Executive Summary

In today’s hyper-competitive environment, pricing is no longer just about cost, margin, or competition – it is about perception. Behavioral economics reveals that customers rarely make purchasing decisions based purely on rational calculations. Instead, they rely on cognitive shortcuts, biases, and emotions. Forward-looking companies are harnessing these insights to redesign pricing strategies that not only protect margins but also drive conversions.

This article explores how businesses can apply behavioral economics to pricing, the psychological levers that truly influence customer behavior, and why perception-driven pricing is emerging as a growth lever across industries.

Why Traditional Pricing Models Fall Short

Conventional pricing approaches – cost-plus or competitor benchmarking – assume that customers behave rationally. They do not.

-

-

- Research shows that companies lose 2–4% of revenue annually due to ineffective pricing decisions, often because they ignore customer psychology.

- Our study highlights that firms applying behavioral pricing levers can increase margins by 8–12% without lowering base prices.

-

In other words, businesses that fail to account for perception risk leaving significant value on the table.

The Science of Perception in Pricing

Behavioral economics demonstrates that humans use mental shortcuts (heuristics) when making decisions. These shortcuts can be strategically influenced through pricing design. A few powerful principles include:

1. Anchoring Effect

Customers rely heavily on what they see first. For example, displaying a “was ₹5,000, now ₹3,500” price creates a mental anchor that makes the discounted price feel more attractive – even if ₹3,500 was the intended price all along.

2. Decoy Pricing

Less attractive option can divert customers toward a higher-margin product. The famous “popcorn pricing” at cinemas – small at $3, large at $7, and medium at $6.50 – drives most buyers to pick the large, which offers higher margins.

3. Loss Aversion

Fear of loss is more than the value equivalent gains. A statement like “Don’t miss out on savings of ₹1,000” often works better than “Save ₹1,000 today.”

4. Price Framing

Presenting the same price in different formats changes its appeal. For example, “$100/month” feels cheaper than “$1,200/year,” even though they’re identical.

5. Scarcity & Urgency

“Only 2 seats left at this price” taps into fear of missing out (FOMO), a proven trigger for conversion in e-commerce and travel.

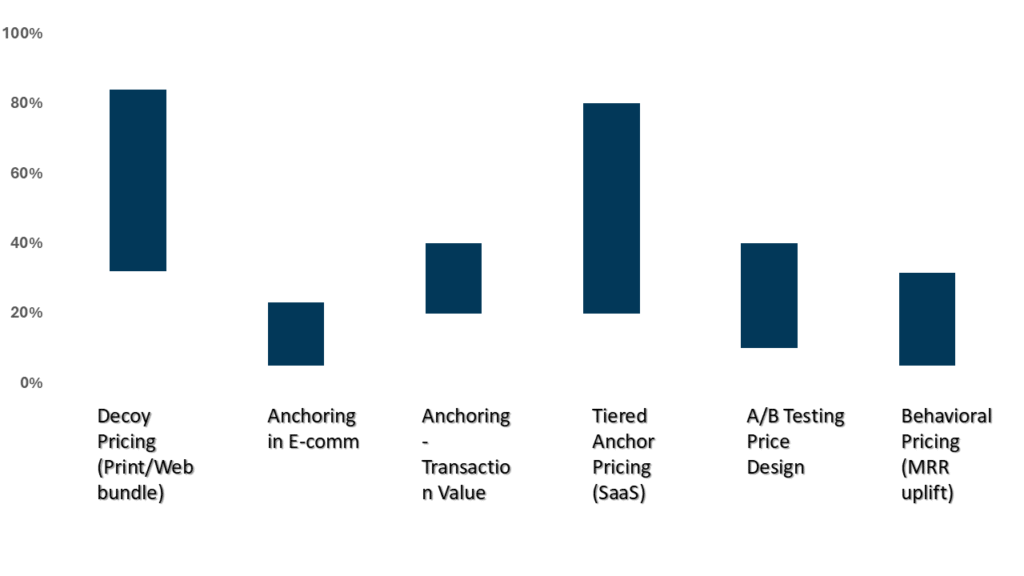

Behavioral Pricing Levers & Their Conversion / Revenue Impact

Real-World Applications Across Industries

1. Retail & E-Commerce

-

-

- Amazon famously uses anchored pricing by showing “list price vs. deal price.”

- A study revealed that strategic framing increased e-commerce conversions by 14% without lowering actual prices.

-

2. Hospitality & Airlines

-

-

- Hotels use tiered room pricing with decoys (basic vs. premium vs. deluxe) to push customers toward mid- or high-tier packages.

- Airlines leverage dynamic framing (“book now before fares rise”) to trigger urgency.

-

3. B2B Industries

-

-

- A SaaS provider reframed its enterprise subscription from $30,000/year to $2,500/month, increasing conversions by 19%.

- Industrial companies using value-based framing (“reduce downtime costs by $50,000 annually”) saw higher acceptance of premium pricing.

-

A Framework for Applying Behavioral Economics to Pricing

1. Diagnose Current Pricing Perceptions

-

-

-

- Conduct pricing perception surveys and analyze customer behavior data.

- Identify where customers see price-value mismatches.

-

-

2. Redesign Pricing Architecture

-

-

-

- Introduce anchors, decoys, and bundles.

- Apply framing strategies aligned with customer segments.

-

-

3. Run Controlled Experiments

-

-

-

- Use A/B testing to validate behavioral hypotheses.

- Example: Test “€999 vs. €1,000” or “€2,500/month vs. €30,000/year.”

-

-

4. Enable Sales & Marketing Alignment

-

-

-

- Train teams to communicate value framing effectively.

- Embed behavioral principles into campaigns, packaging, and proposals.

-

-

5. Institutionalize Behavioral Pricing

-

-

-

- Build pricing playbooks for ongoing deployment.

- Integrate behavioral insights into digital channels and CRM systems.

-

-

Looking Ahead: The Future of Pricing Psychology

The next frontier: AI and Behavioral Science

-

-

- AI can test thousands of pricing frames simultaneously, predicting which messaging works best for each micro-segment.

- Personalized pricing, based on behavioral profiles, will become mainstream – but companies must balance personalization with ethical considerations to avoid perceptions of unfairness.

-

As customer attention spans shrink and choice overload increases, perception-driven pricing will matter more than raw numbers. The companies that master this art will convert better, command stronger pricing power, and create sustainable competitive advantage.

Conclusion

Pricing strategy is less about calculating costs and more about shaping perceived value. By applying principles of behavioral economics, businesses can shift customer perceptions, protect margins, and accelerate conversions without entering a discount war.

The question for executives is no longer “What price should we set?” but “How do customers perceive the value behind the price?”

We help clients move from transactional pricing models to perception-driven strategies that unlock growth, margin resilience, and differentiation in crowded markets.

Unlock the power of behavioral pricing – speak with our experts to redesign your pricing strategy and drive higher conversions.