Executive summary

The global energy landscape is undergoing a profound structural shift. The dual imperatives of energy security and the transitional demand for lower-carbon fuels are compelling producers to seek agile, capital-efficient solutions for gas monetization. In this context, the modular liquefied natural gas (LNG) plant is emerging not merely as an alternative technology, but as a strategic enabler for a new class of projects. It positions modularization as a critical tool for de-risking capital expenditure, accelerating time-to-market, and unlocking the vast potential of stranded and associated gas reserves globally.

Modular LNG plants, being prefabricated, skid-mounted or containerized liquefaction units sized for small-to-medium throughput, have moved from niche proof-of-concept to mainstream project delivery. These scalable facilities typically ranging from mini-scale (under 0.5 million tons per annum, or MTPA) to mid-scale (0.5-2 MTPA) offer agile solutions for monetizing stranded gas reserves, enhancing supply chain resilience, and supporting the shift toward lower-carbon fuels.

Global LNG trade rose to ~411.2 million tons in 2024, underpinning continued investor and policy interest in flexible supply solutions where modular designs now offer a credible route to faster, lower-risk capacity additions where traditional mega-projects are impractical.

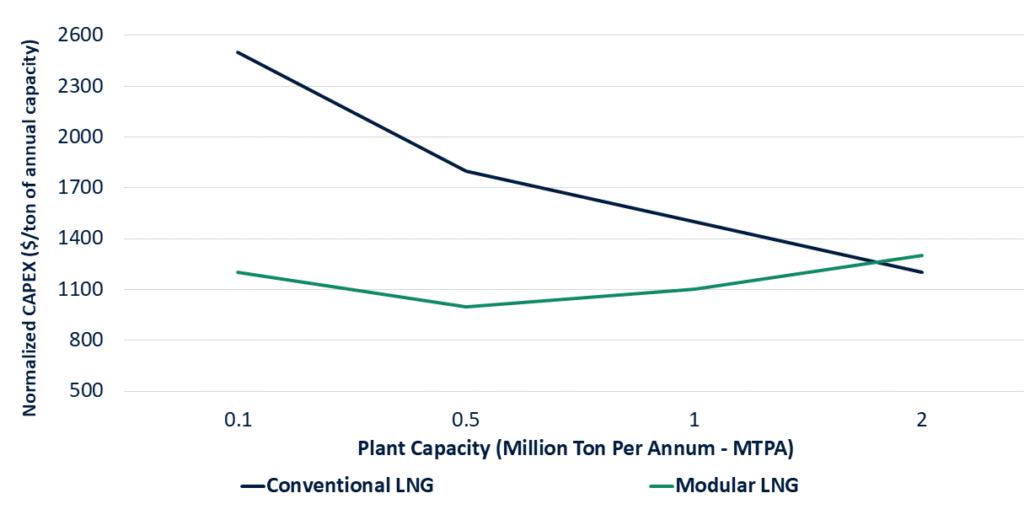

Breaking the Cost Curve: Comparison of Normalized CAPEX per Ton of Capacity

The Paradigm Shift: From Gigascale to Right-Scale

Historically, the LNG industry has been dominated by mega-projects: multi-billion-dollar, bespoke facilities with construction timelines often exceeding five years. These projects, while capable of producing significant volumes, carry immense execution risk, exposure to cost inflation, and require long-term off-take agreements to secure financing.

The modular approach disrupts this paradigm. Modular LNG plants are constructed from prefabricated, skid-mounted units engineered and built in controlled factory environments, then transported to the site for assembly. This methodology transfers a significant portion of the project’s complexity and labor from a remote, often challenging greenfield site to a centralized, efficient fabrication yard.

The core value proposition is threefold:

-

-

- Capital Efficiency: Dramatic reduction in onsite labor and construction overhead.

- Schedule Certainty: Parallel processing of site preparation and module fabrication can compress schedules by 30-40%.

- Risk Mitigation: Mitigates weather delays, local labor shortages, and associated cost overruns.

-

|

Region |

Capacity (MTPA, 2024) | Key Modular Contributions | Growth Projection (to 2028) |

| Asia Pacific | 138.9 | Floating LNG (FLNG) units in Australia |

+20% |

|

North America |

85.0 | U.S. modular expansions like Plaquemines | Double to 24.4 Bcf/d |

| Middle East | 120.0 | Qatar’s modular-scale pilots |

+64 MTPA from expansions |

|

Africa |

60.0 | Tortue FLNG in Senegal-Mauritania | +15% |

| Europe & Others | 90.5 | Emerging small-scale in Baltic regions |

Stable |

Projections indicate liquefaction capacity could expand to over 500 MTPA in 2025 and over 750 MTPA by 2030, driven partly by modular innovations that reduce project timelines by up to 50% compared to traditional mega-plants.

Key Drivers: Fueling Modular Adoption

The demand for modular solutions is being fueled by a powerful convergence of macroeconomic, geopolitical, and environmental factors.

1. Energy Security & Supply Diversification

The geopolitical realignments post-2022 have forced many nations, particularly in Europe, to rapidly diversify their gas supplies. This has created an urgent need for rapid deployment of LNG infrastructure, both for import and export. Modular regasification units (MRUs) and small-scale liquefaction plants are being deployed at an unprecedented pace to address this immediate need.

