Executive Summary

The automotive industry stands at the precipice of its most significant transformation since the advent of the internal combustion engine. While electrification captures headlines, a more profound, connective layer is being woven into the fabric of mobility: Vehicle-to-Everything (V2X) communication. V2X is not merely an incremental feature; it is the foundational technology that will enable a step-change in road safety, traffic efficiency, and the eventual realization of autonomous driving. With road traffic fatalities persisting at approximately 1.19 million annually worldwide, V2X offers a pathway to reduce crashes by up to 80% in non-impaired scenarios.

Defining the V2X Ecosystem

V2X is an umbrella term for a vehicle’s ability to communicate with its environment. This communication breaks down into several key segments:

-

-

- V2V (Vehicle-to-Vehicle): Direct communication between vehicles to exchange data on speed, position, and trajectory, enabling cooperative collision avoidance.

- V2I (Vehicle-to-Infrastructure): Communication between vehicles and roadside units (RSUs) like traffic lights, signs, and lampposts, providing insights into traffic flow, signal timing, and road hazards.

- V2P (Vehicle-to-Pedestrian): Alerting drivers and vulnerable road users (e.g., pedestrians, cyclists) via smartphones or dedicated devices to prevent accidents.

- V2N (Vehicle-to-Network): Leveraging cellular networks to connect vehicles to cloud services for navigation, infotainment, and broader traffic data aggregation.

-

The synergistic effect of these communications is what unlocks V2X’s true potential: the creation of a cooperative, intelligent transportation system.

Technological Foundations and Standardization Pathways

V2X facilitates real-time data exchanges across vehicles (V2V), infrastructure (V2I), pedestrians (V2P), networks (V2N), and energy grids (V2G), leveraging dedicated wireless spectra to mitigate risks and enhance efficiency. Core protocols include Dedicated Short-Range Communications (DSRC) via IEEE 802.11p and Cellular-V2X (C-V2X) under 3GPP specifications, with the latter integrating 5G for latencies below 1 millisecond.

Global standardization efforts are pivotal for interoperability.

-

-

- The ITU’s Recommendation ITU-T Y.Suppl.86 (January 2025) details functional architectures for connected vehicle formations using edge computing, projecting enhanced coordination in multi-lane scenarios to cut emissions by optimizing traffic flows.

- ETSI’s TS 103 969 V2.1.1 (March 2025) specifies NR-V2X and LTE-V2X access layers in the 5 GHz band, mandating tests for transmission/reception to support Europe’s Intelligent Transport Systems (ITS).

-

Complementing this, 3GPP Release 17 introduces sidelink enhancements for non-line-of-sight communications, critical in dense urban environments where the WHO notes 70% of fatalities occur.

Regional nuances persist:

-

-

- Europe’s EU 5G Action Plan mandates uninterrupted 5G coverage on major transport paths by 2025, fostering V2X integration.

- In Asia, China’s Ministry of Industry and Information Technology (MIIT) has allocated the 5905-5925 MHz band for V2X, with drafts for data security standards released in August 2025 to bolster ecosystem resilience.

- Japan’s National Police Agency and Ministry of Land, Infrastructure, Transport and Tourism have deployed ITS systems since 2016, evolving to C-V2X in urban pilots like Tokyo’s Koto Ward (2024 rollout), targeting 80% highway coverage.

-

Clients should prioritize compliance with hybrid DSRC/C-V2X frameworks to hedge against fragmentation, while investing in edge computing for scalable deployments. As ITU forecasts indicate over 75 billion connected devices by 2025 (including vehicles), early standardization alignment can yield competitive advantages in interoperability.

Deployment Dynamics and Regional Insights

The USDOT’s National V2X Deployment Plan aims for 20% coverage on the National Highway System by 2028, backed by $60 million in grants for pilots in Arizona, Texas, and Utah to demonstrate crash reductions. Extrapolating from WHO benchmarks, global implementation could avert millions of incidents annually, with USDOT projections estimating 439,000 fewer U.S. crashes yearly at scale.

Adoption varies geographically:

-

-

- Europe’s ETSI-driven initiatives target 30% urban penetration by 2027, aligned with the 5G Action Plan’s corridor focus.

- In Asia-Pacific, China’s MIIT reports 7.76 million intelligent connected vehicles sold from January to July 2025, with mandates for V2X in new models under national standards.

- Japan’s ITS deployments cover 80% of highways, per government evaluations, emphasizing V2X for autonomous vehicle mandates.

- North America, at 15% penetration in 2025, is ramping up via USDOT’s framework, with the Department of Energy (DOE) allocating $51.7 million in FY2024 for V2X R&D on energy-efficient protocols.

