In an era defined by geopolitical tensions, climate imperatives, and accelerating trade demands, the global ship repair and maintenance sector stands as a critical enabler of maritime resilience and economic stability. With the world merchant fleet exceeding 2.4 billion deadweight tons (dwt) in cargo-carrying capacity as of 2023, and maritime trade volumes projected to expand at 2.5% annually through 2029, the sector faces both unprecedented demands and transformative pressures. The ship repair and maintenance market is characterized by sustained growth, propelled by an aging global fleet, stringent environmental regulations, and shifting trade patterns. Success in this environment will hinge on strategic positioning, technological adoption, and operational agility.

The Macroeconomic Currents: Quantifying the Market Pulse

The foundation of the ship repair and maintenance sector is inextricably linked to the size and composition of the world’s commercial fleet. As of January 2024, the global fleet exceeded 100,000 vessels in number, with a combined deadweight tonnage (DWT) surpassing 2.4 billion tones. This vast asset base represents a perpetual demand driver for maintenance, repair, and overhaul (MRO) services.

The market’s value is consistently robust. Analysis of industry expenditures indicates that annual global spending on ship repair and maintenance reliably exceeds USD 50 billion. This figure is not a static target but a baseline from which significant growth is projected, with a compound annual growth rate (CAGR) estimated between 3% to 5% over the next five years.

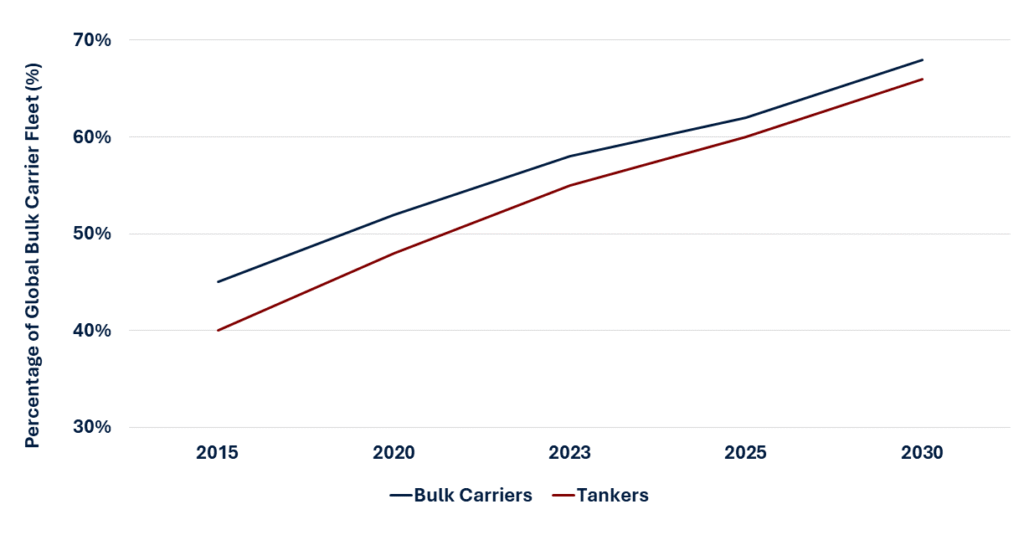

The Aging Fleet Imperative: Projected Percentage of Bulk Carrier Fleet Over 15 Years of Age

This growth is not uniform; it is concentrated in specific vessel segments and geographic regions, creating both challenges and opportunities. The trends suggest that repair and maintenance activities could see compounded growth, as heightened vessel utilization exacerbated by route diversions around chokepoints like the Suez Canal has increased ton-mile demand by 3% globally and 12% for container ships.

Key Drivers: Catalysts for Strategic Investment

Several macro forces propel the sector forward. First, decarbonization imperatives under IMO’s 2050 net-zero ambitions necessitate extensive retrofitting. UNCTAD estimates annual investments of $8 billion to $28 billion for fleet decarbonization, with infrastructure for carbon-neutral fuels requiring an additional $28 billion to $90 billion yearly.

