The Boardroom Perspective: Why CCUS Demands Immediate Attention

The global energy transition is no longer a distant ambition – it is an urgent operational reality. For industrial leaders, Carbon Capture, Utilization, and Storage (CCUS) is not just an environmental consideration but a strategic lever for competitive resilience.

Key Strategic Insights:

-

-

- Regulatory Pressure is Escalating: With the EU’s Carbon Border Adjustment Mechanism (CBAM) and the U.S. Inflation Reduction Act’s enhanced 45Q credits ($85/ton for storage), inaction is now a liability.

- First-Mover Advantage is Real: Early adopters like ExxonMobil (with its Houston CCUS Hub targeting 100 MtCO₂/yr by 2040) are locking in infrastructure, partnerships, and government incentives.

- Investor Sentiment is Shifting: BlackRock and Brookfield are directing over USD 15 billion into decarbonization infrastructure, with CCUS as a core pillar.

-

If your 2030 decarbonization roadmap does not include CCUS, you are either underestimating compliance risks or overestimating alternative solutions.

The Hard Truths: Where CCUS Stands Today

1. The Operational Reality

|

Metric |

Current Status | 2030 Outlook |

| Global Capture Capacity | 55 MtCO₂/yr (2023) |

400+ MtCO₂/yr |

|

Cost per Ton Captured |

$60 to $100 (onshore) | $30 to $50 (with scale & tech) |

| Storage Utilization | <10% of potential capacity |

40%+ (with policy push) |

Critical Takeaway:

Technology exists – the bottleneck is execution. Companies that secure storage sites and offtake agreements now will control the market by 2030.

2. The Competitive Landscape

-

-

- Oil & Gas Majors: BP, Shell, and Chevron are repurposing midstream assets for CO₂ transport, turning a cost center into a revenue stream.

- Industrial Emitters: Cement (e.g., Heidelberg Materials) and steel (e.g., ArcelorMittal) players are embedding CCUS into capex plans to avoid CBAM penalties.

- Tech Disruptors: Startups like Carbon Clean (modular capture) and Climeworks (DAC) are forcing incumbents to innovate or partner.

-

The Geopolitical Wildcard: How CCUS Will Reshape Global Energy Trade

The rise of CCUS isn’t just a technical or financial challenge, it’s a geopolitical realignment tool. Nations that master carbon management will dominate the next era of energy trade, while those that lag risk becoming carbon dumping grounds. Here’s what’s at stake:

Key Geopolitical Shifts to Watch

-

-

- Carbon Tariffs as Trade Weapons:

- The EU’s CBAM and U.S. CCA (Clean Competition Act) will penalize imports from high-emission countries – unless they adopt CCUS.

- Example: Indian steel exports to the EU face nearly €80/ton levies by 2026 unless paired with verified CCS.

- Storage Sovereignty Wars:

- Countries with geologic storage (U.S., Norway, Australia) will attract heavy industry, while others (Japan, Korea) must pay for CO₂ export hubs.

- China’s Play: Building 50+ CCUS projects to avoid EU/U.S. tariffs and position itself as a low-carbon manufacturing hub.

- Hydrogen Cartels:

- Saudi Arabia and Australia are racing to supply blue ammonia to Japan/Korea – using CCUS as a cost lever.

- Risk: OPEC-like cartels for certified low-carbon barrels (e.g., ADNOC’s “blue oil” marketing).

- Carbon Tariffs as Trade Weapons:

-

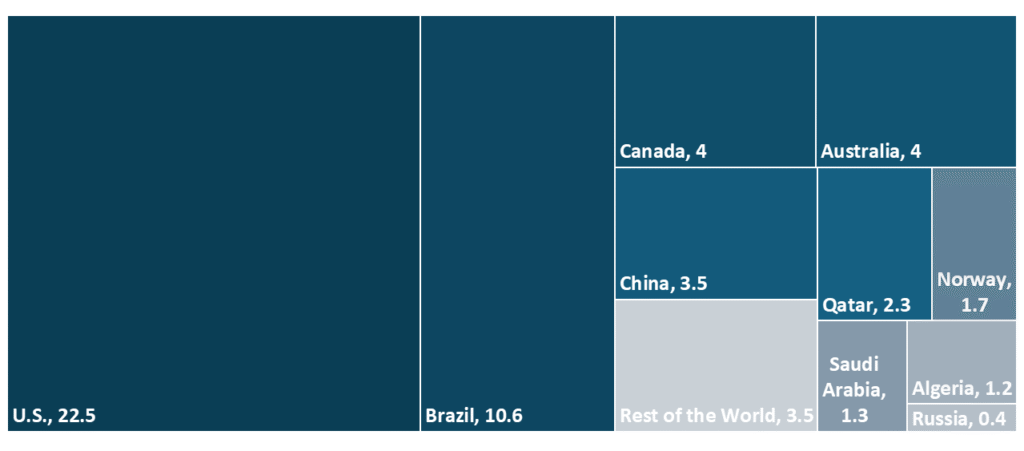

CO₂ Storage Capacity by Country (in Mt Per Year -2023)

