In the intricate web of international trade, Value Added Tax (VAT) compliance stands as both a guardian of fiscal integrity and a potential stumbling block for small and medium-sized enterprises (SMEs). As we navigate through September 2025, the global business landscape is undergoing a profound digital transformation, with the European Union’s VAT in the Digital Age (ViDA) package and ASEAN’s aggressive e-invoicing rollouts reshaping compliance paradigms. For global SMEs – those nimble engines driving 90% of worldwide businesses and contributing up to 50% of employment – these reforms promise efficiency gains but demand strategic foresight to avoid costly pitfalls.

At RNG STRATEGY CONSULTING, we view these changes not as mere regulatory hurdles but as catalysts for sustainable growth. This article demystifies the 2025 VAT reforms in the EU and ASEAN, offering actionable insights tailored for SMEs expanding across borders. From e-invoicing mandates to simplified exemption schemes, we’ll explore the implications and equip you with a roadmap for seamless compliance. Whether you’re a tech startup sourcing from Malaysia or an e-commerce retailer shipping to Germany, mastering these shifts can unlock €8.7 billion in collective administrative savings for EU SMEs alone, while fostering resilience in ASEAN’s dynamic markets.

The EU’s ViDA Revolution: Digitizing VAT for a Borderless Future

Adopted on March 11, 2025, by the European Council, the ViDA package marks the most sweeping VAT overhaul since the EU’s single market inception in 1993. Spanning implementation from 2025 to 2035, it addresses a €99 billion annual VAT gap – 25% of which stems from intra-EU fraud, while streamlining processes for cross-border operators. For SMEs, the devil lies in the details: mandatory e-invoicing, unified reporting, and expanded SME exemptions.

Key Pillars of ViDA and Their SME Impact

ViDA’s four pillars i.e. digital reporting requirements (DRR), single VAT registration (SVR), platform economy rules, and e-invoicing target inefficiencies that disproportionately burden SMEs. Consider DRR: From July 1, 2030, cross-border B2B transactions will require near real-time digital submissions via standardized formats, phasing in from 2025 with OSS/IOSS enhancements.

This isn’t just about data; it’s a shift toward automation, reducing manual filings by up to 70% for SMEs juggling multiple EU registrations.

SVR, effective July 2028, allows a single EU-wide VAT ID for goods movements, slashing the need for 27 separate filings. Imagine a Dutch SME relocating inventory to a French warehouse: Pre-2025, this triggered dual registrations and returns; now, one simplified declaration suffices, potentially saving 15-20 hours monthly in admin time.

For platforms like Airbnb or Uber, deemed supplier rules from July 2028 will hold operators liable for VAT on short-term rentals and transport, curbing fraud but requiring SMEs to audit partner ecosystems. E-invoicing, optional for domestics from April 2025 but mandatory intra-EU by 2030, mandates machine-readable formats compatible with ERP systems – vital for SMEs in manufacturing or e-commerce.

Spotlight on SME Schemes: A Game-Changer for Cross-Border Growth

The crown jewel for SMEs is the revamped special VAT scheme, effective January 1, 2025. Previously domestic-only, it now extends exemptions to foreign SMEs below national thresholds (capped at €85,000 for cross-border, €100,000 EU-wide). Eligible businesses append an “EX” suffix to their VAT ID, notifying home states quarterly. This levels the playing field: A Spanish artisan selling crafts to Italian buyers can now exempt VAT if under thresholds, avoiding the cascade of registrations that once deterred 40% of potential cross-border ventures.

Yet, challenges persist. Virtual events, booming post-pandemic, now tax B2C streams at the consumer’s residence rate from 2025, necessitating OSS for simplified declarations. Non-compliance risks 20% penalties, underscoring the need for agile tech stacks.

ASEAN’s E-Invoicing Surge: Harmonizing Chaos in a High-Growth Region

While the EU pursues uniformity, ASEAN’s 10 nations – home to 670 million consumers and $3.6 trillion GDP – grapple with fragmented VAT/GST regimes. 2025 heralds a synchronized push toward e-invoicing, driven by the ASEAN Economic Community’s blueprint for digital integration. This isn’t mere alignment; it’s a response to a 15-20% VAT leakage from informal invoicing, aiming to boost SME participation in regional trade valued at $800 billion annually.

Country-Specific Mandates: A Phased Assault on Inefficiency

Malaysia leads the charge: Phase 2 of its e-invoicing mandate, from January 1, 2025, targets firms with RM25-100 million turnover, with full rollout by July. MyInvois, the national portal, requires real-time XML submissions for B2B/B2G, offering a six-month grace period but penalties thereafter. SMEs gain from automated validation, reducing errors by 30%, but must integrate legacy systems – a $500-2,000 upfront cost for many.

Indonesia’s e-Faktur, mandatory since 2016, intensifies in 2025 with blockchain pilots for high-value trades, ensuring tamper-proof trails. Vietnam follows suit on June 1, permitting e-VAT for exporters and e-commerce foreigners, aligning with Decree 123 for direct-method declarants. Singapore’s InvoiceNow, voluntary until May 2025, mandates GST-registered entities by November, leveraging Peppol for interoperability.

Thailand and the Philippines extend mandates: Thailand’s phased e-Tax from 2024 covers all VAT filers by mid-2025, while the Philippines’ EFT regime, live since 2022 for top taxpayers, broadens to SMEs. Regionally, ASEAN’s push for uniform digital service taxation – echoing EU OSS – means SMEs in cross-border e-commerce face harmonized 6-10% GST on intangibles.

