For decades, the reigning doctrine of corporate supply chains was optimization above all else. The goal was singular: minimize cost by leveraging global economies of scale. This led to extended, hyper-efficient, and incredibly fragile networks. A series of seismic shock such as the US-China trade war, a global pandemic, and ongoing geopolitical conflicts have shattered this orthodoxy.

Finance leaders now face a critical question: are we heading toward an era of deglobalization (a retreat to regional blocs) or reglobalization (a reconfiguration of global networks)? The answer is both. The defining trend is fragmentation.

Companies are not abandoning globalization; they are building resilience into their strategic imperatives. This shift isn’t just a logistical challenge, it’s a fundamental recalibration of financial models, working capital, and risk management. The businesses that thrive will be those that finance this transition not as a cost, but as an investment in long-term stability.

The Data Behind the Shift: It’s Not a Blip, It’s a Trend

The numbers paint a clear picture of a structural change in global trade:

-

-

- Our analysis found that over 85% of Fortune 1000 companies have experienced supply chain disruptions in the past year, with many incurring significant financial losses.

- Over 70% of companies are now actively seeking to nearshore or friendshore their supply chains, a dramatic increase from pre-2020 levels.

- Geopolitical risk is now a top-three factor in corporate capex decisions, a metric that was negligible a decade ago.

-

This isn’t a temporary reaction; it’s a permanent rewiring of global commerce. The finance function is at the epicenter of this shift.

The Financial Trade-Off: Resilience vs. Efficiency

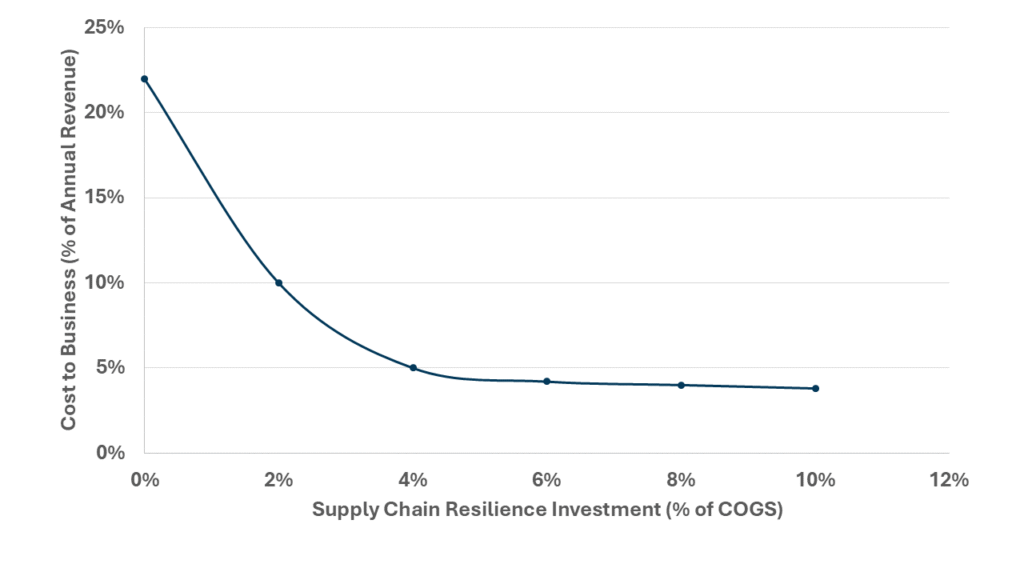

The old model prioritized low cost above all. The new model requires a nuanced balance, accepting a moderate increase in unit cost for a dramatic decrease in systemic risk and volatility.

The core financial challenge is managing this trade-off without eroding profitability. This requires moving from a single-threaded supply chain to a multi-dimensional ecosystem, each with distinct financial implications.

The Financial Trade-Off: Resilience Investment vs. Disruption Cost

Building the Resilient Supply Chain Finance Model: A 4-Pillar Framework

Transforming your supply chain requires a parallel transformation in your financial strategy. Here are the four pillars to build upon:

1. Finance Data-Driven Scenario Planning

Resilience starts with visibility. You cannot finance what you cannot see.

-

-

- Action: Develop a digital twin of your supply chain. Map every node, and logistics route. Layer in geopolitical risk data, climate data, and supplier financial health scores.

- Financial Link: Use this model to run stress-test scenarios. What is the financial impact (on COGS, EBITDA, cash flow) of a 25% tariff on Component X? What if a key port is shut down for 30 days? Quantifying these risks allows you to make informed investments in resilience, such as qualifying alternative suppliers before a crisis hits.

-

2. Optimize Working Capital for Agility, Not Just Efficiency

Traditional working capital management focused on stretching payables and reducing inventory. This now introduces vulnerability.

-

-

- Action: Re-evaluate your inventory strategy. Shift from Just-In-Time (JIT) to Just-In-Case (JIC) for critical components. For non-critical items, JIT remains valid.

- Financial Link: This will increase inventory carrying costs. Frame this not as a cost increase, but as an insurance premium against revenue disruption. The CFO’s role is to calculate the optimal level of this “premium” by weighing the carrying cost against the potential lost margin from a stock-out.

-

3. Diversify Financing for a Diversified Supply Base

Your supply chain financing tools must evolve with your network.

-

-

- Action: Implement supplier financing programs to help your critical (often smaller) regional suppliers access affordable capital. This strengthens their financial resilience, which in turn strengthens yours.

- Financial Link: Explore ESG-linked supply chain finance solutions. Banks offer preferential rates for programs that improve sustainability and social metrics within your value chain. This aligns financial incentives with operational resilience and regulatory trends (like CSRD).

-

4. Make Strategic Capex Decisions for the Long Term

The location of your future facilities is a primary finance decision.

-

-

- Action: Conduct a total landed cost analysis for nearshoring vs. offshoring, incorporating new variables: tariff risk, carbon cost (CBAM), logistics volatility, and intellectual property risk.

- Financial Link: The NPV (Net Present Value) calculation for a new factory must now include a “risk discount factor” for politically unstable regions and a “resilience premium” for stable, allied markets. The project with the slightly higher upfront cost but significantly lower risk profile may now be the superior financial choice.

-

The Bottom Line: Resilience as a Competitive Advantage

The great supply chain reconfiguration is the defining operational challenge of this decade. The question is not if you should invest in resilience, but how and how much.

The companies that will win are those whose finance leaders:

-

-

- Reframe resilience spending from a cost center to a strategic investment protecting revenue.

- Embrace data and analytics to quantify risk and make informed trade-offs.

- Develop flexible financing models that support a more complex, multi-layered supply ecosystem.

-

This is not a return to isolated national economies. It is the emergence of a more nuanced, regionalized, and resilient form of globalization – one where financial strategy is the key to unlocking stability and growth.

Is your supply chain finance model built for the age of fragmentation? Our Finance & Strategy consultants help leaders quantify risk, model scenarios, and build the agile financial operations needed to thrive.

Contact us to begin your resilience assessment.