A robust risk management framework is the bedrock of a resilient organization. It’s designed to identify, assess, and mitigate threats before they can impact strategic objectives. Yet, even the most well-documented frameworks can harbor critical blind spots – unseen vulnerabilities that fester until a crisis strikes.

Many organizations operate with a false sense of security, believing that because they have a framework in place, they are protected. The reality is often different. Nearly 45% of leaders believe their organizations are overly focused on short-term financial metrics and neglect long-term risks. Furthermore, 70% of boards find their traditional risk assessments inadequate for predicting the emerging risks that actually impact their business.

Blind Spot 1: Static Risk Registers

The Problem: Many companies treat their risk register as a static document – a yearly compliance exercise that is filed away until the next audit. This approach is dangerously outdated. In today’s dynamic environment, new risks emerge at lightning speed, while the impact and likelihood of existing risks can change overnight due to geopolitical shifts, technological disruption, or market volatility.

The Fix: Embrace Dynamic Risk Intelligence

-

-

- Action: Move from an annual review cycle to a continuous monitoring process. Integrate real-time data feeds such as geopolitical news, cyber threat intelligence, and social sentiment into your risk assessment tools.

- How: Assign risk owners to regularly review and update their risks quarterly, or even monthly for critical areas. Use technology to automate alerts for triggers that could change a risk’s profile.

-

Blind Spot 2: Siloed Risk Management

The Problem: Risk is often managed in departmental silos. Cybersecurity lives with IT, operational risk with operations, and financial risk with finance. This fragmented approach prevents a holistic view of how risks interconnect and compound. A supply chain disruption (operational risk) can quickly trigger a liquidity crisis (financial risk) and damage brand reputation (strategic risk).

The Fix: Foster Integrated, Enterprise-Wide Collaboration

-

-

- Action: Break down silos by establishing an integrated risk management (IRM) function and a cross-functional risk committee.

- How: Implement a common risk language and taxonomy across the organization. Use workshops and scenario planning exercises that force different departments (e.g., IT, Supply Chain, HR) to collaboratively assess the cross-functional impact of a single risk event.

-

Blind Spot 3: Neglecting Non-Financial Risks

The Problem: Frameworks heavily weighted toward quantifiable financial risks often overlook critical non-financial threats. These include cultural risks, employee well-being, ESG (Environmental, Social, and Governance) factors, and reputational capital. Over 80% of executives are concerned about culture and engagement risks, yet less than 20% feel prepared to address them. A toxic culture or an ESG failure can destroy value just as quickly as a financial misstep.

The Fix: Formalize the Assessment of “Soft” Risks

-

-

- Action: Formally incorporate non-financial risks into your risk register and assign them clear owners.

- How: Develop Key Risk Indicators (KRIs) for these areas. For example, track employee turnover rates, ESG performance scores, or sentiment analysis from employee surveys and social media to provide early warning signals.

-

Blind Spot 4: Overlooking Third-Party Risk

The Problem: In an interconnected world, your risk exposure is only as strong as your weakest vendor. Many organizations meticulously assess their internal controls but fail to extend the same rigor to their third-party ecosystem. A data breach at a small software supplier or a compliance failure at a manufacturing partner can have catastrophic consequences for your organization.

The Fix: Extend Your Risk Framework’s Reach

-

-

- Action: Implement a tiered third-party risk management (TPRM) program that assesses vendors based on their criticality and access to your data/systems.

- How: Conduct due diligence before onboarding and perform regular audits thereafter. Utilize standardized questionnaires and leverage technology platforms to continuously monitor the financial health and security postures of your key partners.

-

Blind Spot 5: Lack of Risk Culture Integration

The Problem: The most elegant framework is useless if it isn’t embedded in the organization’s DNA. When risk management is seen solely as compliance – a function that says “no” – employees disengage. Front-line employees, who are often the first to see emerging risks, won’t speak up if they don’t understand the framework or fear punishment for raising issues.

The Fix: Cultivate a Speak-Up Culture of Risk Awareness

-

-

- Action: Leadership must champion risk management as a core value, not a compliance checkbox.

- How: Incorporate risk objectives into performance reviews. Train all employees on how to identify and report risks. Celebrate and reward employees who proactively raise concerns, turning your workforce into a powerful sensor network for early risk detection.

-

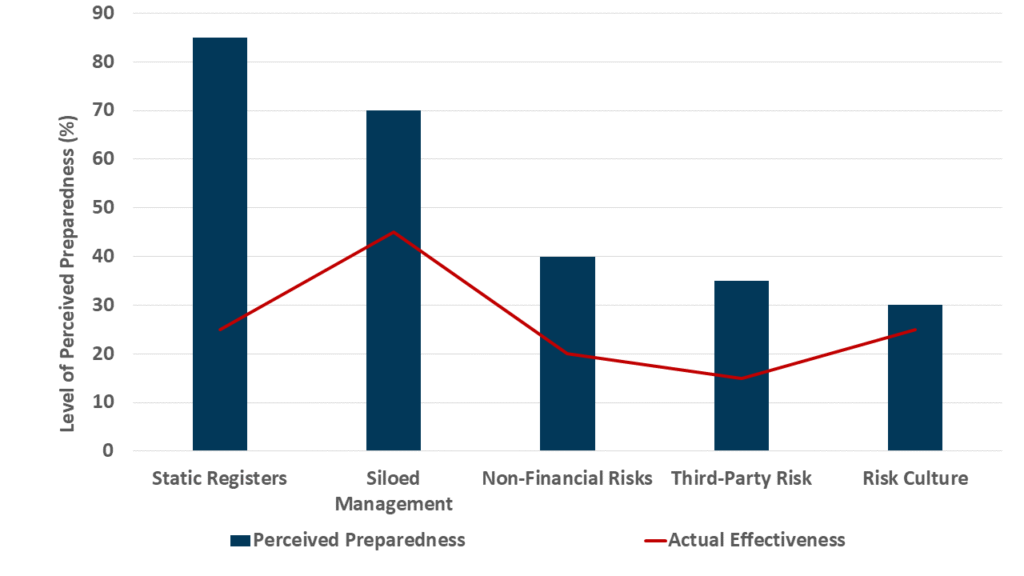

The following chart visualizes the critical gap between how executives perceive the effectiveness of their risk management and the stark reality of emerging threats, highlighting these blind spots.

The Perception vs. Reality of Risk Preparedness

Conclusion: From Blind Spots to Clear Vision

A risk management framework is not a shield that makes an organization impervious to harm. It is a living, breathing system that requires constant care, feeding, and challenge. The goal is not to eliminate all risk that is impossible but to ensure you are not blindsided by the risks you failed to see.

By confronting these five common blind spots, you can transform your risk management function from a passive, defensive cost center into a proactive, strategic asset that empowers intelligent decision-making and builds true organizational resilience.

The question is not if you will face a major risk event, but when. The time to illuminate your blind spots is now, before the unexpected becomes the inevitable.

Are you confident your risk framework is truly resilient? Our consultants can conduct a thorough gap analysis to expose your hidden vulnerabilities and help you build a more robust defense. Contact our Risk Management practice to get started.