-

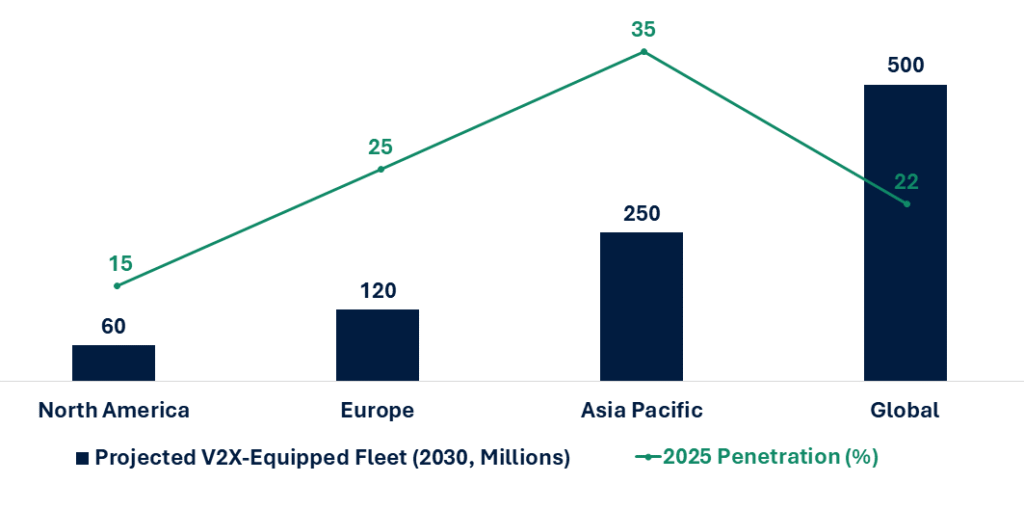

Innovation metrics reinforce momentum: The World Intellectual Property Organization (WIPO) records over 1.1 million transportation-related patents since 2000, with a 25% annual surge in V2X filings, dominated by China (45%) and the U.S. (30%). Our analyses project the connected vehicle fleet exceeding 500 million by 2030, driven by 5G’s 45% global penetration by 2027.

Global Automotive V2X Penetration

The Standards Battle: C-V2X vs. DSRC – A Strategic Inflection Point

A critical strategic challenge for the industry is the coexistence of two primary communication technologies. The following table summarizes the core differentiators.

Key Comparison of V2X Communication Standards

|

Feature |

DSRC (Dedicated Short-Range Communications) | C-V2X (Cellular-V2X) |

| Technology Base | Based on IEEE 802.11p (Wi-Fi variant) |

Based on Cellular LTE/5G standards |

|

Communication Modes |

Only Direct Communication (PC5 interface) | Direct Communication (PC5) & Network-based (Uu) |

| Latency | Very Low (<10ms) |

Low with 5G (<5-10ms) |

|

Evolution Path |

Mature but limited evolution path | Clear roadmap to 5G-Advanced and beyond |

| Global Adoption | Strong in Japan; legacy support in EU/US |

Emerging as the dominant global standard, especially in China, EU, and US |

The strategic momentum has decisively shifted towards C-V2X. Its ability to leverage existing cellular ecosystems, a clear evolution path to 5G’s ultra-reliable low-latency communication (URLLC), and support from a powerful consortium of telecom and tech companies make it a more future-proof investment. China has unequivocally bet on C-V2X, driving its rapid scale. In Europe and the United States, while a transition period exists, the industry consensus is coalescing around C-V2X as the long-term solution.

China represents the most aggressive and coordinated V2X market globally. Driven by national government policy, the “C-V2X Industrial Development Plan” has created a synchronized push from OEMs, infrastructure providers, and telecom operators. Major pilot zones are operational, and deployment is scaling rapidly.

Strategic Imperatives for Industry Stakeholders: A Consultative View

For players in this ecosystem, a passive approach is fraught with risk. Active, strategic positioning is required.

-

-

- For Automotive OEMs: The decision is no longer if but how to integrate V2X. The strategic choice of C-V2X is clear. The challenge lies in developing the software-defined vehicle architecture to manage the data influx and create valuable customer-facing features. Partnerships with tech and telecom firms are crucial.

- For Tier-1 Suppliers: The opportunity is to provide holistic hardware-software solutions that are modular and upgradable. Focus on enabling both direct and network-based communication seamlessly. Security must be a foundational element, not an afterthought.

- For Infrastructure Planners and Governments: The key is strategic, phased investment. Prioritize high-traffic corridors and high-risk intersections for RSU deployment. Develop public-private partnerships to share the investment burden and ensure interoperability through strict adherence to open standards.

- For Investors: The opportunity extends beyond hardware. Look towards the application layer: companies developing software for data analytics, cybersecurity for V2X systems, and services built on the rich data generated by the ecosystem.

-

Conclusion: The Connected Road Ahead

The Automotive V2X market is transitioning from a period of technological debate to one of coordinated deployment. While challenges remain – including cybersecurity, business model development, and the sheer scale of infrastructure investment – the direction is unequivocal. V2X is the cornerstone of the next generation of safe, efficient, and intelligent transportation systems. The organizations that treat V2X as a strategic core competency, rather than a compliance checkbox, will be best positioned to capture value in the new mobility economy.

Schedule a briefing with our mobility specialists to navigate the V2X inflection point.