For years, sustainability was relegated to the Corporate Social Responsibility (CSR) report, a “nice-to-have” initiative often seen as a cost center that stood in opposition to profitability. This perception is not just outdated; it’s financially dangerous. The conversation has decisively shifted from why to how much.

Forward-thinking executives are no longer asking about the cost of becoming sustainable. They are demanding to see the return on investment. They are discovering that a sustainable supply chain isn’t just good for the planet; it’s a powerful engine for efficiency, risk reduction, and revenue growth. It generates what we call The Green Bottom Line.

The End of the Trade-Off Myth: Sustainability as a Value Driver

The traditional view pitted shareholder value against environmental responsibility. This is a false dichotomy. The modern supply chain is a complex system where environmental waste is directly correlated with financial waste. Wasted energy is a cost. Wasted materials are a cost. Wasted capacity is a cost.

Sustainable practices systematically identify and eliminate this waste, creating a more lean, resilient, and valuable operation. The ROI manifests in four key areas:

1. Operational Efficiency: Direct Cost Savings

This is the most straightforward and immediate area of ROI.

-

-

- Energy Efficiency: Upgrading to LED lighting, optimizing HVAC systems in warehouses, and investing in electric vehicle fleets slash utility and fuel costs. These projects often have rapid payback periods.

- Waste Reduction: Implementing circular economy principles like reducing packaging, reusing materials, and recycling byproducts lowers disposal fees and turns waste into a revenue stream. For example, food manufacturers can sell waste for compost or animal feed.

- Water Conservation: Reducing water usage in manufacturing processes cuts costs on both water acquisition and wastewater treatment.

-

Stat to Consider: Companies that actively manage their environmental impact report $1.2 billion in average annual savings from emission-reduction projects alone projects with an average payback period of just three years.

2. Risk Mitigation: Avoiding Future Costs

Sustainability is a powerful hedge against escalating operational risks.

-

-

- Regulatory Compliance: Proactively adapting to environmental regulations (like carbon taxes or plastic packaging bans) avoids future fines, penalties, and costly last-minute overhauls.

- Resource Security: Diversifying energy sources to include renewables shields your operations from the volatility of fossil fuel prices. Similarly, sourcing sustainable raw materials mitigates the risk of resource scarcity.

- Resilience: Climate change poses physical risks to supply chains (e.g., floods disrupting port operations). Assessing and building climate resilience into your network prevents catastrophic business interruption costs.

-

3. Revenue Growth and Market Access

Sustainability is a key driver of top-line growth, unlocking new markets and strengthening brand value.

-

-

- Consumer Demand: Over 75% of U.S. consumers said a sustainable lifestyle is important to them. Products with verified sustainability credentials consistently outperform those without.

- B2B Advantage: Major corporations like Walmart, Amazon, and IKEA are mandating strict environmental standards from their suppliers. A sustainable supply chain is now a prerequisite for doing business with them, it’s your ticket to the party.

- Premium Pricing: Strong sustainability credentials allow brands to command a price premium and foster deep customer loyalty.

-

4. Capital Access and Talent Attraction

The financial markets and labor pool are increasingly voting with their dollars.

-

-

- Investor Appeal: ESG (Environmental, Social, Governance) assets are projected to reach $30 trillion by 2030. Investors see strong ESG performance as a proxy for good management and long-term viability, lowering your cost of capital.

- Talent Recruitment: A clear sustainability mission is critical for attracting and retaining top talent, particularly among younger generations who want to work for purpose-driven companies. This reduces recruitment and turnover costs.