By early 2024, only 14% of new tonnage was alternative fuel-ready, leaving 98.8% of the existing fleet reliant on fossil fuels and ripe for upgrades like scrubber installations or hybrid propulsion systems. This transition not only boosts repair volumes but also opens avenues for consultants to advise on cost-effective compliance strategies.

Second, geopolitical disruptions such as Houthi threats in the Red Sea have rerouted vessels via the Cape of Good Hope, surging arrivals by 89% while slashing Suez transits by 70% in mid-2024. These detours elevate fuel consumption by 200,000 barrels per day and emissions by 4.5%, accelerating wear and tear on hulls and engines. Concurrently, low scrapping rates amid record newbuild orders keep older vessels operational, further straining maintenance resources.

Third, regional dynamics highlight growth hotspots. Asia dominates shipbuilding, with China, Japan, and South Korea accounting for 95% of global output, China alone delivering over half. This concentration fosters adjacent repair hubs, while Europe and North America focus on high-value retrofits. To illustrate regional variances, consider the following table derived from OECD and UNCTAD analyses:

|

Region |

Share of Global Shipbuilding (%) | Key Maintenance Focus Areas | Projected Trade Growth Impact (2024-2029) |

| Asia (China, Korea, Japan) | 95 | Retrofitting for green fuels, hull repairs |

High (63% of container trade) |

|

Europe |

2 | Regulatory compliance, engine overhauls | Moderate |

| North America | 1 | Military vessel MRO, infrastructure upgrades |

Stable |

|

Africa & SIDS |

<1 | Basic repairs, port efficiency improvements |

Low, with vulnerabilities |

The competitive advantage is shifting from pure cost arbitrage to technical capability, reliability, and speed. Yards that can offer value-added services such as expertise in gas-fueled vessel systems, ballast water treatment system installation, and digital dry-docking solutions are positioning themselves for premium margins.

Strategic Imperatives for Stakeholders: A Consultative Perspective

In this complex environment, a passive approach is a recipe for obsolescence. We advise clients to consider the following strategic actions:

1. For Shipowners & Operators:

-

-

-

- Proactive Asset Management: Shift from reactive repairs to predictive maintenance. Invest in IoT sensors and data analytics to monitor vessel health, optimizing dry-dock schedules and reducing downtime.

- Strategic Partnering: Move beyond transactional relationships with repair yards. Develop long-term partnerships with yards that have the technical capability to handle your specific fleet’s compliance and maintenance needs.

- Lifecycle Planning: Integrate future regulatory requirements (e.g., GHG reduction targets for 2030/2050) into today’s repair and retrofit planning.

-

-

2. For Repair Yards & Investors:

-

-

-

- Specialization over Generalization: Competing on price alone is a losing battle against mega-yards. Develop a niche—whether in cruise ship refurbishment, offshore wind support vessel maintenance, or complex gas system retrofits.

- Invest in Digitalization and Workforce: Upgrade yard facilities with automation (e.g., robotic welding, digital project management platforms) and invest in continuous training to address the skilled labor shortage.

- Focus on Throughput and Efficiency: The key metric is not just dock occupancy but revenue per dock-day. Streamlining processes to reduce vessel turnaround time is more valuable than simply filling docks.

-

-

Conclusion: Navigating the Future

The global ship repair and maintenance market is at an inflection point. The era of growth driven solely by an expanding fleet is giving way to a more complex paradigm defined by regulation, technology, and geopolitics. The wave of demand is real and substantial, but it requires a sophisticated vessel to ride it. Stakeholders who embrace a strategic, data-driven, and forward-looking approach will not only survive the coming shifts but will thrive, turning market challenges into sustainable competitive advantages. The question is no longer if the market will grow, but which players are best positioned to capture its value.

To transform these market dynamics into a tailored strategic roadmap for your organization, contact our maritime specialists.