Defining the Shift: From Ownership to Usership

Mobility-as-a-Service (MaaS) integrates various transport services such as public transit, ride-hailing, car-sharing, bike-sharing, and scooter rentals into a single, accessible, on-demand platform. Think of it as a “Netflix for Transportation,” where the user pays for mobility outcomes (point A to B) rather than the physical asset (the car).

The driving forces are multifaceted:

-

-

- Urbanization & Congestion: By 2050, over 65% of the world’s population will live in urban areas. Cities are actively promoting alternatives to private car ownership to reduce congestion and pollution.

- Digital Native Demographics: Generations Y and Z exhibit a markedly lower propensity for car ownership, prioritizing access over assets and digital convenience over maintenance burdens.

- Technology Convergence: The proliferation of smartphones, ubiquitous connectivity, and advances in AI-powered routing and payment systems have made seamless MaaS platforms technically feasible.

- Regulatory Pressure: EU “Fit for 55” and similar global mandates are artificially increasing the cost of individual ownership through congestion charges and ICE bans, while subsidizing shared and electric mobility solutions.

- Economic Rationalization: In dense urban corridors, the total cost of ownership (TCO) for a private vehicle is becoming financially irrational compared to on-demand services. This is a TCO argument you are positioned to lose.

-

The competitive landscape is a dynamic battleground:

-

-

- Tech Giants & Aggregators: Companies are leveraging their vast user networks to become dominant MaaS aggregators.

- Specialized MaaS Providers: Start-ups like Whim (Finland) and Citymapper (UK) are proving the model in specific, dense urban corridors.

- Public Transport Authorities: Forward-thinking cities are developing their own MaaS ecosystems, integrating public and private options.

- Automotive OEMs: The response from traditional manufacturers has varied, ranging from acquisition (e.g., Stellantis’s Free2move) to partnership and in-house development.

-

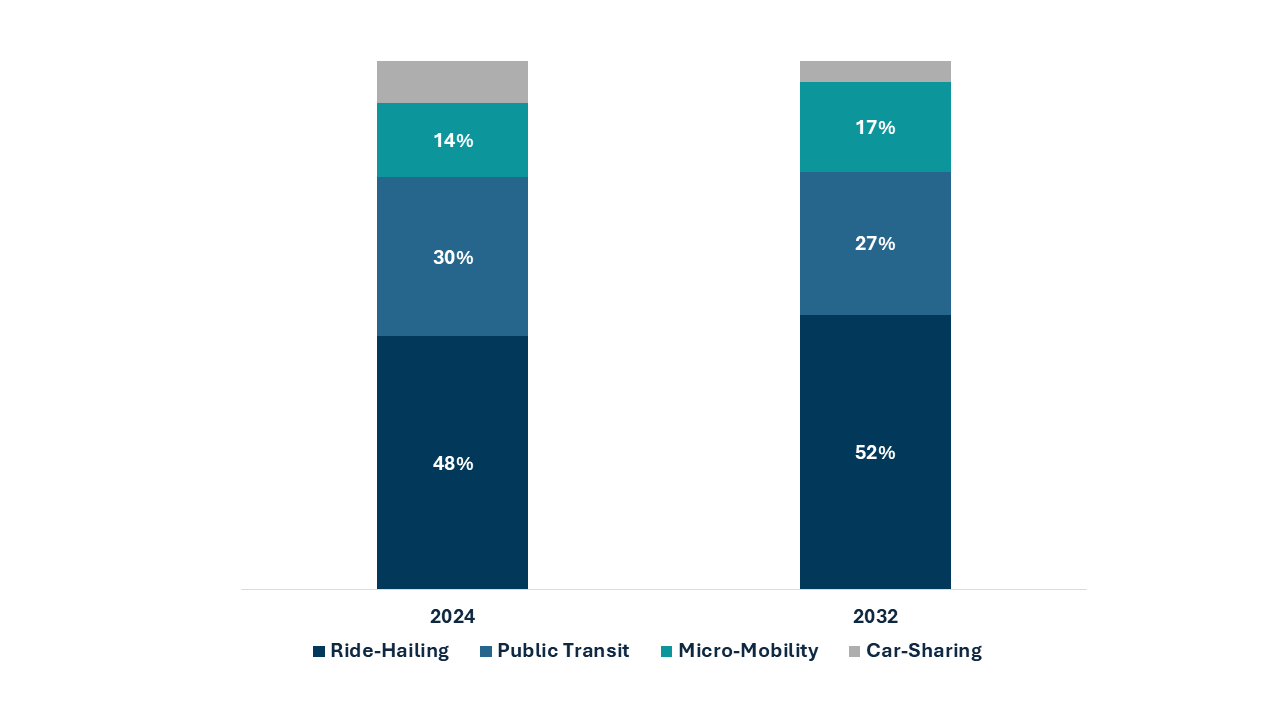

MaaS Adoption Trends by Mode (2024–2032)

Strategic Implications for Automotive Incumbents

The rise of MaaS presents both an existential threat and a monumental opportunity. The traditional volume-based model of selling vehicles is being challenged.

1. The Threat to Volume:

A single shared vehicle can displace up to 15 privately owned vehicles. While this displacement is most acute in dense urban centers which is primary testing grounds for autonomy, it creates a tangible risk of cannibalizing new car sales. Your most valuable future customers may never visit a dealership.