Strategic Pathways: How to Win in CCUS

For Industrial CEOs: Three Non-Negotiable Actions

-

-

- Secure Storage Assets Now

- Example: Norway’s Northern Lights project has sold out its initial 1.5 MtCO₂/yr capacity to industrial players like Yara and Ørsted.

- Leverage Hybrid Business Models

- Enhanced Oil Recovery (EOR) still funds 60% of U.S. CCUS projects, but future-proof with blue hydrogen/ammonia offtake deals.

- Preempt Policy Shifts

- The UK’s GBP 20 Billion CCUS funding pledge and Canada’s Investment Tax Credit (50% for equipment) are templates for lobbying.

- Secure Storage Assets Now

-

For Investors: Where to Place Bets

|

Segment |

Risk Profile |

Upside Potential |

|

Midstream (CO₂ pipelines) |

Low | 12–15% IRR |

| DAC (Direct Air Capture) | High |

20%+ if costs fall below $100/ton |

|

Utilization (e-fuels, concrete) |

Medium |

Over USD 110 Billion market by 2035 |

The Make-or-Break Risks

1. Execution Risks

-

-

- Infrastructure Delays: U.S. needs over 50,000 miles of CO₂ pipelines by 2035. Permitting is the choke point.

- Offtake Uncertainty: Without binding agreements, projects like Australia’s Gorgon CCUS operate at 50% below capacity.

-

2. Policy Gambles

-

-

- 45Q Credits in the U.S. require IRS Rule 45V clarity on hydrogen – delays could freeze billions of dollars in investments.

- EU’s ETS price volatility (~€80/ton) makes standalone CCUS economics precarious.

-

Our Advisory Position:

Treat CCUS like a M&A deal – conduct due diligence on storage sites, lock in offtake, and structure around policy cliffs.

Conclusion: Turning Risks into Competitive Advantage

The CCUS market is at a pivotal juncture – where policy uncertainty, infrastructure gaps, and offtake risks collide with unprecedented investment momentum. For executives, the choice is no longer whether to engage with CCUS, but how to structure engagements to mitigate risks and secure first-mover benefits. Here’s the path forward:

Immediate Actions for Leadership Teams

-

-

- Lock in Incentives Now: With U.S. 45Q/45V credits sunsetting in 2032 and EU CfD auctions becoming competitive, delay equals value erosion.

- Diversify Revenue Streams: Pair EOR cash flows with blue ammonia/hydrogen offtakes (e.g., Japan’s USD 150 billion hydrogen import demand by 2030).

- Preempt Permitting Bottlenecks: File Class VI well applications and pipeline siting permits 24+ months ahead of planned operations.

-

Long-Term Plays to Future-Proof Investments

-

-

- Demand Policy Certainty: Lobby for IRS 45V clarity by Q3 2024 and EU ETS price floors to stabilize merchant CCUS economics.

- Build Strategic Alliances: Partner with tech disruptors (e.g., Carbon Clean) and storage operators (e.g., Northern Lights JV) to de-risk scalability.

- Monitor Asia’s Blueprint: China’s 50 MtCO₂ storage target by 2030 and India’s carbon market launch will reshape global CO₂ arbitrage.

-

The CCUS landscape is bifurcating into winners (those securing storage, offtakes, and subsidies early) and laggards (those facing USD 200+/ton carbon costs and stranded assets).

Your Move:

-

-

- Conduct a CCUS readiness audit – assess storage access, policy exposure, and tech partnerships.

- Engage regulators proactively – leverage the UK/Canada subsidy templates in your jurisdiction.

- Reallocate capital within 12 months – 45Q and EU CfD windows are closing fast.

-

The next wave of CCUS growth will reward execution speed, not just technical prowess. Act decisively or cede the market to competitors who will.

If your team requires a customized CCUS roadmap (including CAPEX modeling, policy risk assessment, and partner screening), schedule a briefing with our experts.