Executive Summary: Beyond a Niche, A Fundamental Market Shift

The global materials sector is undergoing a major transformation. Driven by intensifying regulatory pressure, escalating consumer demand for circularity, and corporate sustainability commitments, the transition from conventional plastics to advanced bioplastics and sustainable materials is no longer a speculative trend.

This market, currently valued in the tens of billions, is projected to experience aggressive double-digit growth over the next decade. For executives and investors, understanding this complex and rapidly evolving sector is critical to mitigating risk, capitalizing on emerging opportunities, and future-proofing operations.

The Catalysts: Deconstructing the Demand Engine

The momentum behind sustainable materials is not monolithic; it is the product of a powerful convergence of external pressures and internal value drivers.

-

-

- Regulatory Onslaught: Governments worldwide are implementing stringent policies to combat plastic pollution. The EU’s Plastics Tax is not a future threat; it is a current-year line item. It imposes a levy of €0.80 per kilogram on non-recycled plastic packaging waste, a cost that is already being pushed down the supply chain by OEMs. For a mid-sized manufacturer, this can represent an annual, non-negotiable cost increase of €2-5 million – directly eroding EBITDA. These are not isolated measures but part of a global regulatory tide that fundamentally alters the cost-benefit analysis of material selection.

- The Conscious Consumer: A 2023 survey found that over 55% of consumers now actively seek products with sustainable packaging and are willing to pay a premium for it. Brand reputation is intrinsically linked to environmental stewardship, making sustainable material sourcing a core component of brand equity and customer retention.

- Corporate Net-Zero Ambitions: With over 1,000 major companies committed to net-zero emissions under initiatives like the Science Based Targets initiative (SBTi), Scope 3 emissions which include raw material production are under intense scrutiny. Switching to bio-based or recycled materials offers a tangible pathway to reduce these emissions and validate sustainability claims.

-

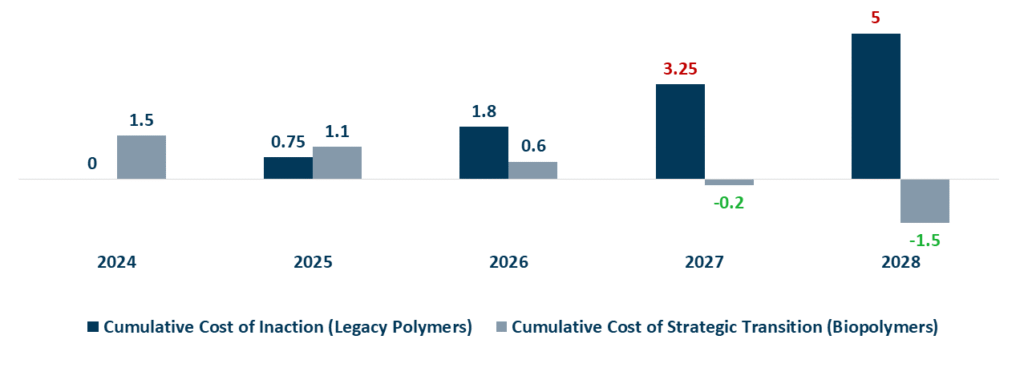

The Strategic Inflection Point: Quantifying the Cost of Inaction

Segment Analysis: Where is the Smart Money Going?

A granular view of the material landscape reveals specific high-growth opportunities and strategic niches.

|

Bioplastic Type |

Base Material | Key Properties | Typical Industrial Applications | Strategic Consideration |

| Polylactic Acid (PLA) | Corn, Sugarcane | Stiff, high strength, compostable | 3D printing filament, non-woven textiles, short-life packaging |

Requires industrial composting; sensitive to heat & moisture. |

|

Bio-based Polyethylene (Bio-PE) |

Sugarcane (Ethanol) | Identical to fossil-based PE | Durable: Automotive parts, pipes, fuel tanks. Packaging: bottles, caps. | True “drop-in” solution. Easily recyclable in existing PE streams. |

| Bio-based Polyamide (Bio-PA) | Castor Beans | High strength, heat resistance, durability | Automotive engine components, electrical connectors, sports equipment |

