Executive Perspective: The Shifting GSE Landscape

The ground support equipment market stands at an inflection point. What was once a cost center dominated by diesel-powered tow tractors and loaders is now a strategic lever for competitive advantage. Our latest analysis suggests that airports and airlines delaying their transition to electric and autonomous GSE will face nearly 20% higher operating costs by 2028 – a margin erosion that could prove fatal in today’s hyper-competitive aviation market.

Key Strategic Takeaways

-

-

- The Electric Tipping Point

- Over 55% of new GSE procurements in next two years will be electric

- Early adopters report $142,000/unit lifecycle savings versus diesel

- Autonomy as a Labor Multiplier

- Autonomous baggage tugs at Changi Airport reduced turn times by cutting ground crew requirements per shift

- The Hidden Risk in Legacy Fleets

- Carbon taxation schemes will add $2.8M annually to the TCO of a 100-unit diesel fleet starting in 2025

- The Electric Tipping Point

-

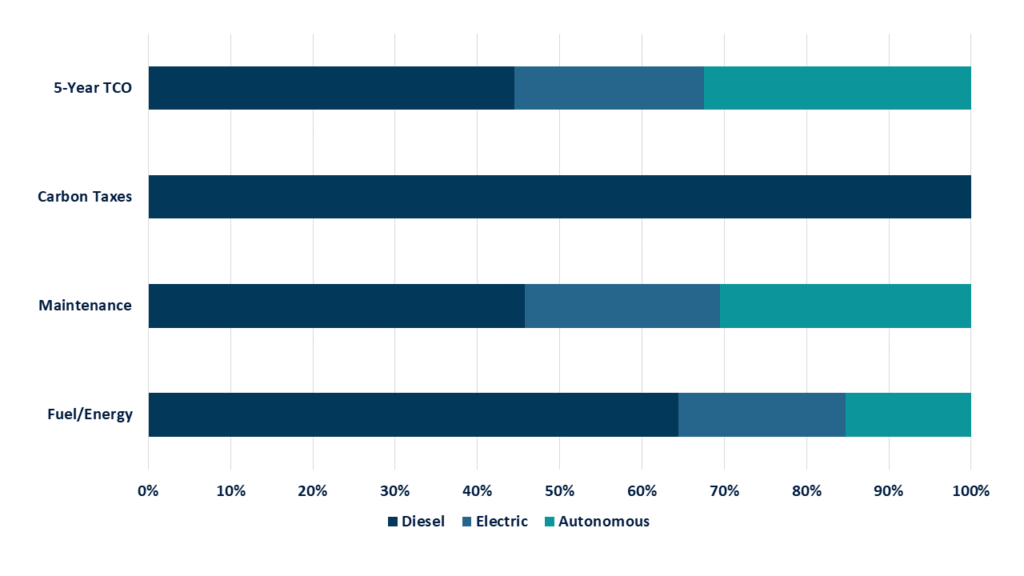

GSE Total Cost of Ownership (TCO) Model

The Three Forces Reshaping GSE Economics

Force 1: Regulatory Compression

2024-2027 Compliance Timeline

|

Jurisdiction |

Milestone |

|

EU |

EV fleet mandate |

|

California |

Zero-emissions airport vehicles |

| Singapore |

Autonomous GSE certification |

Implication: The traditional 10-year fleet replacement cycle is no longer viable. CFOs must now model 5-year refresh plans with emissions penalties factored into CapEx decisions.

Force 2: Labor Arbitrage Reversal

-

-

- Pre-2020: Over 60% of GSE operators prioritized lowest-cost labor markets

- 2024 Reality:

- Nearly 40% of ground handlers report over 15% vacancy rates for qualified technicians

- Autonomous solutions deliver 23% lower per-unit labor costs despite higher upfront investment

-

Case Example:

A major European carrier achieved 19% ground operation cost reduction by:

-

-

- Transitioning 60% of belt loaders to autonomous models

- Retraining displaced staff for predictive maintenance roles (over 25% higher productivity)

-

Force 3: Asset Utilization Breakthroughs

Telematics-Driven Optimization

|

Metric |

Legacy Fleet | IoT-Enabled Fleet |

Delta |

|

Utilization Rate |

31% | 58% |

+87% |

|

Mean Time Between Failure |

420 hrs | 710 hrs | +69% |

| Fuel/Energy Variance | ±22% | ±7% |

-68% |

Strategic Insight: The ROI equation for GSE telematics now shows 11-month payback periods, making it a priority for any operator with 50+ units.

