The Strategic Lens: Why BESS Demands Executive Attention Now

The energy storage revolution is not coming – it is already here. As C-suites and investment committees grapple with energy transition risks, Battery Energy Storage Systems (BESS) have emerged as a non-negotiable asset class for competitive resilience.

Consider this:

-

-

- Every 1 GW of BESS deployment reduces grid congestion costs by nearly USD 200 million annually.

- Falling battery prices (~ USD 130/kWh in 2023) now make BESS the arbitrage tool of choice

- Corporate PPAs with storage clauses have surged 300% since 2020, signaling a structural shift in commercial energy procurement.

-

Three Strategic Levers for Value Capture

1. Capital Allocation: Where to Place Your Bets

Priority Investment Theses:

-

-

- Grid-Scale BESS as Transmission Infrastructure

- ERCOT’s BESS fleet now delivers congestion relief, earning millions in ancillary services. Implication: Storage is becoming a regulated asset class.

- Action: Position portfolios in FERC Order 841-compliant markets where stacked revenue streams exceed USD 250/kW-year.

- Industrial Co-Location: The Hidden Margin Booster

- A Fortune 500 manufacturer reduced peak demand charges by 40% via 20 MW/80 MWh BESS.

- Action: Deploy storage-as-a-service (SaaS) models with tolling agreements to monetize stranded industrial load.

- Grid-Scale BESS as Transmission Infrastructure

-

2. Risk Mitigation: Navigating the Lithium Trap

The lithium-ion hegemony faces two existential threats:

-

-

- Geopolitical Risk: 85% of battery-grade lithium is processed in China.

- Supply-Demand Imbalance: Lithium demand will outstrip supply by 25% by 2027.

-

Strategic Hedges:

-

-

- Dual-Sourcing Contracts: Lock in North American lithium via Albemarle’s Kings Mountain mine (2027 production) or Piedmont Lithium’s Tennessee operations.

- Chemistry Diversification:

- Sodium-ion batteries (CATL, BYD) now at $80/kWh for 8-hour storage – viable for C&I applications.

- Zinc-hybrid (Eos Energy) for 10+ hour duration at USD 160/kWh – immune to thermal runaway.

-

3. Policy Arbitrage: Gaming the IRA and EU Green Deal

U.S. IRA Playbook:

-

-

- Transferability Clause: Monetize the 30% ITC upfront by selling credits to tech giants.

- Domestic Content Bonus: Add 10% ITC by sourcing U.S. made modules (Tesla LFP, Kore Power).

-

EU Countermove:

-

-

- BESS projects in Germany now eligible for capex grants under several initiatives.

- Action: Structure joint ventures with EU utilities (e.g., RWE, Enel) to access state-aid schemes.

-

The Geopolitical Calculus: Why BESS is the New Energy Battleground

The race for energy storage supremacy is no longer just about technology – it’s a geopolitical power play. Nations and corporations that control BESS supply chains and grid-scale deployments will dictate energy security in the 21st century.

-

-

- China currently dominates 80% of battery component manufacturing, but the U.S. and EU are fighting back with USD 100 billion in subsidies and local content mandates.

- Critical mineral supply chains are the new OPEC – who controls lithium, cobalt, and nickel controls storage economics.

- First-mover advantage matters: Countries like Australia (lithium) and Morocco (cobalt) are positioning as alternatives to China, while tech giants (Tesla, CATL) are vertically integrating mines to batteries.

-

Strategic Implications:

-

-

- Corporate players must dual-source batteries or risk sanctions/disruptions – see the U.S. ban on Chinese LFP batteries for grid projects.

- Energy independence = storage independence. The EU’s “Battery Passport” regulation is just the start – expect more trade wars over storage tech.

- Military-grade security for BESS is coming. Cyberattacks on grids (see Ukraine) mean storage systems will need NSA-level encryption.

-

Bottom Line: BESS isn’t just an asset – it’s leverage in the new Cold War over energy dominance. Treat it accordingly.

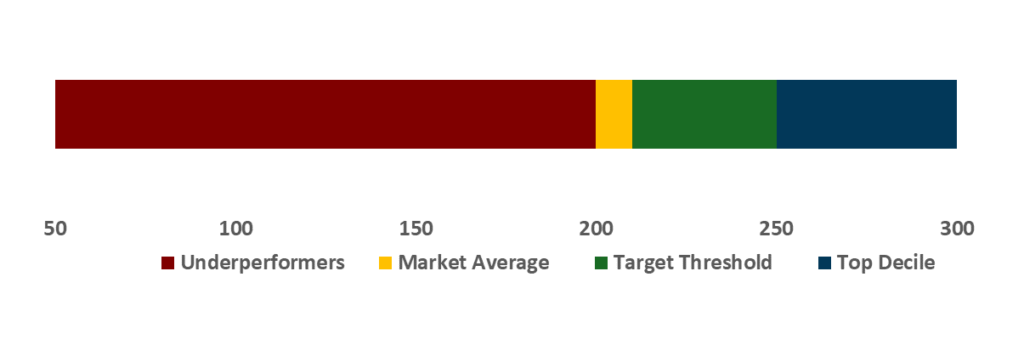

BESS EBITDA Performance Spectrum 2024 ($/kW-Year)

Conclusion: Winning the BESS Game Requires Bold Moves

The Battery Energy Storage Systems (BESS) market is no longer an emerging opportunity – it is the cornerstone of modern energy strategy. For executives, the question is not whether to invest, but how to structure investments for maximum competitive advantage. The winners will be those who treat storage not as a compliance cost, but as a profit center, grid differentiator, and risk hedge.

Key Strategic Takeaways for Leadership Teams

-

-

- Monetize the Full Revenue Stack: Top-performing BESS assets now capture 4+ revenue streams (capacity markets, frequency regulation, arbitrage, and congestion relief). Miss one, and you leave millions on the table.

- Future-Proof Your Supply Chain: Lithium dependence is a single point of failure. Secure alternative chemistries (sodium-ion, flow batteries) and diversify critical mineral sourcing now.

- Leverage Policy Tailwinds Aggressively: The U.S. IRA and EU Green Deal offer once-in-a-generation incentives—delay means ceding advantage to competitors.

- Integrate AI-Driven Optimization: The delta between a basic BESS and a smart, AI-optimized system is 20-30% higher EBITDA. This is now table stakes.

-

The next 24 months will separate the strategic players from the followers. Storage is reshaping energy markets, grid economics, and corporate power strategies. The only mistake is hesitation. Move fast, lock in margins, and own the future.

Final Call to Action:

-

-

- Conduct a Storage Strategy Sprint – Assemble a cross-functional team (finance, operations, policy) to pressure-test your BESS roadmap in 90 days.

- Benchmark Against Leaders – If your BESS EBITDA is below $250/kW-year, you’re underperforming.

- Prepare for the Next Phase – 2025-2030 will see consolidation, new regulatory frameworks, and tech disruptions. Position your organization as an acquirer, not a target.

-

Underperforming assets? Get our proven framework – download the sample or book a 15-min consult.