-

Quantifying the Intangible: A Framework for Measurement

The challenge for many CFOs is moving beyond anecdotal evidence to hard numbers. The key is to move from generalities to specific, project-based ROI calculations.

|

Initiative |

Upfront Cost | Annual Savings/Benefit | Key ROI Metric |

| LED Lighting Retrofit | $100,000 | $25,000 in energy savings |

Simple Payback: 4 years |

|

Packaging Redesign |

$50,000 (R&D) | $200,000 in reduced material & shipping costs | ROI: 300% |

| Supplier Sustainability Audit | $75,000 | Avoided $1M in potential disruption from high-risk supplier |

Risk Mitigation Value |

|

Carbon Offset Investment |

$500,000 | Enabled $5M contract with ESG-mandated client |

Revenue Enablement |

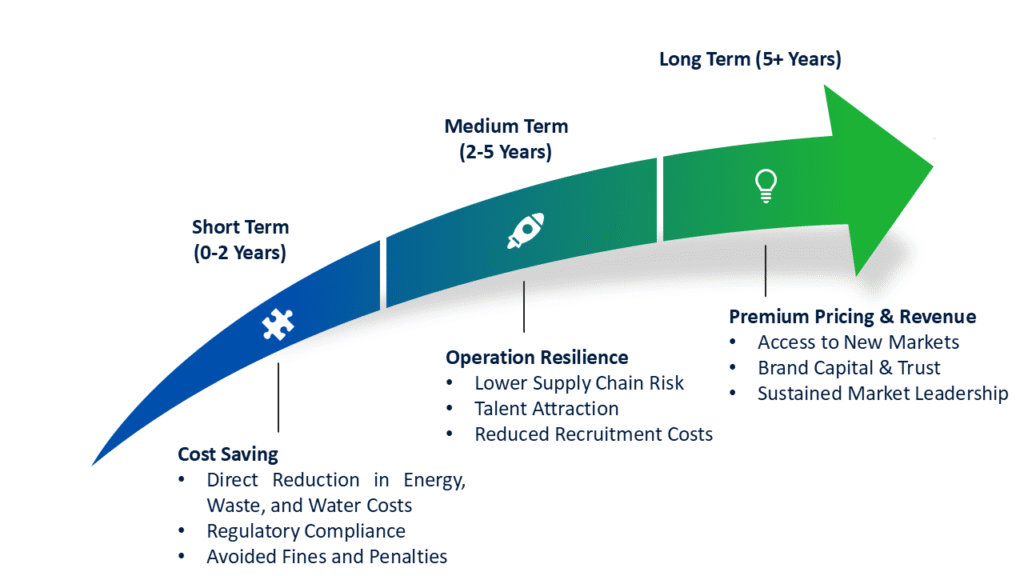

The Strategic Maturity Curve: How ROI Evolves

The financial return on sustainability isn’t static; it compounds as you move from tactical projects to strategic integration. The following graph illustrates how investment and value creation evolve along the maturity curve:

The ROI Horizon Timeline

-

-

- The Compliance Layer: The initial focus is on reducing waste and ensuring compliance, yielding direct cost savings and avoiding fines.

- The Efficient Layer: Companies integrate sustainability into processes like logistics and manufacturing, boosting efficiency and margins.

- The Resilient Layer: Sustainability is used to de-risk the supply chain and build brand trust, protecting long-term value.

- The Growth Layer: Sustainability becomes a core strategy, driving new market opportunities, innovative products, and premium pricing.

-

How to Start Building Your Green Bottom Line

-

-

- Start with an Audit: Conduct a thorough audit of your energy, waste, and water usage to identify the largest and most costly inefficiencies.

- Calculate Full-Cost Accounting: Don’t just look at the direct cost of a project. Factor in the “avoided costs” of risk, the “enabled value” of new revenue, and the “soft benefits” of talent and brand equity.

- Pilot and Scale: Choose one high-impact, high-ROI project like packaging optimization or a warehouse energy retrofit and use the proven savings to fund the next initiative.

- Embed into Procurement: Integrate sustainability criteria into your supplier selection and scoring process. Your supply chain’s footprint is your footprint.

-

Conclusion: Sustainability is the New Standard of Operational Excellence

The data is clear: the green bottom line is a robust, multi-faceted, and compelling financial reality. Sustainable supply chain practices are no longer an optional altruistic endeavor. They are a non-negotiable component of modern business strategy, directly driving cost savings, risk reduction, and revenue growth.

The question for today’s leaders is not whether they can afford to invest in sustainability, but whether they can afford the immense cost of inaction.

Ready to calculate the ROI of sustainability for your specific operations? Let’s transform your supply chain into a value driver.