The Strategic Opportunity: Why D2D Demands Immediate Attention

The Direct to Device (D2D) market is not merely an emerging trend – it is a paradigm shift in global connectivity. The convergence of satellite and terrestrial networks is unlocking unprecedented opportunities for ubiquitous connectivity. D2D eliminates the need for specialized hardware, allowing standard smartphones to receive signals directly from satellites. This innovation is particularly transformative for:

-

-

- Emergency communications (SOS, disaster response)

- IoT and M2M applications (logistics, agriculture, asset tracking)

- Rural and remote connectivity (bridging the digital divide)

-

Key Strategic Insights:

-

-

- Market Acceleration: D2D will grow at over 35% CAGR (2025-2032), reaching USD 10 billion.

- First-Mover Advantage: Early adopters (e.g., SpaceX-T-Mobile, AST SpaceMobile-Vodafone) are already locking in key partnerships.

- Regulatory Tipping Point: 3GPP Release 18 and FCC rulings are removing technical and legal barriers.

-

Companies delaying D2D integration risk irrelevance in high-growth markets (emergency comms, IoT, rural broadband).

The Competitive Landscape: Who’s Winning and Why

1. Strategic Positioning of Key Players

|

Player |

Approach | Critical Advantage |

| SpaceX + T-Mobile | LEO-to-cellular blanket coverage |

Existing Starlink infrastructure |

|

AST SpaceMobile |

Space-based cellular (5G from orbit) | Vodafone/AT&T partnerships |

| Lynk Global | First-to-market with satellite SMS |

Commercial deployments live (Caribbean, Africa) |

| Iridium | IoT/emergency focus (SOS, asset tracking) |

Government/military contracts |

AST SpaceMobile and Lynk are outpacing legacy players due to agile partnerships. Traditional satellite operators must pivot now or cede ground.

Critical Challenges: What Keeps CEOs Awake at Night

- Spectrum Fragmentation: A Looming Bottleneck

-

-

- Without coordinated policy, interference and service degradation are inevitable.

-

- The ROI Conundrum

-

-

- Most D2D business models won’t break even before 2028.

-

- Device Limitations: The Hidden Barrier

-

-

- Limited smartphones today support D2D.

- Consumers won’t tolerate battery drain for “nice-to-have” coverage.

-

Recommendation:

Lobby for priority access licenses and invest in dynamic spectrum-sharing tech.

-

-

- The fragmented global spectrum landscape demands proactive regulatory engagement. Operators must push for priority access licenses in key bands (e.g., L-band, S-band) to avoid congestion, particularly in high-traffic regions. Concurrently, investing in AI-driven dynamic spectrum-sharing (DSS) solutions – like Federated Wireless’s CBRS model – can optimize limited bandwidth. For example, real-time spectrum arbitrage between maritime and emergency services could unlock 20–30% efficiency gains, ensuring QoS while awaiting broader allocations.

-

Focus on high-ARPU use cases first (e.g., maritime, aviation, government).

-

-

- D2D’s capital intensity necessitates focusing on high-ARPU verticals first. Maritime operators pay much higher amount for basic VSAT. D2D can undercut this cost significantly. Similarly, aviation and government contracts offer 5 – 7x higher margins than consumer markets.

-

Co-develop low-power chipsets with MediaTek/Qualcomm and subsidize D2D-enabled devices.

-

-

- MediaTek’s T300reduces D2D power draw by 60% for IoT, while Qualcomm’s X75 adds NTN to mid-tier phones.

- Subsidies (e.g., $30/device rebates) can bridge the cost gap – Globalstar’s iPhone 14 deal proved this cuts adoption timelines by 18–24 months.

Strategic take: Treat chipsets as Trojan horses – embed D2D in 5G modems now to lock in ecosystem control.

-

Strategic Playbook for Leadership Teams

For Satellite Operators: Three Non-Negotiables

-

-

- Formulate JVs with MNOs (e.g., SES + MTN in Africa).

- Diversify beyond SOS – monetize IoT (e.g., agricultural sensors, logistics).

- Preempt regulators by submitting joint spectrum proposals with telcos.

