Executive Summary

The global financial services landscape is undergoing a seismic shift, catalyzed by the rapid ascent of neobanks. These digital-native, branchless institutions are not merely a niche trend; they represent a fundamental recalibration of customer expectations and economic models in banking. For incumbent banks and new market entrants, understanding the drivers, scale, and future trajectory of this disruption is no longer optional. This analysis provides a high-level overview of the global neobanking market, leveraging key data points to illuminate the core vectors of its growth and offering actionable insights for leadership teams navigating this new competitive paradigm.

The Neobanking Phenomenon: Scale and Velocity

Neobanks have moved from the fringes to the mainstream with astonishing speed. Characterized by their mobile-first interfaces, streamlined product offerings, and data-driven customer experiences, they have successfully identified and exploited gaps in the traditional banking value chain.

The market’s growth is not just impressive; it is exponential. The global neobanking market is projected to expand at a compound annual growth rate (CAGR) of over 50% over next decade. This trajectory forecasts a market value exceeding USD 2 trillion by the end of the decade. This is not a market to be monitored; it is one that demands engagement.

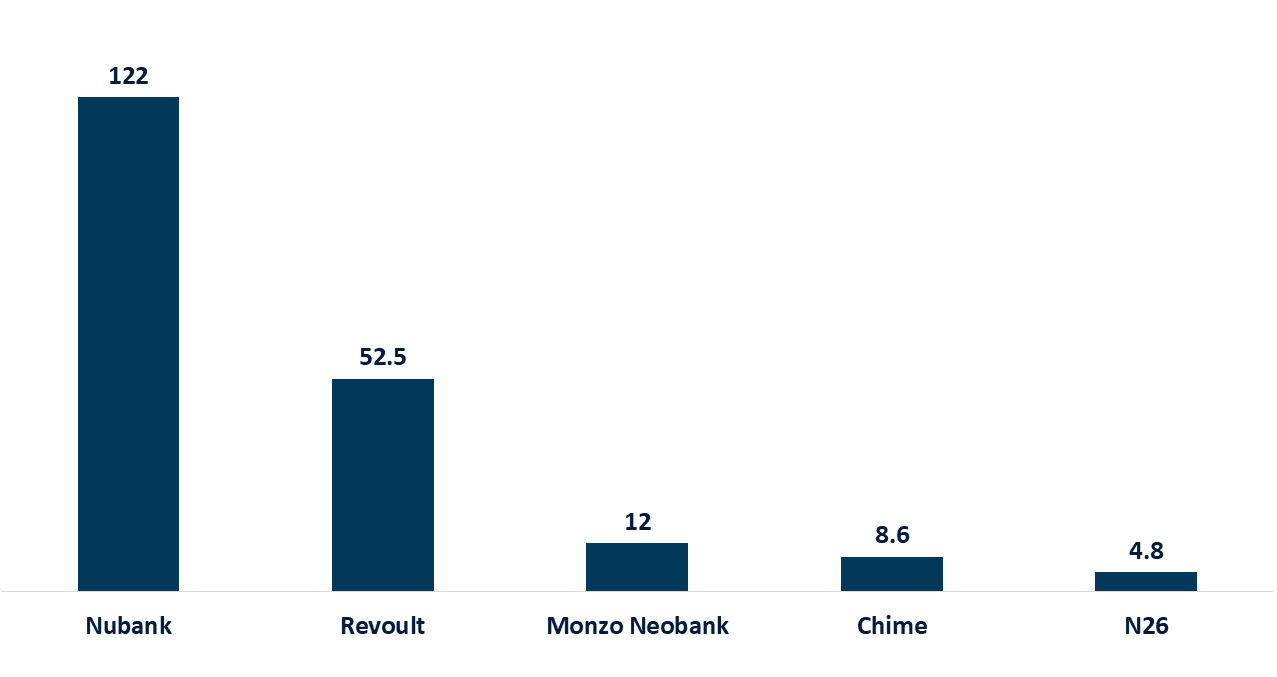

Representative Active Customers (Millions) – Selected Neobanks

Deconstructing the Disruption: Why Neobanks Are Winning

The success of neobanks can be attributed to a potent combination of technological enablers and a sharp focus on underserved customer needs. Our analysis identifies three core pillars of their value proposition:

-

-

- Superior Customer Experience (CX): Neobanks offer a frictionless onboarding process that can be completed in minutes, not days. Their intuitive apps provide real-time insights into spending, automated savings tools, and seamless peer-to-peer payments, addressing the modern consumer’s demand for convenience and control.

