The specter of stagflation that dreaded combination of stagnant economic growth and persistently high inflation is the dominant risk on the minds of General Partners and Limited Partners alike. For private equity firms, this is not an abstract macroeconomic concept; it is a direct threat to portfolio company performance, valuation multiples, and ultimately, fund returns.

The playbook that thrived in an era of cheap debt and steady growth is obsolete. Navigating this high-stakes environment requires a fundamental shift from financial engineering to relentless operational rigor. The firms that will not only survive but thrive will be those that act decisively to future-proof their assets.

Why Stagflation is a Unique Threat to Private Equity

Unlike a pure recession, where costs may fall alongside demand, stagflation creates a vicious pincer movement:

-

-

- The Cost Squeeze: Input costs for raw materials, energy, and labor remain elevated, compressing EBITDA margins.

- The Demand Challenge: Consumer and business spending weaken due to economic uncertainty and higher interest rates, making top-line growth exceptionally difficult.

-

This directly attacks the core value-creation levers of private equity. Simply passing on all cost increases to customers is not a viable strategy when demand is elastic. Relying on revenue growth to cover operational inefficiencies is a dangerous gamble.

By the Numbers: A Reality Check

-

-

- The proportion of deals generating value primarily through revenue growth fell from 47% in 2019 to nearly 30% in 2022, while the share from margin expansion more than doubled.

- The rates of input cost and output charge inflation are diverging, indicating businesses are absorbing costs rather than passing them on, directly impacting profitability.

-

The New Value Creation Playbook: Four Data-Driven Strategies

In this environment, success hinges on a forensic focus on operational efficiency and strategic agility. Here are four critical areas for immediate action:

1. Hyper-Focused Cost Management (Beyond the Obvious)

Traditional cost-cutting is a blunt instrument. The goal now is intelligent cost optimization that protects core capabilities.

-

-

- Zero-Based Budgeting (ZBB) for Key Functions: Instead of basing budgets on prior years, rebuild them from a “zero base,” justifying every dollar spent. This is particularly effective for SG&A (Selling, General & Administrative expenses).

- Strategic Sourcing and Supplier Consolidation: Re-negotiate contracts with key suppliers. Consolidating purchasing power across multiple portfolio companies can unlock significant economies of scale and bargaining power. World-class procurement organizations can generate up to 18% lower costs than typical peers.

- Automate to Accumulate: Identify and automate high-volume, low-value tasks within finance, HR, and customer service. This reduces reliance on expensive labor and boosts productivity.

-

2. Pricing Power Through Value, Not Volume

In a stagflationary environment, the ability to raise prices without losing market share is a superpower. This requires a deep understanding of your customer’s perceived value.

-

-

- Value-Based Pricing Models: Shift from cost-plus pricing to models tied to the specific outcomes and ROI your product or service delivers. This makes price increases justifiable.

- Granular Customer Segmentation: Identify which customer segments are most loyal and least price sensitive. Focus commercial efforts and innovation on these segments.

- Product Tiering: Introduce new, premium tiers with enhanced features or services to protect the core product from price erosion.

-

3. Fortifying the Supply Chain for Resilience

The quest for the lowest-cost supplier has been exposed as a single point of failure. Resilience is the new efficiency.

-

-

- Dual-Sourcing and Nearshoring: Mitigate risk by qualifying alternative suppliers, even at a slightly higher cost. Explore nearshoring options to reduce geopolitical risk and logistics complexity.

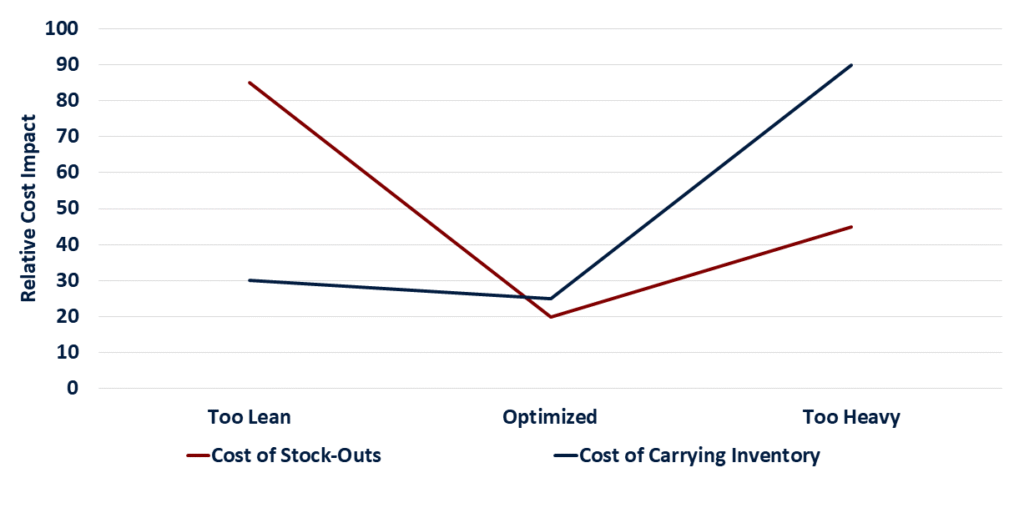

- Data-Driven Inventory Management: Leverage advanced analytics to optimize safety stock levels. The goal is to balance the cost of carrying inventory against the risk of stock-outs and lost sales. The following graph illustrates this critical trade-off that portfolio companies must now model:

-

The Stagflation Inventory Optimization Trade-Off

-

-

- Invest in Visibility: Implement supply chain monitoring tools to provide early warning of disruptions.

-

4. Strategic M&A and Divestitures

Stagflation accelerates industry shakeouts. This creates both vulnerability and opportunity.

-

-

- Roll-Up Strategies: Acquire struggling competitors at attractive multiples to gain market share, consolidate overlapping costs, and achieve scale advantages.

- Prune Non-Core Assets: Conduct a clear-eyed review of the portfolio. Divest non-strategic business units that are capital-intensive or chronically underperforming to free up cash and management attention for the core business.

-

The Role of Data and Technology

Underpinning all these strategies is the non-negotiable need for real-time data. Portfolio companies must move from quarterly financial reviews to continuous performance monitoring.

-

-

- Implement Integrated KPI Dashboards: Track leading indicators (e.g., sales pipeline velocity, customer churn rate, input costs per unit) alongside lagging financial metrics.

- Leverage Predictive Analytics: Use modeling to forecast demand under different scenarios, predict potential cash flow shortfalls, and stress-test the business.

-

Conclusion: From Defense to Offense

The fear of stagflation is real, but it should be a catalyst for action, not paralysis. The private equity firms that will win in this era are those that use this pressure to force operational excellence and strategic clarity within their portfolio companies.

This is not about merely surviving a downturn. It is about seizing the opportunity to create stronger, more efficient, and more resilient businesses. By taking a proactive, data-driven approach to cost management, pricing, and supply chain resilience, GPs can navigate their portfolio companies through this uncertainty and position them for outsized success when the economic cycle eventually turns. The high-stakes game is underway, and the most prepared players will take the pot.

Schedule a confidential operational assessment to bulletproof your portfolio companies today.