-

For Telecom CEOs: The Hybrid Network Imperative

-

-

- Winning Move: Treat D2D as 5G/6G backhaul, not just gap filler.

- Warning: Operators relying solely on terrestrial networks will lose rural/suburban subscribers by 2028.

-

For Governments: Policy as a Growth Lever

-

-

- Best Practice: Follow the UK’s Shared Access Framework (2023) to accelerate deployment.

- Mistake to Avoid: Delaying spectrum auctions.

-

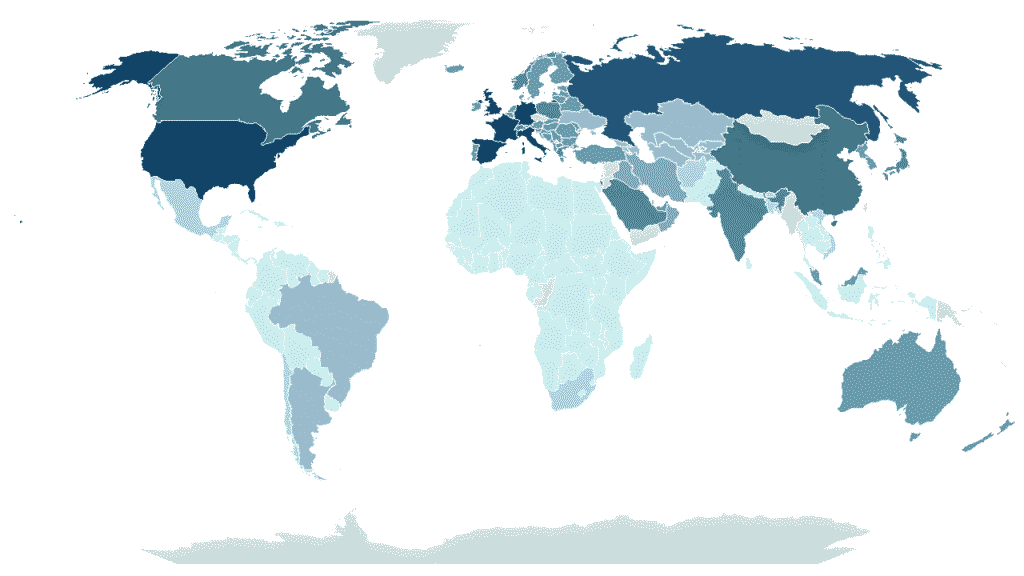

The 40 MHz Bottleneck: Global D2D Spectrum Fragmentation

The Bottom Line: Act Now or Cede the Market

The D2D revolution is accelerating faster than most anticipate. Our engagements with industry leaders confirm three critical realities:

-

-

- Late entrants face 3x cost penalties – spectrum scarcity and early-mover partnerships (e.g., SpaceX-T-Mobile, AST-Vodafone) are already locking out competitors.

- By 2027, D2D will be mandatory for major telecom tenders, as per the World Bank’s digital inclusion benchmarks and EU Digital Compass targets.

- First-mover advantages compound: Early deployments (like Lynk’s commercial SMS) are setting de facto standards for pricing and QoS.

-

Immediate Actions to Secure Market Position

To avoid disruption, leadership teams must:

-

-

- Execute a 90-day D2D audit assessing:

- Spectrum holdings (L-band/S-band gaps)

- Partnership pipeline (MNOs, chipset vendors)

- Tech stack readiness (NTN-compatible core networks)

- Reallocate 15% of R&D spend to:

- Dynamic spectrum-sharing prototypes

- Low-power modem collaborations

- Regulatory lobbying teams

- Execute a 90-day D2D audit assessing:

-

The difference between market leadership and obsolescence will come down to execution speed and organizational commitment. Companies must appoint a C-suite D2D Champion with direct CEO/CTO reporting authority to break down internal silos, accelerate vendor agreements for LEO capacity, and align leadership incentives to D2D milestones.

With the competitive window rapidly closing, organizations that delay action beyond 2025 risk being sidelined in a market where early movers are already consolidating their advantages.

Request Direct to Device Market sample to fast-track your strategy – contact us today.