For today’s CFO and executive team, geopolitical events are no longer distant news items to be watched with passive concern. They are direct drivers of financial performance, capable of unraveling supply chains, cratering markets, and invalidating annual budgets overnight. The war in Ukraine, trade war, and volatility in the Middle East have made it unequivocally clear: geopolitical risk is financial risk.

Yet, most companies remain stuck in a reactive cycle. They monitor headlines but lack a structured framework to translate these macro-trends into actionable financial strategy. The goal for 2025 is not to predict the unpredictable, but to build a financial operation that is resilient, agile, and informed – no matter what the headlines bring.

From Reactive Headline-Reading to Proactive Financial Modeling

The first step is a shift in mindset. Geopolitical risk must be moved from the realm of qualitative PR concerns to a quantitative variable in financial planning and analysis (FP&A).

Our analysis found that while over 60% of executives expect geopolitical instability to have a significant impact on their business in the next five years, only 15% feel prepared to manage such shocks. This preparedness gap is where value is protected and captured.

The question is no longer “What happened?” but “What does it mean for our P&L, balance sheet, and cash flow?”

The Direct Financial Channels of Geopolitical Shock

Geopolitical events impact your finances through several concrete channels:

-

-

- Supply Chain & Input Costs: disruptions can cause sudden spikes in raw material costs, transportation delays, and critical component shortages.

- Energy Volatility: conflict in key regions can trigger fluctuations in oil and gas prices, directly impacting operational expenses.

- Currency & FX Volatility: sanctions, capital flight, and shifting trade flows lead to rapid currency revaluations, affecting the value of overseas earnings and costs.

- Demand Shocks: consumer confidence can plummet in key markets, or conversely, demand can surge unexpectedly in others.

- Capital Access & Cost: rising global risk premiums can increase the cost of debt and make capital markets more skittish.

-

Building the Geopolitical-Resilient Financial Plan

Integrating geopolitical risk isn’t about creating a separate plan; it’s about hardening your existing financial strategy. Here’s how to operationalize it.

1. Quantify the Exposure: Stress Testing & Scenario Planning

Move beyond a single, static budget. Develop a set of plausible, data-driven geopolitical scenarios for 2025 and model their financial impact.

-

-

- Scenario A (Baseline): Continuation of current tensions (e.g., sustained US-China trade tariffs).

- Scenario B (Escalation): A significant escalation (e.g., a major new conflict disrupting a key shipping lane).

- Scenario C (De-escalation): An unexpected resolution leading to improved trade and stability.

-

For each scenario, model the impact on:

-

-

- Cost of Goods Sold (COGS): What if key component costs rise by 15%?

- EBITDA: What if energy prices spike by 30% and sales in Region X drop by 10%?

- Cash Flow: What if customer payment terms double due to economic stress?

-

Our research highlights that organizations that employ advanced scenario planning recover up to 50% faster from economic shocks than those that rely on traditional budgeting alone.

2. Develop Early-Warning Indicator Dashboards

Financial leaders need a dashboard that moves beyond internal KPIs. Integrate leading external indicators that act as tripwires for potential risk. These should be specific to your industry and geographic exposure.

Examples include:

-

-

- Freight rates on key shipping routes (e.g., Shanghai Containerized Freight Index)

- Commodity futures prices for your critical raw materials

- Political stability indices for countries you operate in or source from

- Currency volatility indexes for your functional currencies

-

By monitoring these, your FP&A team can shift from explaining past results to anticipating future pressures.

3. Build Strategic Agility into Capital Allocation

The annual capital allocation process is too slow for a volatile world. The resilient finance function builds in flexibility.

-

-

- Hold a “Strategic Liquidity Buffer”: Maintain access to undrawn credit facilities or a slightly higher cash balance to seize opportunities or weather unexpected storms.

- Stage Investments: Break large capital projects into phases with clear go/no-go decision points tied to your scenario indicators.

- Diversify Supplier Base Financially: Assess the financial health and geographic concentration of your top suppliers. Investing in dual-sourcing, even at a slightly higher cost, is a powerful hedge against disruption.

-

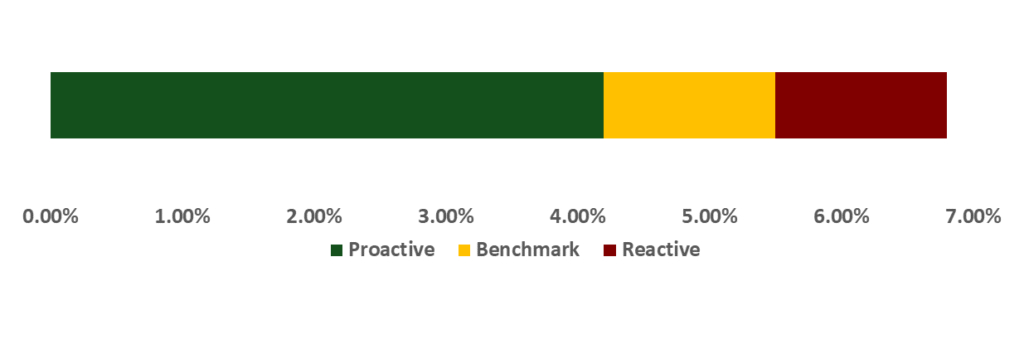

The following graph illustrates the stark difference in performance between companies that take a proactive vs. reactive approach to geopolitical risk, highlighting the tangible value of resilience.

Financial Metric Comparison – Average Weighted Average Cost of Capital (WACC)

The Bottom Line: Resilience as a Competitive Advantage

In the coming decade, financial performance will be inextricably linked to a company’s ability to navigate global uncertainty. The organizations that thrive will be those that treat geopolitical risk not as an unpredictable externality, but as a manageable variable.

The call to action for financial leaders is clear: Begin the integration now.

-

-

- Task your FP&A team to develop three geopolitical scenarios for 2025-26.

- Model the financial impact of each scenario on your budget.

- Formalize a dashboard of early-warning indicators and integrate it into your monthly reporting.

-

By taking these steps, you transform your finance function from a passive recorder of events into a strategic command center, capable of guiding your enterprise through the complexities of the modern world. The goal is to ensure that when the next headline breaks, your company isn’t just reading the news—it’s already executing a plan.

Ready to future-proof your financial strategy? Our Finance & Strategy consultants are experts in building resilient, data-driven financial models tailored to your specific geopolitical exposure.

Contact us today for a confidential assessment.