High-performance alternative with a significantly lower carbon footprint. |

|

Polyhydroxyalkanoates (PHA) |

Microorganisms | Marine biodegradable, biocompatible | Agricultural films, medical devices, water-resistant coatings | High cost; offers true biodegradation in diverse environments. |

| Thermoplastic Starch (TPS) | Corn, Potato | Highly biodegradable, low cost | Loose-fill packaging foam, film blends, disposable cutlery |

Often blended with other polymers to improve performance. |

While drop-in solutions like Bio-PE offer immediate integration, the most profound long-term value lies in innovative biodegradable polymers like PHA and advanced recycling-compatible materials. These technologies address the end-of-life challenge head-on, aligning with a truly circular economy model rather than a linear one with bio-based inputs.

Critical Challenges and Investment Requirements

Despite the optimistic outlook, the market faces significant headwinds that require strategic navigation and substantial investment.

-

-

- Feedstock Dilemma: The debate around first-generation (e.g., corn, sugarcane) vs. second-generation (e.g., agricultural waste, non-food biomass) feedstocks is intensifying. While first-gen offers scalability today, the future lies in second-gen and algal feedstocks to avoid competition with food supply chains. Investment in R&D and scaling these alternative feedstock pathways is paramount.

- The Cost Premium: Bioplastics can still carry a 20-50% price premium over conventional alternatives. While this is narrowing with scale and innovation, it remains a barrier to mass adoption. Strategic offtake agreements and long-term partnerships between producers and major brand owners are essential to de-risk capacity expansion and drive down costs.

- End-of-Life Infrastructure: A compostable package in a landfill is not a solution. The glaring lack of industrial composting and anaerobic digestion infrastructure globally cripples the value proposition of biodegradable plastics. Collaborative investment between material producers, packaging firms, waste management companies, and municipalities is the only way to build the necessary circular systems.

-

Strategic Recommendations for Leadership

For corporations aiming to lead rather than react, we advise a focused, three-pillar strategy:

-

-

- Material Innovation & Portfolio Diversification: Move beyond simple PLA or bio-based PE. Allocate R&D resources to next-generation materials like PHA and explore material blends that optimize performance, cost, and end-of-life outcomes. Diversification mitigates supply chain and regulatory risk. Industrial goods companies leading in circular economy adoption trade at an average EBITDA multiple premium of 2.5x-3x compared to laggards.

- Strategic Partnerships and Vertical Integration: Forge long-term partnerships with leading biopolymer producers to secure supply and influence development. Consider backward integration into feedstock or forward integration into recycling/composting to control more of the value chain and ensure material circularity.

- Lifecycle Assessment (LCA) Leadership: Do not rely on marketing claims. Conduct rigorous, third-party verified LCAs for your products. Transparent data on carbon footprint, water usage, and end-of-life impact is the new currency of trust and will become a key differentiator for B2B and B2C customers alike.

-

Conclusion & Immediate Mandates

Let us be unequivocal: the sustainable materials transition is no longer a parallel initiative to be managed by your sustainability officer. It is the central strategic pivot upon which your future relevance and profitability will turn. This is a fundamental recalibration of your value proposition, supply chain, and operational DNA. Treating it as anything less is a profound failure of governance. Your competitors are not coming; they are already here, securing supply, locking in contracts, and building the moats that will define the next decade of industrial leadership.

-

-

- Appoint Singular Accountability: A named, C-suite executive must own this portfolio transition with direct P&L responsibility and a board-mandated budget. This cannot be a collaborative effort; it requires a commander.

- Reframe the Business Case: Immediately cease cost-benefit analyses that pit “green premium” against old material costs. The new calculus must measure the Cost of Inaction: lost contracts, regulatory penalties, brand irrelevance, and a deteriorating valuation multiple.

- Weaponize Your Progress: Your first successful material transition is not a pilot project; it is your most powerful business development and marketing asset. It is the key that unlocks conversations with top-tier OEMs and investors who have already moved on from vendors offering legacy solutions.

-

To receive a tailored sample strategy for your highest-value product line, request our executive briefing.