Strategic Imperative at a Glance

The boardrooms of energy majors, industrial titans, and sovereign wealth funds are converging on one unavoidable reality: green hydrogen electrolyzers represent the single most scalable lever for deep decarbonization of heavy industry and long-haul transport. But here’s what most market reports won’t tell you:

-

-

- This is not a technology race – it’s a systems integration challenge. The winners won’t be those with the most efficient electrolyzers, but those who optimally combine them with renewable assets, offtake contracts, and policy arbitrage.

- Geopolitical forces are distorting the playing field. The IRA’s $3/kg subsidy has made U.S. hydrogen projects 40% more bankable overnight, while EU carbon border adjustments will force steel and chemical players into hydrogen adoption – ready or not.

- First-mover advantage is real, but fragile. Early projects in Germany and Texas are locking in scarce electrolyzer supply, renewable PPAs, and skilled labor – creating a winner-takes-most dynamic in key industrial clusters.

-

Drawing on experience advising both energy ministries and global energy leaders, Let’s separate signal from noise to provide:

-

-

- The three electrolyzer deployment scenarios that will separate industry leaders from stranded assets

- Where capital is actually flowing versus where the headlines suggest

- Your 12-month playbook for securing position in this USD 100 billion opportunity

-

The Decarbonization Calculus: Where Electrolyzers Fit

1. Hard-to-Abate Sectors: The Hydrogen Imperative

The decarbonization playbook for light industry and passenger transport is clear: electrify everything. But for steel (7% of global CO₂), ammonia (1.8% of global energy use), and heavy transport (12% of oil demand), the physics don’t cooperate.

-

-

- Steelmakers face a binary choice: replace coking coal with green hydrogen (via DRI) or risk becoming stranded assets under CBAM. H2 Green Steel’s USD 6 Billion valuation proves the model works.

- Ammonia producers must choose between blue hydrogen (with CCS risks) or green hydrogen (with renewable PPA challenges).

- Heavy transport (shipping, mining trucks) needs hydrogen-derived e-fuels – batteries can’t handle 200-ton payloads. Maersk’s methanol-powered fleet orders signal where this is heading.

-

Strategic implication: If your portfolio includes these sectors, hydrogen isn’t optional – it’s your license to operate in a net-zero world.

2. The Renewable Energy Arbitrage: Turning Curtailment Into Cash Flow

Markets like Texas (30% curtailment rates in West Texas) and Australia (negative prices >10% of time in QLD/SA) are creating a hidden opportunity: electrolyzers as demand-side management assets.

-

-

- Economics 101: When wholesale power prices crash below $20/MWh (common during midday solar peaks), electrolyzers can produce hydrogen at <$2.50/kg—cheaper than SMR with carbon credits.

- Project Alpha Case: A 100MW Texas electrolyzer running only during negative pricing hours achieves 18% IRR before IRA credits. Add the $3/kg PTC, and it prints money.

- The Catch: You need offtake certainty. This is why players like Air Products are locking in 15-year deals with German industrials.

-

Strategic implication: Electrolyzers aren’t just hydrogen plants, they’re renewable energy monetization engines. The best sites will be gone by 2026.

3. Geopolitical Realignment: The New Hydrogen Trade Wars

Europe’s 10Mt import target by 2030 isn’t just a number – it’s a supply chain earthquake that will:

-

-

- Create hydrogen OPECs: Chile (Atacama solar) and Mauritania (wind + desal) could become the new Saudis of H2. TotalEnergies’ Mauritanian bet proves the thesis.

- Redraw shipping routes: Expect ammonia tanker traffic to mirror today’s LNG flows, with choke points in Suez and Panama.

- Trigger protectionism: The EU’s “green hydrogen” rules (additionality, hourly matching) are designed to block U.S. IRA projects. Trade wars are coming.

-

Strategic implication: Your hydrogen strategy needs a trade policy desk – the winners will navigate Brussels/Washington/Beijing’s rulemaking better than they navigate electrolyzer specs.

Technology Bet Assessment: Beyond the Hype

1. The Three Electrolyzer Archetypes – Strategic Tradeoffs

|

Parameter |

Alkaline (AEL) | PEM | SOEC |

| Best For | Large-scale, steady operation | Intermittent renewable input |

High-temp industrial sites |

|

Key Risk |

Low flexibility | Iridium dependency | Durability unknowns |

| Who Should Deploy | Ammonia producers | Energy majors with renewables |

Heavy industrials with waste heat |

2. Emerging Strategic Plays

-

-

- Hybrid systems (AEL + PEM) for baseload + flexibility

- Iridium recycling loops to preempt supply chain crises

- AI-driven electrolysis optimization (early mover advantage)

-

Strategic Insight: Most corporate strategies treat electrolyzers as a commodity purchase. Winners will treat them as integrated energy system assets.