2. Monetization of Stranded and Associated Gas

Over 140 billion cubic meters (BCM) of gas is flared annually globally. This represents a monumental economic waste and a significant source of CO2 emissions. Modular LNG plants offer a technically and economically viable solution to capture this gas, converting a liability into a valuable product for power generation or local distribution. A 0.1 MTPA (Million Tons Per Annum) modular plant can effectively eliminate flaring from a mid-sized oil field while creating a new revenue stream.

3. The Transition Fuel Narrative

Natural gas, particularly when displacing coal, plays a crucial role in the energy transition by providing dispatchable, lower-carbon power. The International Energy Agency (IEA), in its Net Zero by 2050 roadmap, notes that while unabated gas use must decline, LNG trade will be essential in the near-to-midterm to support grid stability and the phase-out of more polluting fuels. Modular plants align perfectly with this transitional, decentralized energy model.

Nearly 300 bcm/yr of new export capacity between 2025 and 2030, much of it being modular will minimize environmental footprints through reduced on-site construction. Demand in Asia, particularly China and India, remains robust, with global supply reaching over 660 MTPA by 2028. Technological advancements, such as FLNG vessels, exemplify this; projects like Tortue FLNG commenced in late 2024, proving modular viability for offshore fields.

Regional Perspectives: A Global Lens

Globally, modular LNG adoption varies by region. In North America, the US leads with facilities like Sabine Pass at 28 MTPA, incorporating modular trains for scalability. Asia Pacific, exported nearly 139 MT in 2024, with modular FLNG in Australia addressing declining feedstocks.

Africa emerges as a hotspot with approvals post-2022 boosting continental capacity, with modular plants unlocking stranded reserves. In Europe, small-scale modular regasification supports import diversification, though demand peaks soon. The Middle East, led by Qatar, integrates modular elements in mega-expansions for export flexibility.

Strategic Applications of Modular LNG Plants

|

Application Segment |

Value Driver | Typical Capacity Range | Regional Hotspots |

| Stranded Gas Monetization | Creating value from previously uneconomic reserves. | 0.1 – 0.5 MTPA |

Sub-Saharan Africa, Latin America, Southeast Asia |

|

Associated Gas Capture |

Reducing flaring penalties, generating ESG-compliant revenue. | 0.05 – 0.3 MTPA | U.S. Permian Basin, Middle East, North Africa |

| Marine Bunkering | Providing compliant fuel for shipping (IMO 2020). | 0.1 – 0.5 MTPA |

Europe, Singapore, Panama Canal, U.S. Gulf Coast |

|

Peak-Shaving & Remote Power |

Ensuring grid reliability and displacing diesel. | 0.01 – 0.1 MTPA |

Island Nations (e.g., Caribbean), Remote Industrials, Asia-Pacific |

Strategic Considerations and Implementation Challenges

-

-

- Higher Front-End Engineering Design (FEED) Costs: The design phase for a modular project is more intensive and costly, requiring meticulous planning to ensure modules interface correctly on site. This non-recurring engineering cost must be viewed as an investment in overall project de-risking.

- Logistics and Supply Chain Mastery: Transporting large modules from fabrication yards (often in East Asia, Middle East, or U.S.) to the project site is a complex operation requiring specialized vessels and route surveys. This necessitates a robust and experienced supply chain partner.

- Technology Selection: Not all liquefaction technologies are equally suited to modularization. Selection criteria must prioritize process simplicity, turndown flexibility, and compact footprint. Technologies like nitrogen expander cycles are often favored for their operational flexibility in modular applications.

-

Conclusion and Strategic Recommendations

The modular LNG plant market represents a fundamental evolution in the gas industry’s approach to project development. It is a direct response to the demand for capital discipline, speed, and flexibility in an uncertain global environment.

For energy companies, investors, and national oil companies, the time for strategic positioning is now. We recommend the following actions:

-

-

- Re-evaluate Your Asset Portfolio: Conduct a systematic review of stranded gas reserves and associated gas streams through the lens of modular LNG economics. The viability threshold has been significantly lowered.

- Integrate Modularity into Long-Term Strategy: Do not treat modular LNG as a one-off tactical solution. Embed its principles into your organization’s capital allocation and project development frameworks.

- Forge Strategic Partnerships: Success in this space is contingent on strong partnerships with EPC firms that have proven modular execution capabilities and technology providers with scalable, modular-ready processes.

- Prioritize FEED and Pre-FID Planning: Allocate sufficient capital and time for a comprehensive FEED study. The adage “front-loading saves back-ending” is profoundly true for modular projects.

-

We recommend stakeholders invest in digital twins for plant optimization and explore emerging markets like Southeast Asia, where modular scalability addresses infrastructure gaps. Risk mitigation through diversified portfolios and ESG-compliant designs will be crucial. The future of gas monetization is not only about scale but about intelligence, flexibility, and speed. The modular LNG plant is the physical manifestation of this new strategic reality.

Let’s co-develop the next generation of standardized, scalable modular trains to dominate the fast-growing distributed LNG market.