For years, Environmental, Social, and Governance (ESG) reporting has often resided in the realm of marketing and corporate social responsibility, a voluntary exercise to showcase brand values and attract conscious investors. That era is over.

The European Union’s Corporate Sustainability Reporting Directive (CSRD) represents the most significant regulatory shift in corporate reporting in decades. It moves sustainability from the voluntary periphery to the mandatory core of financial and operational disclosure. For finance and strategy leaders, this is not a sidebar issue; it is a complex, data-intensive compliance obligation with profound cost implications and strategic opportunities.

Failing to prepare is preparing to fail. This article provides a strategic roadmap for navigating the CSRD, transforming a compliance mandate into a foundation for resilient, long-term value creation.

The CSRD: Understanding the Seismic Shift

The CSRD fundamentally expands the who, what, and how of sustainability reporting.

-

-

- Who? It casts a much wider net than its predecessor (the NFRD). It will apply to:

- All large companies (meeting 2 of 3: €40M+ turnover, >250 employees, €20M+ assets)

- All companies listed on EU regulated markets (excluding micro-enterprises)

- Non-EU companies with significant activity in the EU (€150M+ net turnover in the EU)

- Ultimately, over 50,000 companies will be affected, far more than the ~11,000 under the NFRD.

- What? Reporting must be based on the European Sustainability Reporting Standards (ESRS), a detailed set of standards covering everything from carbon emissions and biodiversity to worker treatment and supply chain due diligence.

- How? The reported information must be digital, audited (assured), and published within the company’s management report, granting it the same legal status as financial information.

- Who? It casts a much wider net than its predecessor (the NFRD). It will apply to:

-

The Direct and Hidden Cost Implications

The transition to CSRD compliance is not free. Understanding the cost drivers is the first step to managing them effectively. The initial investment is significant, but it should be viewed as building a new, critical capability.

- Data Acquisition & Management Costs: This is the largest cost component. Companies can no longer rely on estimates.

-

-

- Technology: Investment in ESG data management software is virtually mandatory.

- Internal Labor: Significant time from finance, operations, HR, and sustainability teams to gather and validate data.

- External Expertise: Hiring consultants for gap analysis, ESRS interpretation, and implementation support.

-

- Process Transformation Costs: Complying requires embedding new processes across the organization.

-

-

- Supply Chain Mapping: Collecting data from your value chain (Scope 3 emissions) is notoriously complex and expensive.

- Internal Controls: Developing controls for sustainability data akin to those for financial data.

-

- Audit & Assurance Costs: The requirement for limited assurance (moving to reasonable assurance) creates a new, annual cost line item for external audit services.

Our survey found that over 60% of companies anticipate a 10 to 30% increase in compliance costs in the first year of CSRD adoption. However, this investment is not a sunk cost.

