In an era defined by escalating energy demands, climate imperatives, and digital disruption, smart meter emerges as a cornerstone of modern energy infrastructure. Unlike traditional meters, smart meters enable real-time data collection, two-way communication, and automated controls, empowering utilities, governments, and consumers to optimize energy use, integrate renewables, and enhance grid reliability. Globally, the adoption of smart meter is accelerating, driven by policy mandates and investment surges, positioning it as a critical enabler for net-zero transitions.

The smart meter market sits at the intersection of digitization, decarbonization and customer empowerment. Global deployments exceeded the 1 billion meter milestone in recent years, driven by large-scale national programs (China in particular), utility modernization in OECD markets and renewed policy pushes in emerging economies.

Unlocking the Tiered Value Proposition of AMI Deployment

The Macro-Driver: A Converging Storm of Policy, Technology, and Consumer Demand

The adoption of smart meters is not occurring in a vacuum. It is the direct result of three powerful, global macro-trends:

1. The Regulatory Push for Grid Modernization

Governments worldwide are enacting stringent decarbonization and energy efficiency targets. For instance, the European Union’s Clean Energy for All Europeans package mandates member states to promote the deployment of smart meter systems. Similarly, initiatives in Asia and North America are backed by substantial public funding for grid modernization, positioning AMI as critical public infrastructure.

2. The Rise of Distributed Energy Resources (DERs)

The exponential growth of rooftop solar, residential battery storage, and electric vehicles (EVs) is rendering the traditional grid obsolete. A passive meter cannot manage the bidirectional flow of energy, nor can it support the sophisticated time-of-use pricing required to balance a grid saturated with intermittent renewables.

3. Economic Pressure on Utilities

Operational efficiency is paramount. Smart meters drastically reduce costs associated with manual meter reading, estimated billing disputes, and field operations for connect/disconnect services.

The confluence of these factors has created an unstoppable momentum. Global investment in digital electricity infrastructure, including smart meters, grew by over 50% between 2015 and 2021, signaling a profound shift in utility capital expenditure priorities.

Global Market Landscape: Varied Maturity and Growth Phases

The global smart meter market is not monolithic; it is a collection of regional markets at different stages of maturity. A strategic view is essential for allocating resources and anticipating market opportunities.

|

Region |

Market Phase | Primary Driver |

Key Characteristic |

|

North America |

Second-Wave Rollout |

Grid Resilience & DER Integration |

Focus on replacing first-generation meters and integrating with DERMS (Distributed Energy Resource Management Systems). |

|

Europe |

Mass Rollout / Post-2020 |

EU Mandates & Decarbonization |

Driven by EU policy; high penetration in markets like Spain, Italy, and the UK. Eastern Europe is emerging as a growth hotspot. |

|

Asia-Pacific |

High-Growth Expansion |

Massive Electrification & Urbanization |

China leads in volume, driven by state-grid modernization. India’s smart meter rollout is accelerating under government schemes. |

|

Latin America / MEA |

Nascent / Pilot Phase |

Loss Reduction & Operational Efficiency |

Focus on combating non-technical losses and improving billing efficiency in rapidly growing urban centers. |

China accounts for more than half of the installed base followed by EU and U.S. with mid-double-digit and low-double-digit shares respectively. In Europe alone, the European Commission anticipates EUR 584 billion in electricity grid investments by 2030, of which EUR 170 billion is allocated to digitalization efforts, including smart meter.

India set an ambitious replacement target (250 million meters) and has approved large volumes under the RDSS. Official communications reported installed meters under RDSS of ~2.41 crore (24.1 million) as of July 2025, with broader counts reported across schemes. These figures highlight both the scale and the implementation complexity of national rollouts.