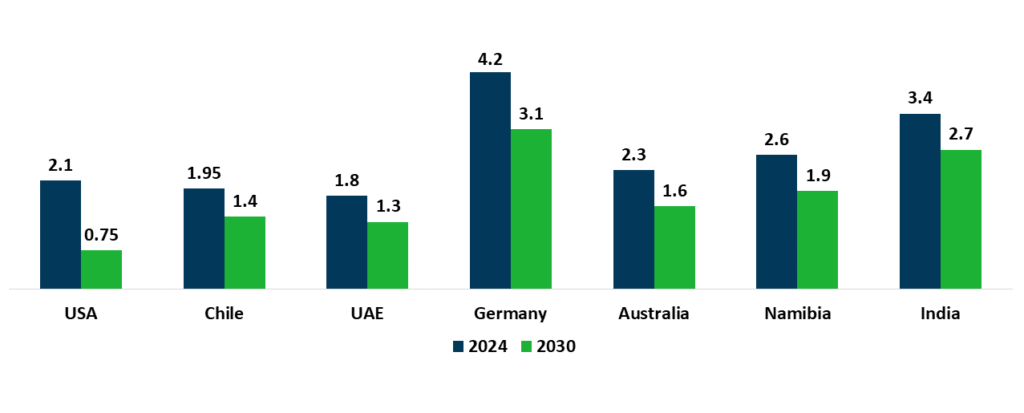

Green Hydrogen Levelized Cost (LCOH) Forecast by Key Region (USD/kg, adjusted for policy incentives)

Geopolitical Strategy: A Tiered Market Approach for Hydrogen Investors

Immediate Deployment Markets (Tier 1)

These jurisdictions offer mature policy frameworks, substantial incentives, and established demand – representing the lowest-risk entry points for capital deployment:

Germany

-

-

- €9 billion in direct subsidies through H2Global initiative

- Anchor demand from chemical (BASF) and steel (Thyssenkrupp) sectors

- First-mover advantage in building import infrastructure

-

Gulf Cooperation Council

-

-

- Unmatched production economics: <$2/kg achievable through:

• Ultra-low cost solar ($10-15/MWh)

• Existing CCS infrastructure repurposing

• Sovereign wealth fund backing

- Unmatched production economics: <$2/kg achievable through:

-

Emerging Opportunity Markets (Tier 2)

These regions show strong fundamentals but require more nuanced execution strategies:

U.S. Gulf Coast (IRA Beneficiaries)

-

-

- 45V tax credit creates nearly $1/kg cost advantage vs. Europe

- Strategic for:

• Ammonia exporters targeting EU CBAM compliance

• Oil majors repurposing existing infrastructure

-

Chile (Atacama Corridor)

-

-

- Best-in-class renewable resources (70% capacity factors)

- Critical needs:

• Port infrastructure development

• Long-term offtake certainty to justify FID

-

Future Potential Markets (Tier 3)

These markets require monitoring but warrant limited current resource allocation:

India

-

-

- Strong manufacturing base (Over 50% of global electrolyzer capacity)

- Execution risks:

• Policy inconsistency in renewable incentives

• Lack of coordinated demand signals

-

African Export Hubs

-

-

- Long-term potential for EU supply (post-2030 horizon)

- Require resolution of:

• Water access challenges

• Political risk premiums

-

Capital Allocation Playbook

1. For Industrial Players

-

-

- Vertical integration: Owning electrolyzers + renewables = 30% lower LCOH

- Pre-empt offtake wars: Lock in steel/chemical partners now

-

2. For Investors

-

-

- Avoid pure-play electrolyzer makers: Margins will compress to <15% by 2027

- Back integrated platforms: Companies combining IP + EPC + asset ownership

-

3. For Governments

-

-

- Subsidize demand, not supply: CfDs beat capex grants

- Mandate industrial blending: 5% hydrogen in refining/ammonia forces demand

-

The Make-or-Break Variables

Watch These Metrics Closely

-

-

- Iridium prices (2x increase could erase PEM economics)

- Renewable PPA volatility (Hydrogen breaks even at <$30/MWh)

- Carbon border adjustments (EU CBAM will force hydrogen adoption)

-

When to Walk Away

-

-

- Projects relying on merchant hydrogen prices before 2030

- Any technology claiming “breakthrough efficiency” without 10,000-hour durability data

-

Conclusion: Turning Insights into Action

The green hydrogen revolution is no longer a debate – it’s an inevitability. But as with any industrial transformation, the greatest rewards will flow to those who move decisively, with precision, and ahead of structural constraints. The window for establishing competitive advantage is narrow, and the cost of hesitation will be measured in stranded capital and lost market share.

Immediate Priorities for Leadership Teams

-

-

- Industrial CEOs: Lock in long-term hydrogen supply agreements now – before scarcity dynamics take hold. Partner directly with electrolyzer developers to secure capacity in upcoming gigafactories.

- Energy Companies: Treat electrolyzers as flexible grid assets, not just hydrogen producers. Optimize renewable curtailment and policy incentives (e.g., IRA’s $3/kg credit).

- Investors: Focus on vertically integrated players – those controlling renewable power, electrolysis, and offtake. Avoid pure-play manufacturers facing margin compression.

- Policy Makers: Accelerate demand-side incentives (carbon contracts for difference, blending mandates) rather than subsidizing unproven technologies.

-

The transition won’t be linear, and not every bet will pay off – but inaction is the only guaranteed losing strategy. The question isn’t whether to engage with green hydrogen, but how aggressively and intelligently your organization will move.