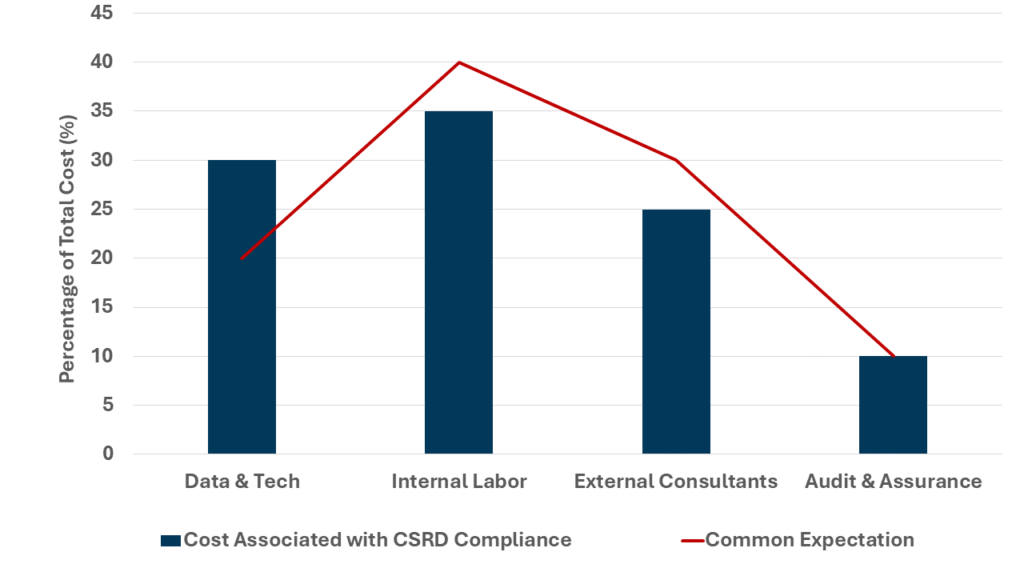

Projected first-year cost allocation for CSRD compliance

From Compliance Cost to Strategic Value: Reframing the Investment

While the costs are real, a forward-thinking finance strategy views the CSRD not as a burden, but as a catalyst. The data required for CSRD is the same data needed to future-proof your business.

- Unparalleled Operational Insight: The granular data you collect on energy use, waste, and water consumption across your value chain is a roadmap for operational efficiency and cost reduction. Identifying carbon hotspots directly correlates with identifying cost hotspots.

- De-risking the Business Model:

-

-

- Investor Confidence:90% of S&P 500 companies now publish ESG reports, and investors are demanding higher-quality, comparable data. CSRD-compliant reporting meets this demand decisively.

- Supply Chain Resilience: Deep mapping of your value chain reveals concentration risks, ethical vulnerabilities, and dependencies you may not have been aware of.

- Avoiding Future Liability: Robust due diligence processes, as required by the CSRD, are a primary defense against future litigation related to environmental or social impacts.

-

- Securing Strategic Advantage: The market is moving towards sustainability. The CSRD forces you to build the data infrastructure to lead in this new environment.

-

-

- Green Financing: Access to sustainability-linked loans and bonds, which often offer preferential rates, requires robust, auditable data.

- Talent Attraction & Retention: A genuine, data-backed commitment to sustainability is increasingly critical for attracting top talent.

- Futureproofing: Regulations will only get stricter. CSRD compliance positions you ahead of upcoming mandates in other regions (e.g., California’s Climate Disclosure laws, IFRS S1/S2).

-

A Strategic Roadmap for Finance Leaders

Phase 1: Assessment & Scoping

-

-

- Conduct a double materiality assessment: This is the cornerstone of the CSRD. Determine which sustainability topics have financial impact and which impact people and the environment.

- Form a cross-functional task force: Include Finance, Legal, Operations, Supply Chain, and HR. This is not a one-department project.

- Perform a gap analysis: Benchmark current disclosures against the full ESRS requirements.

-

Phase 2: Implementation & Data Building

-

-

- Select and deploy technology solutions for data collection and management.

- Engage your value chain: Start dialogues with suppliers now about data requirements. This will be the longest pole in the tent.

- Develop robust internal controls for sustainability information.

- Pilot your first full reporting cycle internally.

-

Phase 3: Embedding & Assurance

-

-

- Publish and assure your first CSRD report.

- Integrate insights into strategic planning and risk management.

- Continuously improve data quality and processes.

-

The Bottom Line: Compliance is the Floor, Not the Ceiling

The CSRD is a transformative force. The companies that will succeed are those that look beyond the initial compliance cost and see the strategic imperative. They will be the ones using this unprecedented view into their operations and value chain to drive efficiency, attract capital, foster innovation, and build undeniable resilience.

The question for leadership is not “How do we minimize the cost of compliance?” but rather “How do we maximize the strategic value of the data infrastructure we are now required to build?”

Ready to transform your CSRD compliance from a cost center into a strategic advantage? Our Finance & Strategy consultants specialize in building data-driven frameworks and business cases to navigate this new landscape effectively.

Contact us for a strategic assessment.