For private equity firms, the ultimate measure of success is a successful exit at a premium valuation. While strong financials are the price of entry, the difference between a good exit and a great one increasingly hinges on a less tangible factor: strategic positioning. In today’s market, the most coveted acquisitions are not just profitable; they are “tech-enabled” – scalable, data-rich, and capable of accelerating the buyer’s own digital strategy.

The days of handing a buyer a data room full of spreadsheets and hoping they uncover the value are over. The modern exit is a curated performance. It requires weaving a compelling narrative where technology and data are not support functions, but the core drivers of future growth. This process, known as Data Storytelling, separates a commodity asset from a strategic must-have.

Why Strategic Acquirers Pay a Premium: The Value of Synergy

Financial buyers look at EBITDA. Strategic acquirers (e.g., corporates, larger platforms) look at Strategic EBITDA – the baseline earnings plus the net present value of synergies they can unlock. Your goal is to use data to quantify and de-risk those synergies, making the acquisition case irresistible.

By the Numbers: The Storytelling Premium

-

-

- 70% of M&A professionals believe that the ability to tell a compelling data-driven story significantly increases deal success and valuation.

- Acquisitions where technology and data capabilities are a primary rationale command valuation premiums that are 10-20% higher than those where they are not.

- “Synergy Leverage” – where the buyer can clearly see and value potential cost and revenue synergies – is the strongest predictor of a high-multiple exit.

-

The Three Pillars of a Tech-Enabled Exit Narrative

To build this narrative, you must prepare your portfolio company across three dimensions long before the banker is engaged.

1. Operational Scalability: Proving You Can Grow Efficiently

A strategic acquirer is buying future growth, not just past performance. Your technology stack must demonstrate that it can support this growth without proportional cost increases.

-

-

- The Cloud Narrative: Show that your infrastructure is cloud-native (AWS, Azure, GCP), allowing for elastic, on-demand scaling. This is a powerful contrast to a company reliant on expensive, rigid on-premise servers.

- Automation Evidence: Quantify the extent of automation in key processes (sales, marketing, finance, ops). Metrics like % of orders processed touchlessly or % of customer service queries resolved via AI are incredibly valuable.

- Platform Stability: Provide data on system uptime (e.g., 99.99% SLA), security posture, and disaster recovery capabilities. This de-risks the acquisition for the buyer.

-

2. Data as a Strategic Asset: The New Oil on the Balance Sheet

Data is an intangible asset that rarely appears on financial statements, but it can be your most powerful valuation tool.

-

-

- Customer Intelligence: Move beyond basic CRM data. Can you provide deep analytics on customer lifetime value (LTV), churn prediction, segmentation, and buying patterns? This allows a buyer to model cross-selling opportunities immediately.

- Operational Data: Show how data optimizes your supply chain, inventory management, or pricing strategy. This demonstrates operational excellence that can be exported to the acquirer’s other business units.

- Data Moats: Does your proprietary data create a competitive barrier to entry? This is a hugely valuable narrative for buyers looking to defend market position.

-

3. The Synergy Roadmap: Your Most Valuable Document

This is the centerpiece of Data Storytelling. Don’t make the buyer guess the synergies; present a quantified, credible model for how they will be achieved.

-

-

- Cost Synergies: Model how the acquirer can consolidate your technology onto their platform (or vice versa), eliminating redundant software licenses, IT staff, and infrastructure costs.

- Revenue Synergies: This is the golden ticket. Use your data to model:

- Upsell/Cross-sell: How many of the acquirer’s customers would be likely buyers of your product? What is the projected LTV of those customers?

- New Market Entry: How does your technology platform lower the cost for the acquirer to enter a new geographic or product market?

