For decades, private equity due diligence has been a triumvirate: financial, legal, and commercial. While these pillars remain critical, a fourth, more decisive pillar has emerged: Digital Due Diligence (DDD). In an era where every company is a technology company, acquiring a firm without understanding its digital core is like buying a house without inspecting its foundation. The polished façade of strong EBITDA can hide a crumbling infrastructure of technical debt that can evaporate your equity value post-close.

Digital Due Diligence moves beyond a simple IT checklist. It is a forensic analysis of a target’s technology stack, digital capabilities, and data assets to achieve two core objectives:

-

-

- Quantify Risk: Uncover hidden technical debt and cybersecurity vulnerabilities that could lead to massive capital expenditure.

- Identify Opportunity: Unlock value-creation levers through technology-enabled growth and efficiency gains.

-

The Staggering Cost of Ignorance: Why DDD is Non-Negotiable

The price of neglecting technology in due diligence is no longer acceptable. The market is littered with deals that failed to meet ROI expectations due to unforeseen tech issues.

By the Numbers: A Reality Check

-

-

- Software and IT issues are among the top causes of synergy capture failure in M&A, impacting nearly 30% of deals.

- Through 2025, 60% of acquirers will significantly undervalue their targets because they failed to assess tech debt during due diligence.

- The average cost of a single data breach is now over $4.45 million, a risk directly inherited through acquisition.

-

These figures underscore a simple truth: tech debt is financial debt. It simply hasn’t been booked yet.

The Three Pillars of a Robust Digital Due Diligence

A comprehensive DDD framework investigates three interconnected layers:

1. Infrastructure and Architecture: The Foundation

This assesses the core health and scalability of the technology stack.

-

-

- Technical Debt Audit: Evaluate code quality, platform modernity, and system documentation. Is the core platform a modern, cloud-native system or a monolithic legacy application held together by “duct tape and prayers”?

- Scalability and Stability: Can the current infrastructure handle projected growth? What is the historical rate of system outages, and what are their causes?

- Total Cost of Ownership (TCO): Model the full IT run-rate, including licensing, cloud spend, and maintenance personnel. Are costs aligned with industry benchmarks?

-

2. Data and Analytics: The Lifeblood

Data is the most undervalued asset on a balance sheet. This pillar assesses its quality and potential.

-

-

- Data Quality and Governance: Is data accurate, complete, and accessible? Or is it siloed, inconsistent, and poorly governed?

- Analytics Maturity: Does the company use data for strategic decision-making, or is it reliant on static, outdated reports?

- Asset Value: Does the data itself create a competitive moat or offer potential for new revenue streams (e.g., monetizable insights)?

-

3. Cybersecurity and Compliance: The Liability Shield

This is a non-negotiable risk assessment.

-

-

- Vulnerability Assessment: Review past security audits, penetration tests, and incident response histories.

- Regulatory Compliance: Ensure the target is compliant with relevant regulations (e.g., GDPR, CCPA, HIPAA). Non-compliance can lead to fines that destroy deal value.

- Intellectual Property (IP) Review: Confirm ownership and security of key software and patents.

-

From Liability to Opportunity: The Value-Creation Lens

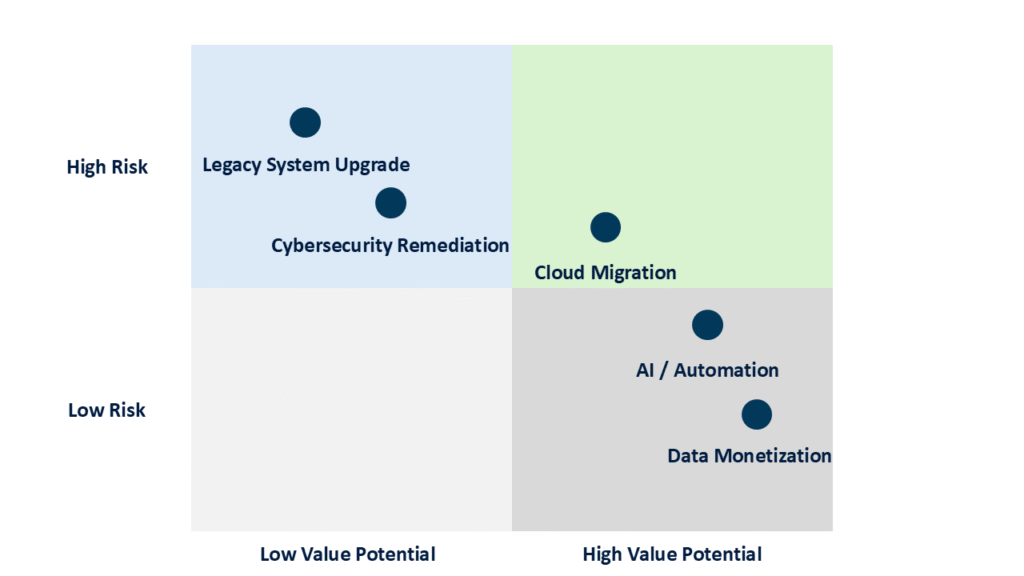

The output of DDD should not just be a list of problems; it must be a roadmap for value creation. The graph below illustrates the core paradigm shift DDD enables: moving from a reactive cost-center view of IT to a proactive value-driver view.

The Digital Due Diligence Value Matrix

This matrix helps prioritize initiatives post-acquisition. The immediate focus must be on the top-left quadrant: mitigating high-risk liabilities. The goal is to fund these necessary repairs by executing on the high-value opportunities in the bottom-right quadrant.

Quantifying the Findings: The Tech Debt Adjustment

The final, and most crucial, step is translating technical findings into financial impact. This requires modeling a “Tech Debt Adjustment” to the target’s EBITDA and valuation.

-

-

- One-Time Capex Requirement: Estimate the capital required to remediate critical issues (e.g., $2M for a necessary platform migration).

- Recurring Cost Impact: Model the ongoing drag of inefficient systems (e.g., 20% higher IT run-rate than peers due to manual processes and legacy licensing).

- Synergy Potential: Quantify the upside from opportunities identified (e.g., 15% margin expansion from automating manual order processing, or 5% new revenue from data monetization).

-

This adjustment moves the conversation from subjective technical complaints to objective financial impacts, empowering deal teams to renegotiate price, structure earn-outs, or adjust their investment thesis entirely.

Conclusion: A Prerequisite for Modern M&A

Digital Due Diligence is no longer a niche service for software deals. It is a fundamental component of rigorous investing in the 21st century. For private equity firms, embedding DDD into the pre-acquisition process is the key to:

-

-

- De-risking Investments: Avoiding catastrophic post-close surprises.

- Informing Valuation: Creating a fair and accurate price based on a complete picture.

- Accelerating Value Creation: Building a 100-day technology plan from day one, rather than spending months figuring out what you bought.

-

In today’s market, the greatest value and the greatest risk are often buried in the code, data, and systems of a target company. Uncovering it is the difference between a savvy investment and a costly mistake.

Request our Digital Due Diligence checklist to uncover hidden tech debt before your next deal.