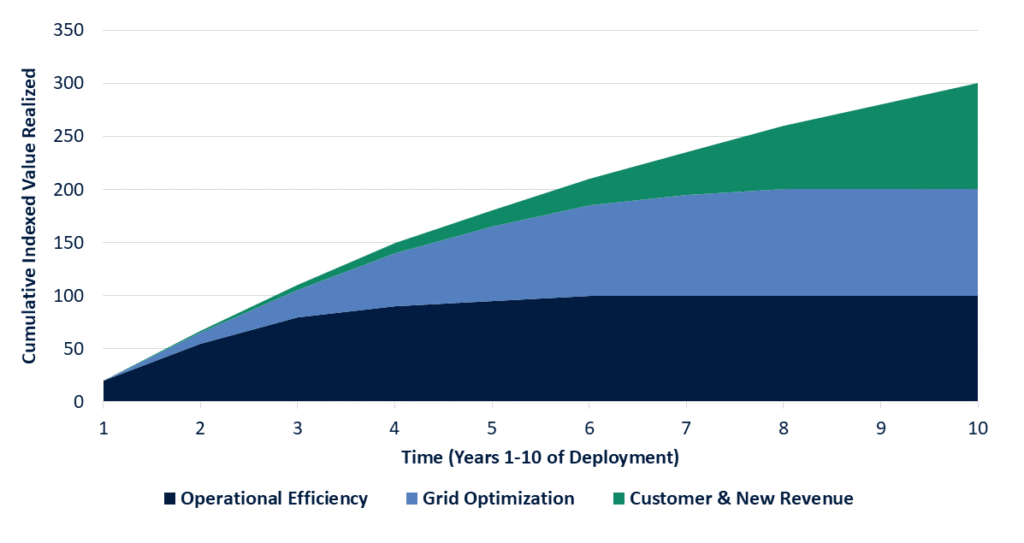

The Value Proposition: Moving Beyond AMI to a Data-Centric Utility

The conversation must evolve from simply counting meter installations to quantifying the value derived from the data they produce. Our consulting engagements identify three layers of value creation:

1. Operational Efficiency (Tactical)

This is the foundational ROI. Utilities with large-scale AMI deployments report a 20-30% reduction in operational expenditure (OpEx) related to meter reading, truck rolls, and call center volume. The outage detection and restoration times can be improved by over 40% with AMI data.

2. Grid Optimization (Strategic)

This is where the true transformation begins. Smart meters provide granular, interval data that enables:

-

-

-

- Dynamic Pricing: Encouraging load shifting to off-peak hours, flattening the demand curve, and deferring costly grid upgrades.

- Loss Analytics: Precisely identifying areas of technical and non-technical losses, enabling targeted interventions.

- Voltage Optimization: Maintaining power quality within tighter bands, reducing waste and extending asset life.

-

-

3. Customer Engagement & New Revenue (Transformational)

The data from smart meters empowers consumers and creates new business models. Utilities can offer personalized energy efficiency reports, facilitate seamless integration for prosumers (those who both produce and consume energy), and partner with third parties for value-added services like EV charging management.

Challenges: Navigating Risks in a Connected Ecosystem

Despite momentum, challenges loom, particularly in cybersecurity and data privacy areas demanding proactive interventions. Globally, incidents like those in Ukraine underscore the need for resilience measures.

1. Data Management and Cybersecurity

A single smart meter generates thousands of data points per year. A full deployment creates a data deluge. The primary challenge shifts from data collection to data management, analytics, and security. A robust cybersecurity framework is non-negotiable to protect this critical infrastructure from threats.

2. Consumer Acceptance and Regulatory Scrutiny

Concerns over data privacy, health, and perceived cost-benefit have led to public pushbacks in some markets. A transparent communication strategy, coupled with clear opt-in/opt-out policies for data sharing, is crucial. Regulatory bodies are increasingly focused on ensuring that the benefits of AMI are equitably distributed among all ratepayers.

3. Interoperability and Technology Lifecycle

The ecosystem includes meters, communication networks (RF, PLC, Cellular), and head-end systems. Ensuring these components from various vendors work together seamlessly is a persistent challenge. Furthermore, with rapid technological advancement, utilities must plan for technology refresh cycles to avoid stranded assets.

Strategic Recommendations for Stakeholders

1. For Utility Leaders

Develop a Holistic AMI Roadmap, not just a procurement plan. This roadmap must integrate with your broader grid modernization, DER integration, and customer engagement strategies. Prioritize investments in the data analytics platform alongside the hardware.

2. For Policymakers

Craft regulations that incentivize value creation over mere deployment. Support pilot programs for innovative rate designs and ensure regulatory frameworks allow utilities to earn a return on their digital investments.

3. For Investors

Look beyond the meter manufacturers. The highest growth potential may lie in companies providing the enabling software: cybersecurity solutions, data analytics platforms, and DER management systems that leverage the AMI backbone.

Conclusion

The global transition to smart meter is a cornerstone of the 21st century energy system. It is a complex, capital-intensive, but ultimately indispensable undertaking. The organizations that will succeed are those that view AMI not as a simple meter replacement project, but as the foundational layer for a new, digital, and resilient utility business model.

The question is no longer whether your organization will participate in this market, but how strategically it will navigate the transition to capture the full spectrum of operational, strategic, and transformational value.

To transform this strategic analysis into a tailored roadmap for your organization, contact our energy practice to initiate a consultation.