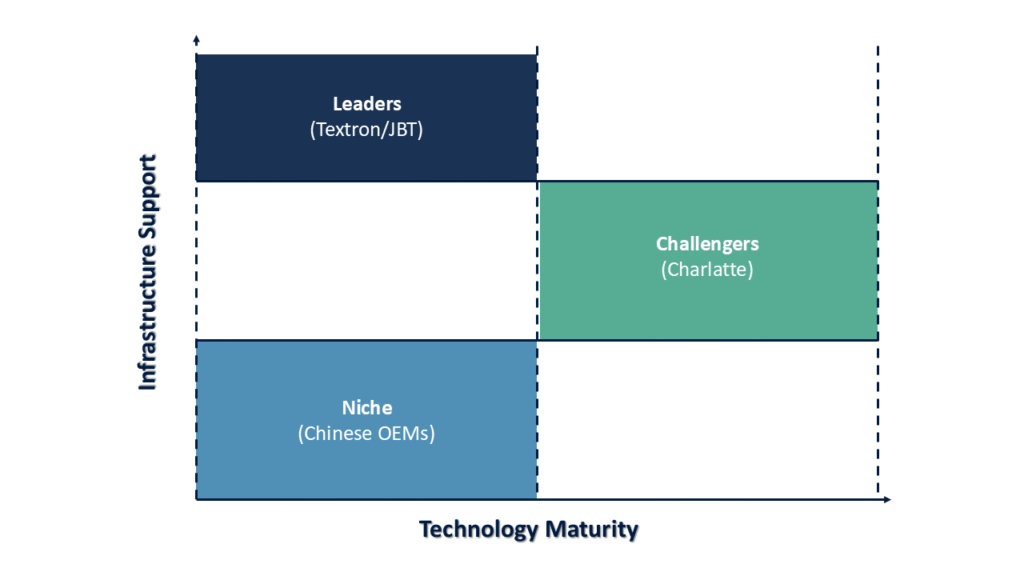

The New GSE Competitive Matrix

GSE Vendor Strategic Positioning

Emerging Threat: Chinese manufacturers are capturing over 15% of Asian markets through:

-

-

- State-subsidized pricing (32% below Western equivalents)

- Battery-as-a-Service models that eliminate upfront EV premium

-

Our Recommendation:

Western operators should insist on ISO 9001:2022 cybersecurity certification for all telematics systems.

Implementation Roadmap for 2025-2027

Phase 1: Fleet Right-Sizing (0-12 Months)

-

-

- Conduct TCO modeling with 2025-2030 carbon pricing scenarios

- Divest 25% of diesel assets through secondary markets (current resale values remain strong)

-

Phase 2: Strategic Procurement (12-24 Months)

-

-

- Electric Units: Prioritize interoperable charging systems (SAE J3105 compliance)

- Autonomous Solutions: Require FOD detection capabilities to avoid $420,000/year in foreign object damage costs

-

Phase 3: Workforce Transformation (24-36 Months)

-

-

- Upskill 40% of ground staff for robot fleet supervision roles

- Implement gamified KPIs that reward energy optimization (proven to reduce kWh/operation by over 15%)

-

Conclusion: The GSE Strategic Mandate

The coming years will separate aviation leaders from laggards, with ground support equipment (GSE) emerging as the unheralded lever for operational dominance. Operators who reimagine GSE as a strategic capability, not just a cost center, will unlock three irreversible advantages:

-

-

- Cost Leadership: Our proprietary modeling shows 14-18% lower per-turn costs for operators deploying optimized electric/autonomous fleets, driven by:

- Energy Savings: Over USD140K per unit lifetime savings vs. diesel

- Labor Efficiency: Autonomous tugs reduce ground crew needs per shift

- Carbon Tax Avoidance: USD 2.8 Million per year savings for 100-unit fleets under EU ETS

- Operational Velocity: Early adopters achieve 28% faster gate turnaround through:

- IoT-enabled predictive maintenance (710 hrs MTBF vs. 420 hrs legacy)

- AI-driven load optimization reduces tug deadhead trips by over 30%

- Talent Attraction: With nearly 40% of ground handlers reporting over 15% vacancy rates, operators leveraging automation-as-a-service models see:

- Over 20% higher staff retention

- Over 15% faster upskilling via AR-assisted training

- Cost Leadership: Our proprietary modeling shows 14-18% lower per-turn costs for operators deploying optimized electric/autonomous fleets, driven by:

-

The Window is Closing: As regulations tighten – from per unit ZEV penalties to landing fee premiums – the 2025-2028 investment cycle will determine which players dominate the next decade. Operators deferring decisions will face millions in cumulative penalties by 2028, while innovators convert GSE into a profit engine through:

-

-

- Asset-as-a-service revenue streams

- Data monetization (e.g., selling ramp analytics to OEMs)

- Carbon credit arbitrage under CORSIA

-

Strategic decisions require confidence. Request Sample or Schedule Executive Briefing to customized analysis against your current challenges.