The ink is dry, the press release has been circulated, and the deal is officially closed. For many executives, this feels like the finish line. In reality, it is merely the starting block. The period immediately following the close, the first 100 days, is the most critical and volatile phase of any merger or acquisition. It is here, in this narrow window, that projected value is either captured at a premium or evaporates at an astonishing rate.

Companies with a best-in-class post-merger integration (PMI) process generate median annual Total Returns to Shareholders (TRS) that are 7 percentage points higher than their peers with poor PMI capabilities. Conversely, 70% to 90% of acquisitions fail to achieve their original strategic and financial objectives, often due to mismanagement in the initial integration period.

The first 100 days are not about gradual assimilation; they are a sprint to establish control, stabilize the environment, and secure the key assets that justified the deal’s price tag. Here is the strategic blueprint for ensuring your M&A value is made, not broken.

The Pre-Day One Imperative: Building the Launchpad

The most common and fatal mistake is waiting until close to begin planning for integration. The PMI workstream must run in parallel with the later stages of due diligence.

-

-

- Establish the Integration Management Office (IMO): This dedicated, cross-functional team of high-performers is the command center for the first 100 days. They must be empowered with a clear mandate, a detailed budget, and direct access to the steering committee.

- Develop the Day One Playbook: This is a minute-by-minute plan for the first 96 hours. It covers everything from system access and first-day communications to customer outreach and media responses. There is no room for ambiguity on Day One.

-

Phase 1: Days 1-30 – Stabilize and Secure (The “Hold Steady” Phase)

The primary goal of the first month is not transformation; it is to prevent value destruction. Uncertainty is your enemy, and communication is your weapon.

-

-

- Secure Key Talent: The value you acquired is intellectual capital. Acquired companies lose over 20% of their key employees post-merger. Within the first week, key personnel must have signed retention agreements, understood their new roles, and received clear, personal communication from leadership.

- Lock Down Customers: Your competitors are already whispering in your new customers’ ears. A coordinated, reassuring communication from the CEO and sales leadership must be launched on Day One, emphasizing commitment and enhanced service.

- Stabilize Operations: Avoid drastic changes. Focus on ensuring business continuity i.e. paychecks are processed, systems remain operational, and customers receive their orders. This builds confidence and allows you to gather intelligence.

-

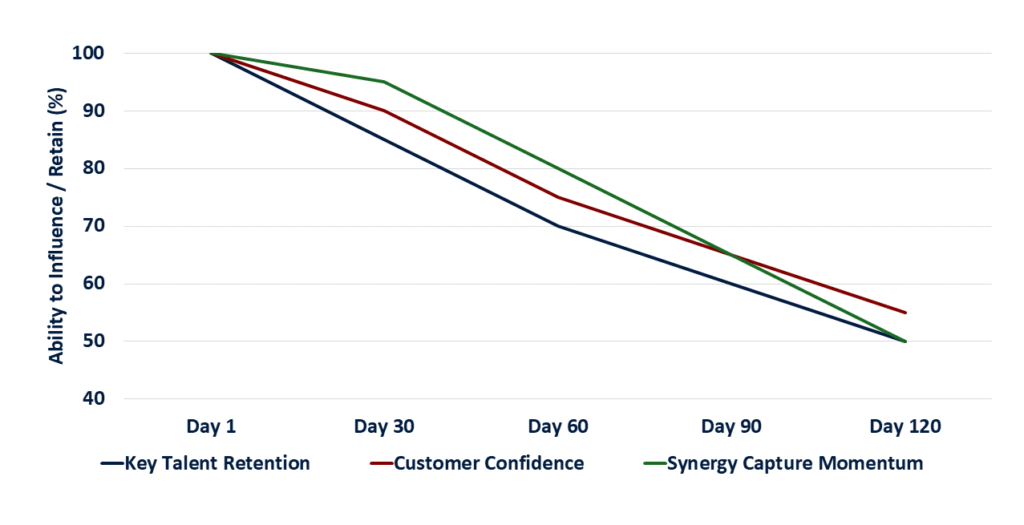

The following graph illustrates the rapid decline in the ability to retain critical assets and momentum after the deal closes, highlighting the narrow window for action.

The Race Against Time: The Rapid Erosion of Post-Merger Value Lever

Phase 2: Days 31-80 – Accelerate and Integrate (The “Value Capture” Phase)

With the environment stabilized, the focus shifts to executing the synergy plan and launching strategic integrations.

-

-

- Launch Quick Wins: Identify and execute on low-risk, high-visibility synergy projects. This could be consolidating two warehouses in the same region or leveraging the acquiring company’s purchasing power to secure better rates for the target. Quick wins build momentum and credibility for the larger integration effort.

- Begin Functional Integration: Functional teams (HR, Finance, IT, Supply Chain) formed during diligence now activate their plans. This is where the detailed technology and process integration begins. The goal is not full integration by Day 80, but to have clear plans, established governance, and pilot programs running smoothly.

- Communicate Relentlessly: Silence breeds rumor mills. Establish a regular rhythm of communication – weekly newsletters, monthly town halls, and an open Q&A portal. Be transparent about what is known, what is not yet known, and the timeline for decisions.

-

Phase 3: Days 81-100 – Align and Transform (The “Strategic Alignment” Phase)

As the initial sprint concludes, the focus must expand from tactical integration to strategic transformation.

-

-

- Align Culture and Ways of Working: By now, cultural friction points will be evident. Address them head-on with focused workshops, cross-company mentoring programs, and by celebrating joint successes. The goal is to forge a new, shared identity, not simply absorb one company into another.

- Refine the Long-Term Roadmap: The IMO’s work is not done. They must transition from a 100-day tactical plan to a 12-18 month strategic integration roadmap. This plan should be based on real-world learnings from the first 90 days, not just the pre-close theoretical model.

- Measure and Report: Define 3-5 Key Performance Indicators (KPIs) specifically for integration health e.g., retention rate of key talent, customer churn, synergy capture vs. plan. Report these metrics rigorously to the steering committee to ensure accountability.

-

Conclusion: From Integration to Transformation

The first 100 days are a finite period with infinite consequences. It is a disciplined race against the clock to mitigate risk, retain value, and build the foundation for long-term success.

A successful integration is more than a checklist of completed tasks; it is the process of uniting two entities into a single, more competitive, and more valuable organization. By treating the first 100 days not as an administrative aftermath but as a strategic imperative, you transform the acquired potential on a balance sheet into tangible, market-leading performance.

Stop planning for integration after the close – let’s build your 100-day value capture plan today.