2. The Opportunity in New Value Chains:

The value in the MaaS ecosystem migrates from the point of sale to the lifetime of service. Profit pools will emerge in new areas:

The Strategic Migration of Automotive Value Pools

|

Legacy Value Pool (Threatened) |

Emerging Value Pool (Opportunity) |

Critical Strategic Question for the Board |

|

Vehicle Sales Margin |

Fleet Management & Monetization: Lifetime revenue from purpose built vehicles (PBVs) via subscription, usage fees, or B2B leasing. | Do we have a dedicated business unit with P&L responsibility for designing, financing, and operating a commercial fleet? |

|

After-Sales Parts & Service |

Predictive Maintenance & Uptime Assurance: High-margin service contracts guaranteeing 99%+ operational readiness for MaaS fleets. | Is our service organization structured to serve high velocity B2B fleet operators, not just retail customers? |

|

Traditional Automotive Financing |

MaaS Specific Financial Instruments: Asset-backed securities for EV fleets, usage-based insurance, and subscription finance products. | Is our captive finance arm developing innovative products for the usership economy, or just optimizing loans for ownership? |

|

Brand Value via Marketing |

Platform & Data Dominance: Ownership of the customer interface and the priceless data on mobility patterns it generates. | Are we building, buying, or partnering to own the customer relationship in the MaaS ecosystem? |

3. The Data Imperative:

MaaS platforms generate petabytes of invaluable data on consumer mobility patterns. This data is the new oil. It can inform everything from future vehicle design (e.g., designing PBVs for MaaS, not retrofitting consumer cars) to dynamic pricing and urban planning. OEMs who fail to capture and leverage this data will be relegated to low-margin hardware providers.

Strategic Challenges and Mitigation

The MaaS ecosystem faces several hurdles that require strategic foresight:

Interoperability: Fragmented systems across public and private providers hinder seamless integration.

-

-

- Solution: Develop standardized APIs and foster PPP, as exemplified by MaaS Global’s collaboration with Unipol in Italy.

-

Regulatory Complexity: Varying data privacy and transport regulations across regions create compliance risks.

-

-

- Solution: Engage with policymakers to co-create frameworks, as seen in Singapore’s Smart Nation initiative.

-

Cybersecurity: With MaaS platforms handling sensitive user data, cyberattacks pose a significant threat.

-

-

- Solution: Implement end-to-end encryption and AI-driven threat detection, drawing from best practices in fintech.

-

A Strategic Roadmap for Automotive Leaders

Based on our engagements with global OEMs, we recommend a dual-path strategy:

1. The Offensive Play: “OEM-as-a-Service-Provider”

-

-

- Objective: Control the ecosystem. Launch or acquire a MaaS platform to own the customer relationship and brand experience.

- Action: Establish an independent business unit with a separate tech stack and agile operating model. Fund it to compete with tech-native players, not to satisfy traditional automotive ROI cycles. See: BMW’s ReachNow (initial phase), FREE NOW (Daimler/BMW JV).

-

2. The Defensive Play: “Strategic Enabler & Fleet OEM”

-

-

- Objective: Become the dominant B2B supplier. If you cannot win the platform war, ensure every other platform runs on your hardware and services.

- Action: Accelerate development of Purpose-Built Vehicles (PBVs):

- Radical cost-down engineering for TCO.

- Durable, easy-to-clean interiors.

- Modular designs for easy repair and upgradability.

- Offer bundled “Mobility-in-a-Box” solutions: PBVs + financing + maintenance.

-

3. The Asymmetric Play: “Targeted Partnerships & Investments”

-

-

- Objective: De-risk, learn, and gain optionality.

- Action: Forge non-dilutive partnerships with public transit authorities, tech firms, and even other OEMs. Make strategic venture investments in high-potential MaaS enablers (e.g., AI routing, battery health software, fleet management SaaS). This is your strategic radar.

-

Regional Strategies for MaaS Market Entry and Growth

-

-

- Asia Pacific (Over 30% Market Share): Leverage high population density and government support in China and India. For instance, Didi Chuxing’s integration of AI-driven routing and EV fleets offers a blueprint for scaling in dense urban markets.

- Europe: Capitalize on robust public transit systems and MaaS pioneers like Whim. Focus on cross-border interoperability to address the EU’s fragmented regulatory landscape.

- North America: Invest in autonomous vehicle integration, with companies like Waymo leading trials in San Francisco and Phoenix. Prioritize partnerships with tech giants to enhance platform scalability.

- Emerging Markets: In Latin America and Africa, tailor solutions to local needs, such as Brazil’s focus on decarbonization through EV-based MaaS pilots.

-

Conclusion and Immediate Next Steps

The MaaS transition is a certainty. The only variables are the timing of its impact on your sales volume and your degree of preparedness. Following are the immediate actions:

-

-

- Commission a TCO Model: Task finance with building a granular model comparing the lifetime revenue of a vehicle sold to a retail customer vs. the potential lifetime value of the same vehicle deployed in a MaaS fleet.

- Form a MaaS War Room: Assemble a cross-functional team (Product, Finance, Service, Sales, Digital) to pressure-test the strategies against your specific corporate strengths.

- Board Approval for CapEx: Allocate dedicated capital in the next budget cycle for one offensive, defensive, or asymmetric play. This cannot be funded from existing product development budgets.

-

The goal is not to abandon your core – it is to defend it by boldly investing in the new value chains that will define the next era of mobility.

Schedule your confidential executive briefing to define a targeted MaaS strategy and safeguard your core revenue.