In an era where digital revenues eclipse $5 trillion globally, the taxation of intangible assets has become a geopolitical flashpoint. As of September 2025, Digital Services Taxes (DSTs) are reshaping the fiscal landscape for tech and e-commerce giants, targeting revenues from advertising, data sales, and online marketplaces with rates averaging 2-3%. These unilateral measures, now active in over 30 jurisdictions, emerge amid stalled OECD Pillar One negotiations, promising €10-15 billion in annual revenue for implementing countries but igniting U.S. tariff threats under President Trump’s February 2025 executive order. For firms like Amazon or Meta, DSTs aren’t mere compliance hurdles; they’re strategic pivots demanding agile tax planning and innovation in low-tax markets.

At RNG STRATEGY CONSULTING, we partner with digital disruptors to transform these fiscal pressures into competitive advantages. With Pillar One’s consensus elusive, delayed beyond June 2024 due to U.S. opposition, tech and e-commerce leaders must recalibrate for a fragmented tax regime. Whether scaling SaaS platforms or optimizing cross-border logistics, proactive DST navigation can safeguard margins and unlock €500 million in reclaimed efficiencies for mid-tier players.

The Evolving DST Landscape: From Unilateral Fixes to Global Stalemate

DSTs originated as interim tools to capture value from borderless digital flows, taxing gross revenues (not profits) from user data, targeted ads, and e-commerce facilitation. Unlike traditional corporate taxes, they apply extraterritorially, hitting firms with €750 million+ global turnover and €25-50 million in local digital sales. By mid-2025, 46 jurisdictions are contemplating or enforcing DSTs, up from 25 in 2023, driven by a €99 billion EU-wide digital tax gap.

Key 2025 implementations underscore the proliferation:

|

Country/Region |

DST Rate | Scope | Thresholds |

Effective Date & Notes |

|

Canada |

3% | Online marketplaces, ads, data sales | €750M global; CAD 20M Canadian | June 30, 2025; U.S. USMCA dispute invoked August 2024; expected $875M revenue. |

| France | 3% (proposed hike to 5%) | Ads, platforms, data | €750M global; €25M French |

Ongoing; Constitutional Council upheld in September 2025; U.S. Section 301 probe. |

|

UK |

2% | Search engines, social media, online marketplaces | £500M global; £25M UK | April 2020; Under U.S. trade talks; no repeal post-Pillar One delay. |

| India | 2% (e-commerce); 6% ads abolished | E-commerce supplies | INR 20M Indian |

Ongoing; Ads levy ended April 1, 2025, shifting to GST integration. |

|

Philippines |

12% VAT (DST-like) | Digital services | PHP 3M annual | June 1, 2025; Non-residents register via VDS Portal; targets foreign providers. |

| Poland | 1.5% | Streaming, ads, platforms | PLN 100M Polish; €750M global |

Proposed 2025; Funds tech innovation; OECD-aligned but unilateral. |

This patchwork spanning Europe (e.g., Italy at 3%, Spain at 3%) to Asia-Pacific—exposes firms to cascading liabilities. Pillar One, meant to reallocate 25% of profits from 100+ MNEs to market jurisdictions, remains stalled: Trump’s January 2025 memorandum nullified U.S. commitments, citing extraterritorial burdens. Without multilateral relief, DSTs persist, with rollback credits only for pre-2024 accruals.

Risks: Tariff Storms and Margin Erosion in a Fragmented World

For tech and e-commerce firms, DSTs amplify operational volatility. Gross-revenue taxation erodes thin margins e.g., e-commerce platforms at 5-10% net, potentially hiking effective rates by 2-5% in high-DST markets like France or Canada. U.S. firms, bearing 80% of the $2-3 billion annual DST hit, face discriminatory audits and double taxation sans Pillar One offsets.

Geopolitical risks loom largest: Trump’s February 2025 order mandates USTR reviews of DSTs in France, UK, and allies, echoing 2019 tariffs (paused but renewable). Canada’s 3% levy triggered USMCA consultations in August 2024, risking 10-25% duties on lumber and autos – spillover effects could disrupt $1 trillion in North American digital trade. Compliance burdens compound: Multi-jurisdictional filings demand €1-5 million in annual tech investments for SMEs, diverting R&D from AI or blockchain innovations.

