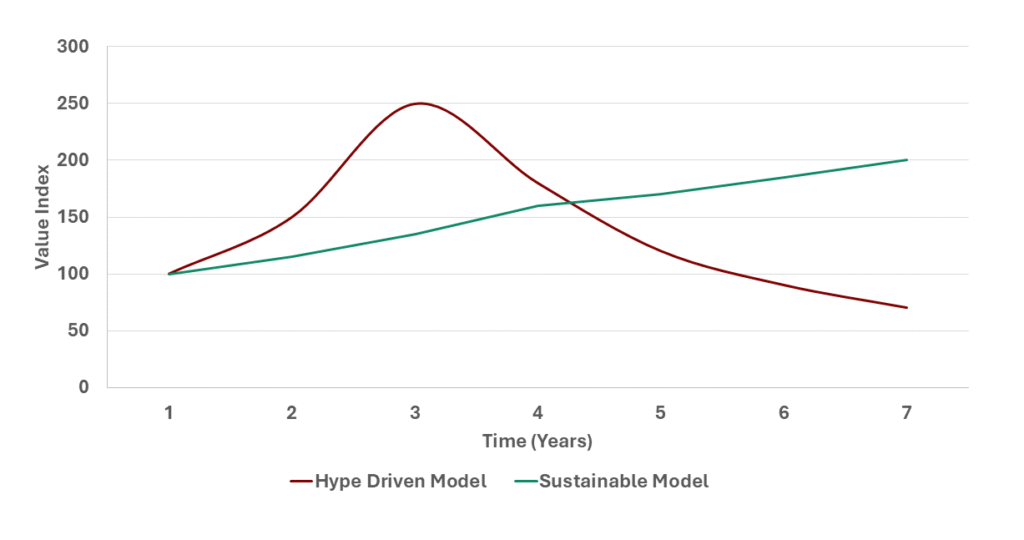

The following graph illustrates the fundamental strategic difference between the two approaches over a typical 7-year journey, highlighting the moment of truth when market conditions shift.

The Growth Strategy Divergence: Hype vs. Sustainability

The Financial Leader’s Playbook: Engineering Sustainable Growth

The transition to a sustainable model requires decisive actions from the finance function.

-

-

- Change the Metrics in the Boardroom: Stop presenting vanity metrics like “total users” or “raw top-line growth.” Instead, focus on LTV:CAC, Net Revenue Retention, Free Cash Flow Margin, and Payback Period. This changes the strategic conversation.

- Incentivize the Right Behavior: Align executive and employee compensation with profitability and efficiency metrics, not just revenue targets.

- Build a Fortress Balance Sheet: Prioritize maintaining a healthy cash runway. Discipline in spending is not about being cheap; it’s about extending your options and strategic optionality.

- Fund Growth from Revenue, Not Just Capital: The most powerful growth is that which can be funded by your own operating cash flow. This creates a virtuous cycle where success fuels more success without dilution.

-

The Bottom Line: Building an Enduring Company, Not a Flashy Headline

The “unicorn” myth has created a generation of companies that are brilliant at raising capital but poor at building fundamentally sound businesses. The market is now ruthlessly punishing this model.

Sustainable growth is the antidote. It is a disciplined, often less glamorous, path that focuses on:

-

-

- Economic resilience over viral buzz.

- Customer value over vanity metrics.

- Long-term compounding over short-term spikes.

-

In the end, the choice is between building a company that is valued at $1 billion on paper and one that is genuinely worth that much based on its durable profits and cash flow. The former is a myth that can vanish overnight. The latter is a legacy.

Ready to build a financial strategy for sustainable value? Our consultants help leaders replace hype with rigor, designing growth models that are built to last.

Contact us to transform your financial plan.