- Economic Efficiency: Unburdened by the massive fixed costs of physical branch networks and legacy IT infrastructure, neobanks operate with significantly lower overheads. This allows them to offer lower fees, higher interest rates on savings, and more competitive exchange rates, creating a compelling price-value equation.

- Hyper-Relevant Product Offerings: Rather than offering hundreds of complex products, leading neobanks focus on doing a few things exceptionally well. They leverage data analytics to tailor offerings to specific demographics, such as freelancers (e.g., Holvi, Qonto), millennials (e.g., Chime, Varo), or travelers (e.g., Revolut, N26).

-

Market Segmentation and Regional Hotspots

The neobanking revolution is global, but its manifestation varies significantly by region, influenced by regulatory frameworks and local banking maturity.

-

-

- Europe: The pioneer, driven by a progressive PSD2 regulation that mandates open banking. This has fostered a fertile ground for brands like Revolut, N26, and Monzo to expand rapidly across the continent.

- North America: A massive market focused largely on addressing domestic pain points, such as overdraft fees and financial inclusion. Chime leads in user acquisition, while others like Current and Varo have gained significant traction.

- Asia-Pacific: The fastest-growing region, fueled by a large unbanked/underbanked population and skyrocketing smartphone penetration. Companies like WeBank (China), and KakaoBank (South Korea) are not just neobanks; they are integrated into vast digital ecosystems.

-

Global Neobanking Market by Account Type

|

Account Type |

Key Characteristics & Drivers |

|

Business Accounts |

High-value segment. Demand for automated invoicing, expense management, and integration with accounting software. |

|

Savings Accounts |

Attractive due to higher interest rates than traditional banks. Driven by automated round-up and savings features. |

|

Checking Accounts |

The entry-point product. Focus on fee-free structures, early direct deposit, and intuitive spending analytics. |

Challenges on the Horizon: Sustainability and Profitability

Despite their growth, neobanks face significant headwinds. The central challenge is the path to profitability. Many rely on interchange fees (from card transactions) as a primary revenue source, a model that is vulnerable and often insufficient for long-term sustainability. Scaling this model requires massive customer acquisition, which is becoming increasingly expensive.

Furthermore, as they mature, they encounter the very complexities they sought to avoid: increased regulatory scrutiny, the need to develop more sophisticated and costly products like credit and wealth management, and the constant threat of cybersecurity breaches. The initial focus on customer acquisition must inevitably shift to customer monetization and lifetime value optimization.

Strategic Recommendations for Incumbents and New Entrants

For traditional financial institutions, the response must be strategic and decisive. A reactive, piecemeal approach will fail. We advise our clients to consider the following pathways:

-

-

- Build: Launch an independent digital brand (“neobank-within-a-bank”) with autonomy over its technology stack and culture to compete directly. This protects the core brand while enabling innovation.

- Partner: Forge strategic partnerships with established neobanks or fintech to quickly integrate their best-in-class technology and user experience into your existing offerings.

- Acquire: Acquire a leading neobank to rapidly gain technology, talent, and a new customer base. This is a capital-intensive but fast route to market transformation.

- Emulate: Drastically accelerate digital transformation initiatives by adopting agile methodologies, leveraging cloud-native core banking systems, and creating a compelling, mobile-first UX for your own products.

-

For potential new entrants, the strategy must involve a clear focus on an underserved niche or demographic, a robust and multi-pronged revenue model that goes beyond interchange fees, and a relentless focus on unit economics from the outset.

Conclusion

The global neobanking market has shifted from experimentation to structural relevance. With customer bases in the tens of millions and revenue curves resembling mid-tier banks, digital challengers are no longer “disruptors on the fringe” but established financial institutions competing for mainstream share. What separates the leaders from the rest is not growth alone but the ability to translate scale into profitable, regulated, and trust-anchored businesses.

For boards and executive teams, three imperatives stand out:

-

-

- Institutionalize profitability – move from top-line growth obsession to rigorous unit-economics discipline.

- Secure trust at scale – regulatory compliance, data security, and risk controls are now differentiators, not hygiene factors.

- Build adaptive business models – diversify revenue streams through credit, SMB services, and embedded finance partnerships to weather cycles.

-

Those who execute against these imperatives will not only survive regulatory tightening and competitive intensity but emerge as the next generation of global financial institutions.

Partner with us to turn neobanking scale into sustainable profitability and long-term market leadership.