In the traditional playbook, cross-border M&A was driven by a relatively simple calculus: market access, revenue synergy, and talent acquisition. Today, that playbook is being rewritten. Boardrooms and corporate development teams are now prioritizing two powerful, interconnected forces: geopolitical strategy and supply chain resilience. These are no longer secondary considerations in the deal-making process; they have become primary drivers of value and necessity.

The era of hyper-globalization, optimized for cost-efficiency through intricate, far-flung supply chains, is giving way to an era of strategic fragmentation. Companies are no longer just asking, “Will this deal be profitable?” They are asking, “Will this deal make us more secure, agile, and independent in a volatile world?”

The Geopolitical Imperative: De-risking the Map

Geopolitical tensions from trade wars and sanctions to regional conflicts and great-power competition have injected unprecedented risk into global operations. Relying on a single country or region for manufacturing or critical materials is now seen as a significant strategic vulnerability.

-

-

- The China+1 Strategy: This is the most prominent example. Following pandemic disruptions and U.S.-China tensions, companies are actively diversifying their manufacturing bases away from a sole reliance on China. Our survey found that over 70% of supply chain leaders had moved sourcing and manufacturing activities out of China or plan to do so by 2025. This isn’t about a full exit from a massive market; it’s about de-risking. Cross-border M&A provides the fastest route to establish a immediate, scaled presence in alternative markets like Vietnam, India, Mexico, and Eastern Europe.

- Friend-shoring and Near-shoring: Governments are increasingly incentivizing companies to bring critical supply chains back to allied nations (“friend-shoring”) or closer to home (“near-shoring”). The U.S. CHIPS and Science Act and the Inflation Reduction Act are powerful examples, creating massive financial pull for investments in domestic semiconductor and green technology production. Acquiring a foreign firm with advanced capabilities and shifting its focus to a friendly jurisdiction is a powerful way to capitalize on these incentives and secure supply.

-

The Supply Chain Catalyst: Building Resilience through Acquisition

The quest for resilience is moving beyond simple diversification. It’s about gaining control, visibility, and redundancy. Organic growth is too slow to achieve this swiftly. M&A offers a shortcut.

-

-

- Vertical Integration for Control: Companies are using acquisitions to move upstream or downstream in their supply chains. An automaker might acquire a battery manufacturer to secure its core input. A pharmaceutical company might purchase a contract drug manufacturer to control its production destiny. This vertical integration insulates them from market shortages and pricing volatility.

- Acquiring Critical Technology and IP: Resilience isn’t just about physical components; it’s about knowledge. Acquiring a firm for its proprietary technology, software, or intellectual property can be the key to unlocking a more automated, predictable, and efficient supply chain. This includes everything from AI-driven logistics platforms to patented manufacturing processes.

- Data as an Asset: The acquisition targets now include firms with superior data analytics capabilities. The ability to predict disruptions, optimize routes, and manage inventory in real-time is a form of supply chain armor, making the entire operation more resilient to shocks.

-

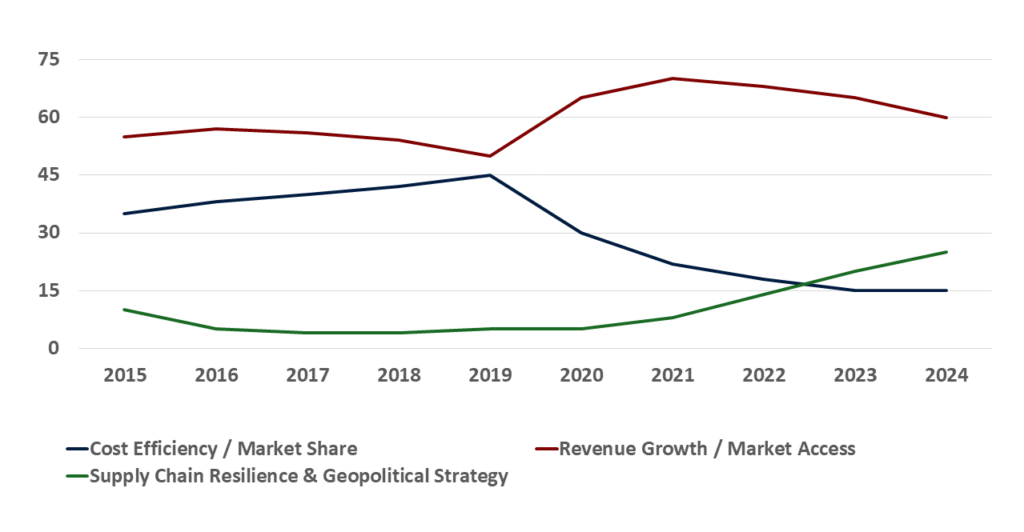

The following graph illustrates this dramatic strategic shift, showing how the motivation for cross-border deals has evolved from cost-cutting to risk mitigation and strategic security.

Evolution of Primary Drivers in Cross-Border M&A

Navigating the New Landscape: A Consulting Perspective

For executives considering this new breed of cross-border M&A, the due diligence process must be radically expanded.

-

-

- Geopolitical Due Diligence: This goes far beyond standard legal review. It requires deep analysis of:

- Trade Agreements: Tariff structures and rules of origin for the target’s location.

- Political Stability: The risk of regulatory change, nationalization, or civil unrest.

- Sanctions Exposure: The target’s indirect exposure to sanctioned entities or regions.

- Government Incentives: Navigating the complex web of available subsidies and tax breaks for strategic investments.

- Supply Chain Due Diligence: This must be operational and granular.

- Map the Target’s Supply Chain: Understand their second- and third-tier suppliers. Where are their vulnerabilities?

- Assess Flexibility: How easily can the target’s production be shifted or scaled? What are the contractual constraints?

- Evaluate Technology: Does the target possess the IoT, AI, and data analytics tools to provide true supply chain visibility?

- Integration Planning: The post-merger integration (PMI) phase is critical. The goal isn’t just to absorb the target but to leverage it immediately to de-risk the entire organization. This requires a dedicated team focused on swiftly rerouting supply chains, applying for new government incentives, and integrating technology platforms to create a single source of truth for the newly combined entity.

- Geopolitical Due Diligence: This goes far beyond standard legal review. It requires deep analysis of:

-

Conclusion: The New M&A Mandate

The convergence of geopolitics and supply chain strategy has fundamentally altered the M&A landscape. The most successful deals of this decade will not be those that simply create the most financial synergy, but those that create the most strategic resilience.

The question for leadership is no longer if they should use M&A to address these challenges, but how and where to do it most effectively. The winners will be those who treat geopolitics and supply chains not as external risks to be mitigated, but as core strategic pillars around which their entire M&A strategy is built. The race to secure control, capability, and capacity is on, and cross-border acquisition is its primary vehicle.