The global industrial adhesives and sealants market represents a critical, yet often overlooked, barometer of worldwide industrial and economic health. Far from being commoditized products, these advanced materials are fundamental enablers of innovation across sectors from lightweight electric vehicles and sustainable packaging to next-generation renewable energy systems. Driven by escalating needs in construction, automotive, and electronics, the market is poised for sustained growth, potentially approaching USD 100 billion over next decade based on historical trends and sector-specific projections.

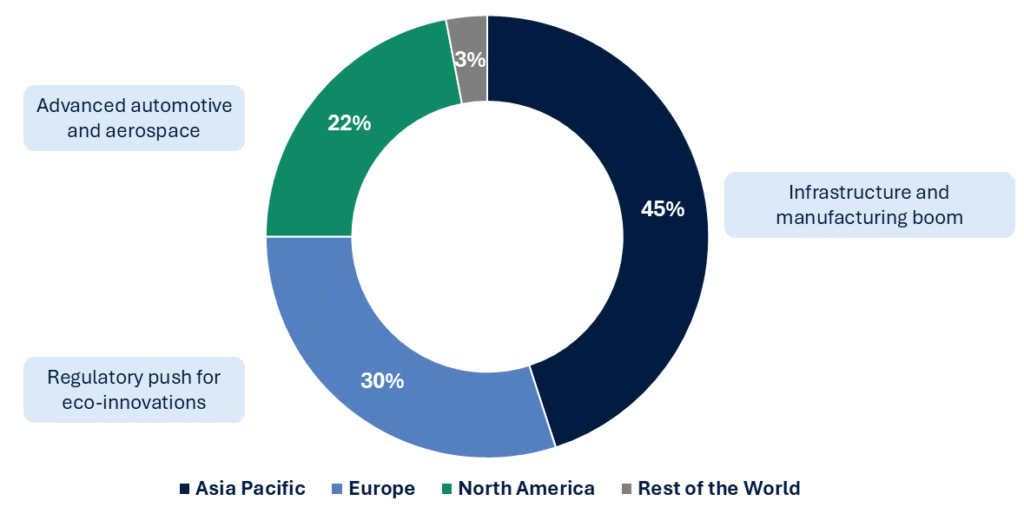

Regional Industrial Adhesives and Sealants Market

Structural Growth Drivers & Constraints

1. Lightweighting and Electrification (Opportunity)

OEMs are substituting mechanical fasteners with adhesives and structural bonding to reduce mass and integrate multi-material assemblies (metals, composites, polymers). The automotive production footprint, concentrated in Asia, translates into predictable regional demand growth.

The automotive industry’s pivot to Electric Vehicles (EVs) is a paramount driver. EV manufacturers rely on advanced structural adhesives to bond dissimilar materials (e.g., aluminum to carbon fiber), reducing vehicle weight to extend battery range and enhancing overall structural integrity and crash performance. This is a definitive shift from mechanical fasteners to adhesive-based joining.

2. Construction & Retrofit Activity (Steady Baseline)

Adhesives and sealants are critical to modern building envelopes, insulation and facade systems. These applications provide a defensive revenue base in slowdown periods. Construction is highlighted as a core market in Europe.

3. Regulatory & Safety Constraints (Near-term Headwind)

The EU’s REACH amendment (Commission Regulation (EU) 2020/1149) introduced stricter controls and mandatory training for diisocyanates (effective measures and training obligations from Aug 24, 2023), which materially affect polyurethane systems and require compliance investments across supply chains.

4. Sustainability & Circularity (Strategic Pivot)

A pivotal trend is the transition toward eco-friendly adhesives and sealants, aligning with global sustainability goals. Bio-based alternatives, derived from renewable sources like starch and proteins, are gaining traction.

The European Circular Economy agenda and national policies push formulators to reduce VOCs, increase bio-based feedstocks and design for disassembly – positioning adhesives as both an enabler of recycling and a target of reformulation incentives.

Material Technology Segmentation: A Shifting Value Pool

The market’s technological landscape is segmented by chemistry, each with distinct performance and application profiles. The critical strategic insight is the ongoing migration of value from traditional commodity systems to advanced, engineered chemistries.

Key Adhesive & Sealant Chemistries: Attributes and Primary Applications

|

Chemistry Type |

Key Characteristics | Primary End-Use Applications |

| Epoxy | High strength, chemical resistance, thermosetting |

Aerospace, automotive, wind energy, electronics, construction |

|

Polyurethane |

Flexibility, toughness, good impact resistance | Automotive, construction, footwear, packaging |

| Silicone | Extreme temperature resistance, weatherability |

Construction, electronics, solar energy, aerospace |

|

Acrylic |

UV resistance, durability, fast curing | Transportation, signage, construction, pressure-sensitive tapes |

| Cyanoacrylate | Very fast curing, high strength on plastics |

Electronics, medical, consumer applications |

The highest growth rates are observed in epoxy, polyurethane, and silicone segments, driven by their criticality in the high-value EV, renewable energy, and electronics sectors.

Strategic Implications

-

-

- Product roadmap: invest in low-VOC, bio-based and reversible-bond chemistries. Where customers are migrating toward circular design (packaging, electronics, automotive interiors), differentiated formulations command price premiums and lower regulatory risk.

- Compliance-as-a-service: Build training and certification services (or partnerships) around REACH diisocyanate obligations — a revenue adjacency that reduces client friction and supports account retention.

- Regional market playbook: Prioritize Asia-Pacific expansion for volume capture (manufacturing concentration) while protecting margins in Europe via higher-value, low-emission formulations.

- Raw-material risk management: Secure strategic feedstock contracts (or backward integration for polymer precursors) to mitigate petrochemical price volatility. Consider toll-manufacturing agreements in high-growth geographies.

- Commercial model innovation: Sell outcomes (durability guarantees, EPD-backed environmental claims), not just kg/l. Buyers increasingly value lifecycle credentials and supplier transparency.

-

Conclusion

The global industrial adhesives and sealants market is a high-stakes arena where success will be determined by strategic agility and a forward-looking investment thesis. The era of competing on generic formulations is over.

For sustainable value creation, there are three core imperatives:

-

-

- Innovate for Megatrends: Direct R&D and product development resources squarely at the needs of the EV, renewable energy, and sustainable packaging revolutions. Formulations that enable lightweighting, durability, and recyclability will command premium margins.

- Embrace the Sustainability Mandate: Proactively transition your portfolio away from legacy, solvent-based systems. Invest in marketing and lifecycle analysis to articulate the value of your sustainable solutions, moving the conversation beyond a simple price-per-kilo metric.

- Optimize for the Regional Reality: A one-size-fits-all global strategy is suboptimal. Tailor your commercial and supply chain strategies to capitalize on the volume-driven growth in Asia-Pacific while leveraging the high-value, innovation-led opportunities in North America and Europe.

-

The companies that will lead this market in the coming decade are those that view adhesives and sealants not as mere chemicals, but as critical, enabling technologies for the future of global industry.

Contact our strategic advisory practice to transform these market insights into your proprietary growth agenda.