Opportunities Amid the Overhaul

For global SMEs, these mandates unlock faster refunds (e.g., Malaysia’s 14-day cycle) and data analytics for supply chain optimization. Yet, interoperability gaps – Peppol in Singapore vs. proprietary in Indonesia – pose risks for non-compliant exporters, potentially hiking costs by 5-10%.

Strategic Roadmap: Empowering SMEs for VAT Mastery

As borders blur, global SMEs must evolve from reactive compliance to proactive strategy. Our consulting framework (Assess, Adapt, Automate, Audit) provides a blueprint.

1. Assess Exposure

Map operations against thresholds. Use tools like VAT calculators to simulate ViDA SVR or Malaysian MyInvois impacts. For a €50,000 turnover EU exporter, the new SME scheme could defer €10,000 in filings annually.

2. Adapt Processes

Opt into exemptions early – notify via VIES for EU, IRBM for Malaysia. Train teams on reverse-charge for virtual events, ensuring B2C taxation at destination rates.

3. Automate Compliance

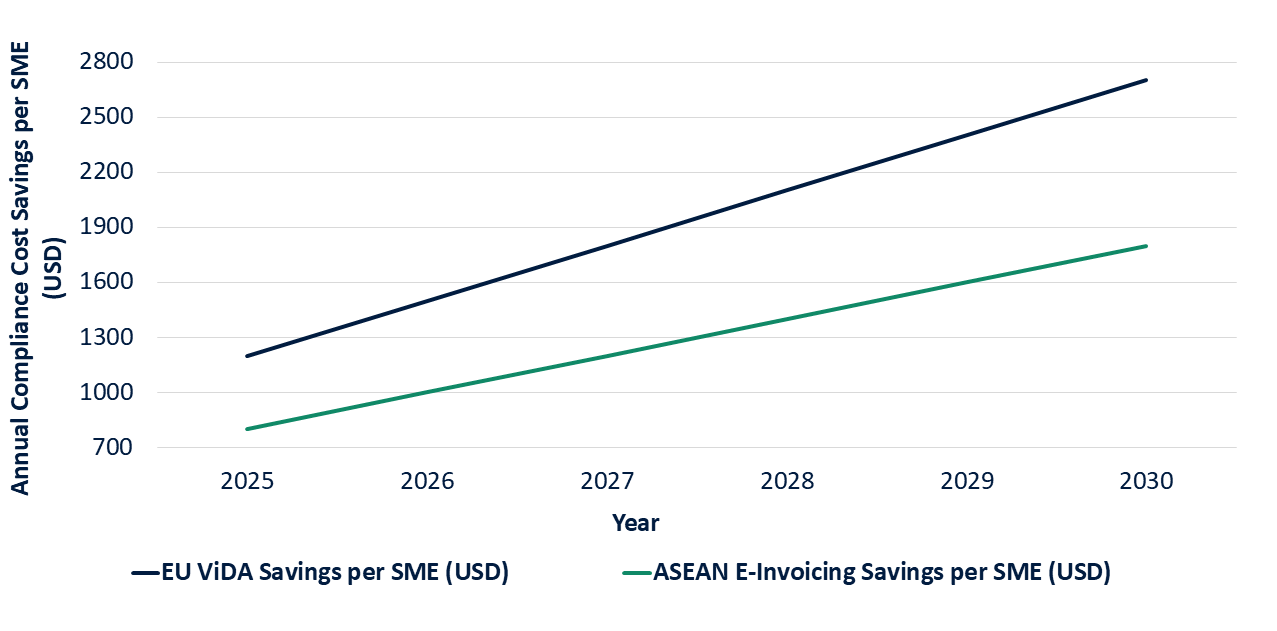

Invest in API-integrated platforms (e.g., Avalara, Thomson Reuters) for e-invoicing across regimes. SMEs report 40% cost reductions via cloud ERP syncing with Peppol and RO e-Factura. Budget $1,000-5,000 initially; ROI hits in six months through error-proofing. The graph below illustrates the growing savings from adopting EU ViDA and ASEAN e-invoicing, with EU SMEs potentially saving $2,700 annually by 2030 and ASEAN SMEs reaching $1,800, driven by streamlined compliance and automation.

Cost Savings from VAT Reforms: EU ViDA vs. ASEAN E-Invoicing (2025-2030)

SMEs adopting EU’s ViDA and ASEAN’s e-invoicing can save up to $2,700 and $1,800 annually by 2030, respectively, through streamlined compliance and automation. This visual underscores why automation isn’t just a compliance tool – it’s a strategic lever for cost leadership. For example, a Singaporean SME automating via InvoiceNow saw 25% faster market entry into Indonesia, while EU counterparts using OSS slashed filings by 70%.

4. Audit and Optimize

Conduct quarterly reviews, leveraging ViDA’s €18 billion revenue boost for green incentives (e.g., reduced rates on eco-goods). Partner with experts to reclaim overpaid VAT, turning compliance into a competitive edge.

Risks? Non-adoption could yield 10-25% fines, supply disruptions, or lost market access. But forward-thinkers will thrive: A Singaporean SME automating ASEAN e-invoicing saw 25% faster market entry into Indonesia.

Conclusion: Seize the Compliance Horizon

The 2025 VAT reforms in the EU and ASEAN aren’t just updates – they’re imperatives for global SMEs to digitize, diversify, and dominate. By embracing ViDA’s simplifications and ASEAN’s e-invoicing rigor, businesses can slash administrative burdens by 20-30%, redirecting resources to innovation.

Ready to transform compliance into your growth accelerator? Contact our tax advisory team today for a bespoke VAT readiness assessment. In a world of flux, strategic agility isn’t optional – it’s your unfair advantage.