-

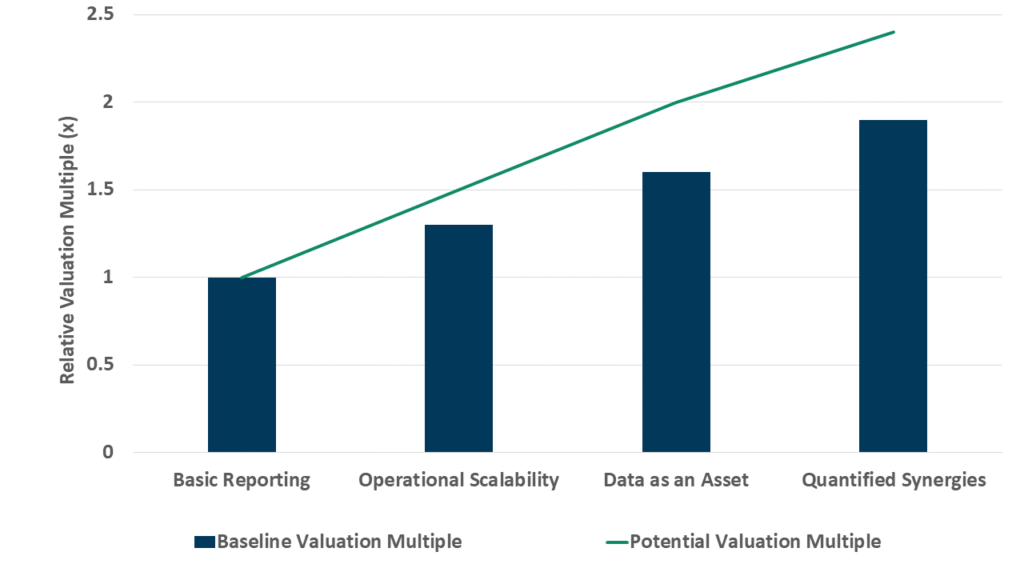

Visualizing the Narrative: The Exit Multiplier Effect

The following graph illustrates how stronger tech and data narrative directly influences buyer perception and willingness to pay. It moves the company from being valued as a standalone entity to being valued as a strategic accelerator.

The Exit Multiplier Effect: How Tech-Readiness Influences Valuation

The graph demonstrates clear progression. Each level of preparedness provides the acquirer with more confidence and a clearer vision of post-acquisition value, directly translating into a higher valuation multiple.

The Preparation Timeline: Building the Story Starts on Day One

Crafting this narrative is not an 11th-hour task. It is a core part of the value creation plan that begins at acquisition.

-

-

- 12-24 Months Pre-Exit: Begin formalizing the narrative. Conduct internal audits of tech stack and data assets. Start cleaning and structuring key data sets.

- 6-12 Months Pre-Exit: Develop the synergy hypothesis. Build financial models that quantify the opportunity. Create marketing materials that hint at the tech-enabled story.

- During the Process: The management presentation must be a masterclass in Data Storytelling. Weave the narrative throughout, using clear visuals and hard data to support every claim about scalability, data intelligence, and synergy potential.

-

Conclusion: The Final Multiplier in Your Value Creation Strategy

A successful exit is the culmination of years of value creation. Yet, in the final stretch, that created value must be effectively communicated and translated into a compelling strategic vision for the buyer. A tech-enabled exit, powered by robust data storytelling, is not merely a presentation tactic; it is the critical multiplier that ensures the market fully appreciates the transformation you have engineered. It shifts the buyer’s perspective from evaluating a static set of financials to envisioning a dynamic, scalable platform for their own future growth. This is how you transition from a price negotiation based on past performance to a value discussion centered on future potential.

Ultimately, the goal is to ensure your portfolio company is not perceived as a standalone entity, but as a key that unlocks immense value within the acquirer’s organization. By meticulously preparing the narrative around operational scalability, data intelligence, and quantified synergies, you are doing more than selling a company – you are selling a de-risked strategic advantage.

In an increasingly competitive and data-driven M&A landscape, the ability to articulate this vision with clarity and conviction is what separates top-tier private equity firms from the rest, ensuring they don’t just exit, but exit on their own terms with a premium valuation.