The compliance function has long been characterized by manual processes, sprawling spreadsheets, and a reactive posture. Teams are buried under an ever-growing mountain of regulatory changes, transaction alerts, and data requests. This traditional model is not only inefficient but increasingly dangerous in a world of sophisticated financial crime and rapid regulatory evolution.

The paradigm is shifting. Artificial Intelligence (AI) is moving compliance from a cost center focused on retrospective review to a strategic value-driver capable of predicting and preventing risk. This journey begins with automation but reaches its zenith with predictive forecasting, offering a glimpse into the future of risk.

The Evolutionary Leap: From Manual to Predictive

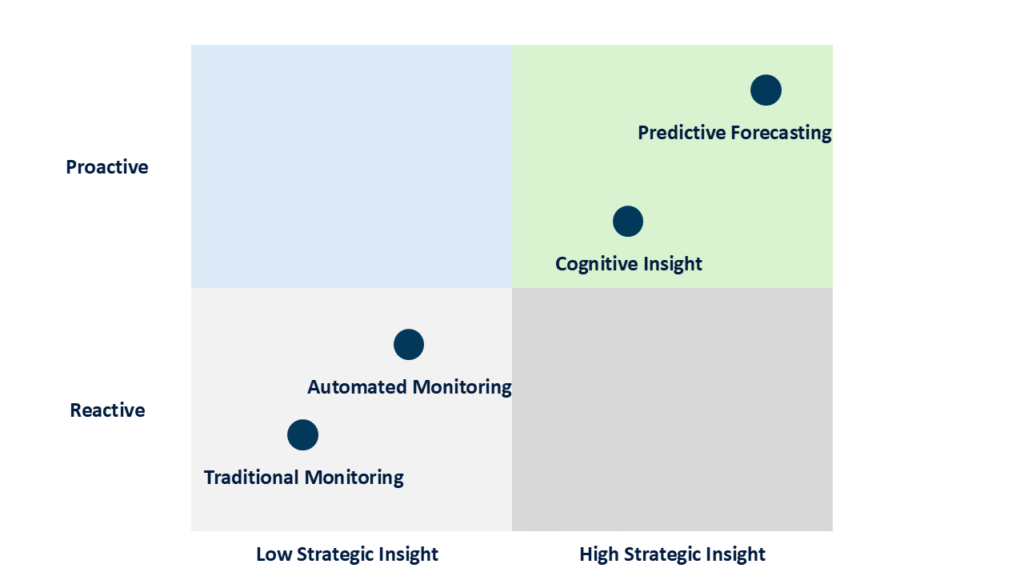

The adoption of AI in compliance isn’t a single step but an evolutionary journey up the value chain:

-

-

- Automated Monitoring: The foundation of AI implementation. This involves using rule-based systems and machine learning (ML) to automate repetitive tasks like transaction monitoring, communications surveillance, and know-your-customer (KYC) checks.

- Cognitive Insight: The intermediate stage. Here, AI moves beyond simple rules to understand context. Natural Language Processing (NLP) can scan thousands of legal documents to identify regulatory changes relevant to your business or analyze employee communications for nuanced signs of misconduct.

- Predictive Risk Forecasting: The ultimate destination. AI models analyze vast, interconnected datasets – internal transactions, external news, geopolitical events, market data – to identify subtle patterns and correlations. This allows them to predict potential compliance breaches before they occur.

-

The Tangible Benefits: Beyond Efficiency

The value proposition of AI extends far beyond simple cost reduction.

-

-

- Unmatched Efficiency & Cost Savings: Manual compliance is expensive. According to our analysis, banks spend nearly $200 billion annually on compliance costs. AI can automate up to 50% of core compliance operations, freeing skilled professionals to focus on high-value investigation and strategy.

- Dramatically Improved Accuracy: Traditional rule-based systems are notoriously noisy, generating false positive rates of 90-95% for financial transaction monitoring. This alert fatigue cripples effectiveness. ML models continuously learn and adapt, reducing false positives by over 50% and allowing investigators to focus on genuine threats.

- Proactive Risk Management: This is the game-changer. Predictive models can flag a potential sanctions breach based on a complex web of counterparty relationships or detect emerging fraud patterns in real-time, moving the function from reactive to proactive.

-

The Engine Room: Key AI Technologies in Action

-

-

- Machine Learning (ML): The core of predictive analytics. ML algorithms learn from historical data (e.g., past confirmed fraud cases) to identify similar patterns in new data, constantly improving their accuracy.

- Natural Language Processing (NLP): Essential for parsing unstructured data. NLP can scan emails, news articles, regulatory filings, and internal reports to identify risks, sentiments, and regulatory obligations.

- Network Analysis: Maps relationships between entities (people, companies, transactions) to uncover hidden complex fraud rings or money laundering schemes that would be invisible to manual review.

-

The following graph illustrates how the adoption of these technologies moves the compliance function up the value chain, from reactive efficiency to proactive strategic insight:

Implementing AI: A Strategic Framework for Success

Adopting AI is not merely a technology purchase; it’s a strategic transformation.

-

-

- Define the Problem, Not Just the Tool: Start with a specific use case with a clear ROI. Don’t seek “AI for compliance”; seek “to reduce false positives in our trade surveillance by 40%” or “to automate 80% of our initial KYC onboarding.”

- Audit Your Data Infrastructure: AI is powered by data. Ensure you have access to clean, structured, and integrated data from across the organization. Garbage in, garbage out is the cardinal rule.

- Choose a Phased Approach: Begin with a pilot program on a discrete process. A successful pilot builds organizational confidence and provides a blueprint for scaling to other areas.

- Foster Human-Machine Collaboration: AI will not replace compliance officers; it will augment them. Invest in training your team to work alongside AI – interpreting its findings, challenging its assumptions, and making final strategic judgments.

- Address Ethical Governance & Bias: AI models can inherit human biases present in historical data. Establish a robust governance framework to ensure your AI systems are transparent, ethical, and fair. Regularly audit algorithms for drift and bias.

-

The Future is Predictive

The integration of AI into compliance is no longer a futuristic concept; it is a present-day imperative for competitive and secure operations. The journey from labor-intensive monitoring to automated efficiency is the first step. The final frontier and the greatest source of strategic advantage lies in predictive risk forecasting.

Organizations that harness this power will not only be more secure but will also operate with greater agility, unencumbered by the inefficiencies of the past. They will transform their compliance function from a defensive shield into a strategic compass, guiding the business safely toward future growth.

Ready to explore how predictive compliance can transform your risk landscape? Contact our Risk Management & Consulting experts for a personalized assessment.