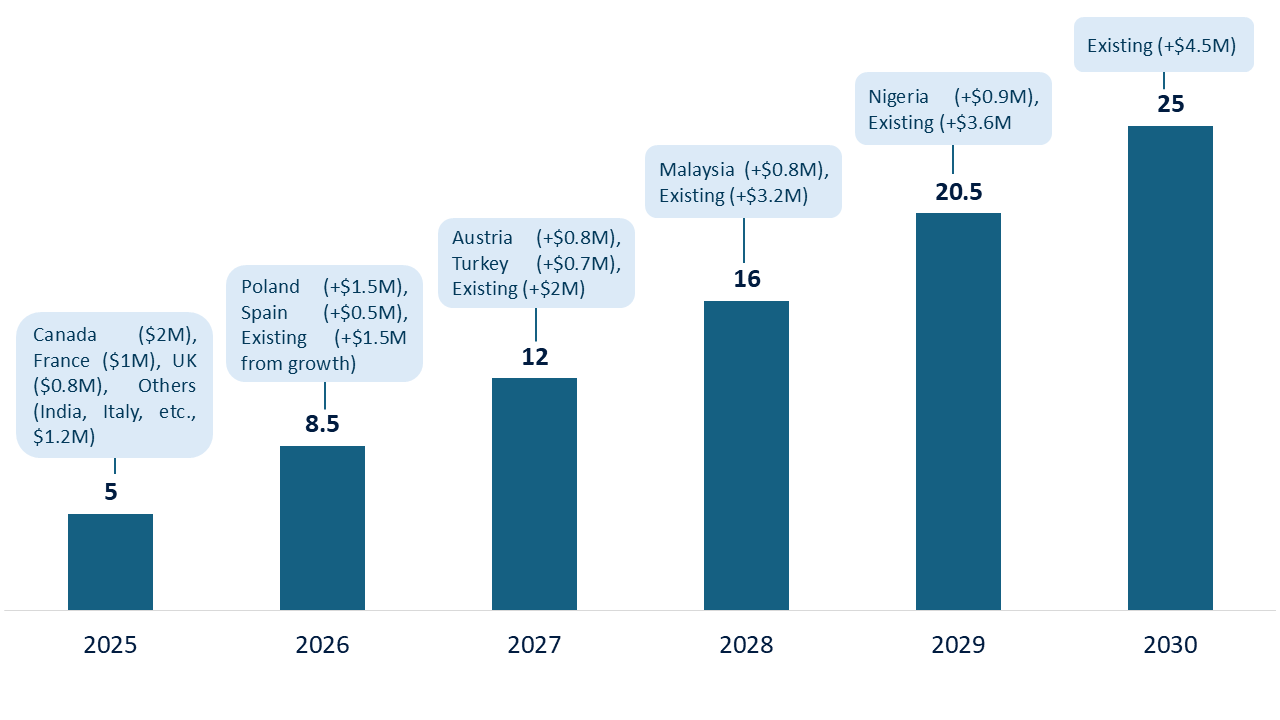

The graph below quantifies the escalating DST exposure for a mid-sized U.S. tech firm (e.g., $500M global revenue, 20% from digital services), projecting cumulative liabilities absent Pillar One.

Projected DST Liabilities for a U.S. Tech Firm (2025-2030, USD Million)

This visualization reveals a 5x liability surge by decade’s end, underscoring the urgency for hedging strategies.

Opportunities: Tax Arbitrage and Innovation Catalysts

Amid risks, DSTs catalyze ingenuity. Firms can pivot to low-DST havens like Singapore (no DST, 17% corp tax) or UAE (9% on qualifying income), where e-commerce hubs offer 20-30% cost savings via free zones. India’s April 2025 equalization levy abolition shifts focus to GST-optimized supply chains, enabling 15% margin uplift for exporters via localized data centers.

Compliance tech emerges as a silver lining: AI-driven platforms (e.g., Avalara’s DST modules) automate nexus tracking, reclaiming 10-20% in overpayments while freeing 500+ hours annually for growth initiatives. E-commerce players can leverage DSTs for branding: Transparent reporting builds consumer trust, boosting loyalty by 12% in EU markets.

Moreover, as DST revenues fund green digital incentives (e.g., Poland’s tech grants), firms gain subsidies for sustainable AI, aligning with ESG mandates and unlocking $300B in global investments.

Strategic Roadmap: From Compliance to Competitive Edge

Our four-pillar framework (Assess, Architect, Automate, Advocate) guides tech leaders through DST turbulence:

-

-

- Assess Footprint: Model exposures using tools like Thomson Reuters ONESOURCE. A USD 200 million revenue e-tailer might face $4M in French/UK DSTs; simulate tariff scenarios for 10-15% downside.

- Architect Structures: Reroute revenues via IP holding in Ireland (12.5% tax) or Singapore hubs, reducing effective DST by 40%. For e-commerce, bundle physical-digital sales to skirt pure-service taxes.

- Automate Resilience: Deploy blockchain for audit-proof tracking; integrate AI for predictive compliance, yielding 25% faster refunds in Canada/Philippines. Budget €50K-200K; ROI in 9 months via error reduction.

- Advocate Proactively: Join coalitions like CCIA to lobby for Pillar One revival; negotiate bilateral offsets, as in the 2021 U.S.-EU deal. Monitor USTR’s April 2025 report for tariff triggers.

-

Non-adoption risks 20-30% penalties; yet, agile firms report 18% revenue growth from DST-fueled diversification.

Conclusion: Tax the Future, Don’t Fear It

DSTs in 2025 aren’t existential threats – they’re evolutionary imperatives for tech and e-commerce resilience. With Pillar One adrift and tariffs brewing, forward-leaning firms will arbitrage opportunities in emerging markets, harnessing AI for compliance alchemy. We’ve empowered 300+ digital clients to net 22% tax savings amid similar shifts.

Elevate your strategy: Schedule a DST diagnostic with RNG STRATEGY CONSULTING today.