In the competitive world of private equity (PE), generating outsized returns requires more than just financial leverage and operational improvements. It demands a sophisticated strategy for rapid, value-accretive growth. While the traditional buyout model remains relevant, the most successful firms have mastered a more powerful approach: the strategic use of add-on acquisitions.

This strategy, known as a “buy-and-build” or “platform-and-add-on” model, is no longer a niche tactic. It is a central pillar of modern private equity, responsible for a significant portion of the industry’s value creation. Add-on acquisitions accounted for a staggering over 75% of all PE deals in 2023, a figure that has more than doubled over the past decade.

But why has this strategy become so dominant? And how do top-tier firms execute it to consistently drive portfolio company value?

The Strategic Rationale: Why Add-Ons Are a Powerhouse

The buy-and-build model involves first acquiring a “platform” company – a typically stable, well-managed business in a fragmented market. Subsequent “add-on” or “bolt-on” acquisitions are then made to complement and enhance this platform. The value creation levers are powerful and multiplicative:

-

-

- Accelerated Growth: Add-ons provide an immediate injection of revenue and customers, far exceeding what organic growth alone can achieve in a typical PE holding period.

- Scale Economics: This is the most direct value lever. Combining businesses creates immediate cost synergies by eliminating redundancies in G&A, consolidating suppliers for greater purchasing power, and optimizing overlapping sales territories.

- Strategic Enhancement: Add-ons can be used to acquire new technologies, products, or capabilities, allowing the platform company to enter new markets or become a more comprehensive solution provider for its customers.

- Market Consolidation: In fragmented industries, a relentless add-on strategy can roll up smaller players to create a market-leading entity, which commands higher valuation multiples upon exit due to its dominant position, enhanced stability, and growth profile.

-

The Execution Challenge: Beyond the Deal Thesis

Identifying a target is the easy part. The real differentiator is a firm’s ability to successfully source, integrate, and manage these add-ons.

-

-

- Proactive Sourcing, Not Reactive Waiting: Top firms don’t wait for investment bankers to call. They build dedicated internal teams that work closely with platform management to constantly map the competitive landscape, identify ideal targets, and build relationships long before a deal is on the table. This proprietary sourcing is key to finding off-market opportunities at attractive valuations.

- Diligence as Integration Planning: The due diligence process for an add-on is fundamentally different. While financials are still critical, the focus must intensely shift to operational and cultural compatibility.

-

- How will the CRM and ERP systems connect?

- What does the new org chart look like, and how will we retain key talent from the add-on?

- Are the sales cultures compatible?

- Failed integration is the primary reason add-on acquisitions underperform, highlighting that operational due diligence is just as important as financial.

-

- The Integration Playbook: Firms with repeatable success have a standardized, yet flexible, integration playbook. This isn’t a one-size-fits-all document; it’s a detailed framework that outlines the first 100 days post-close. It covers everything from branding and customer communication to technology integration and synergy tracking. The goal is to move with speed and purpose to capture value immediately.

-

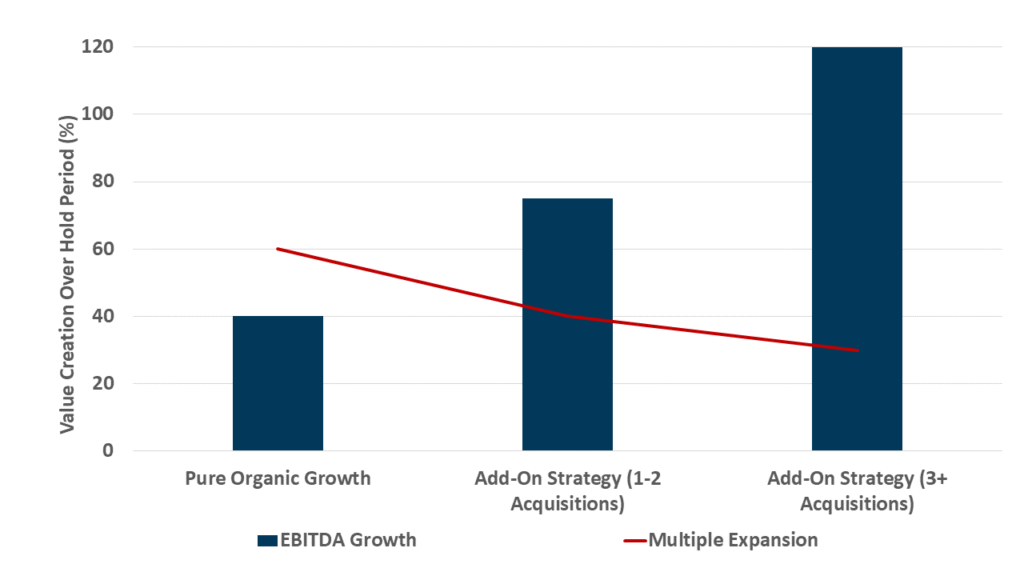

The following graph illustrates why the buy-and-build strategy has become the dominant model in private equity, showcasing its impact on both multiple expansion and EBITDA growth – the two core components of value creation.

The Add-On Advantage: How Buy-and-Build Drives Value Creation

The Exit Multiplier: Creating a More Valuable Asset

The ultimate test of any PE strategy is the exit. A successfully executed buy-and-build strategy doesn’t just create a bigger company; it creates a fundamentally different and more valuable one.

-

-

- The Strategic Premium: A consolidated market leader with a diversified customer base, robust product suite, and proven acquisition engine commands a significant premium over a standalone small business. Strategic acquirers are willing to pay up for a platform that has already done the consolidation work for them.

- The Recurring Revenue Story: Add-ons can help build a more resilient business model. For example, bolting on a service-based business to a product-based platform can create a valuable recurring revenue stream, making the company’s earnings more predictable and valuable.

- Proving the Concept: A track record of successful acquisitions demonstrates to the next buyer that the company has a viable blueprint for future growth, de-risking their investment and justifying a higher valuation.

-

Conclusion: The Standard for Modern Private Equity

The buy-and-build model has evolved from a clever tactic to the standard playbook for value creation in private equity. In a market characterized by high entry multiples and intense competition, organic growth alone is insufficient to meet target returns.

The firms that will succeed are those that institutionalize the capability for repeatable, disciplined add-on acquisition. This requires a dedicated operational focus, a rigorous integration playbook, and a mindset that views M&A not as a sporadic event, but as a continuous strategy for building better, stronger, and more valuable market leaders.

The question for private equity firms is no longer if they should pursue add-ons, but how quickly they can build the internal muscle to execute this strategy at scale. The value creation advantage is too significant to ignore.

Stop growing organically alone – let’s build your proprietary buy-and-playbook to accelerate value creation.