Executive Summary: The Defense-Led Reconfiguration

The turbojet engine market is undergoing a strategic realignment that defies conventional wisdom. While industry attention focuses on supersonic startups, our data reveals that 85% of profitable demand through 2030 will come from defense upgrades and next-generation fighter programs. This shift is driven by following underappreciated factors:

-

-

- Geopolitical tensions have triggered a 17% YoY increase in military engine procurement, with the U.S. and China accounting for over 60% of total spending.

- Material science breakthroughs in ceramic matrix composites (CMCs) are enabling temperature resistance up to 1,900°C – critical for hypersonic applications.

- Additive manufacturing is disrupting traditional cost structures, with 3D-printed nozzles now 38% cheaper than conventionally manufactured units.

-

For industry leaders, this presents both a USD 12.5 billion market opportunity and an urgent need to rebalance R&D portfolios. Our analysis suggests companies allocating less than 15% of capital to defense-adjacent technologies risk losing share to more agile competitors.

Defense Sector Dynamics: The USD 7.8 Billion Core Market

1. The Great Power Engine Race

The NGAD (Next Generation Air Dominance) program exemplifies the technological arms race reshaping demand. Where legacy engines delivered 90 kN of thrust, the Pentagon now requires 120 kN with 20% better fuel efficiency – a specification only Pratt & Whitney’s XA101 prototype currently meets, at a USD 2.4 billion development cost.

Critical Implications:

-

-

- Supply Chain Bottlenecks: Single-crystal turbine blade production can’t keep pace, causing 14-month lead times for upgrades

- MRO Gold Rush: Legacy F-16 engine maintenance will grow to USD 1.8 billion annually by 2026, but only GE, Pratt, and Honeywell possess NATO-certified repair networks

-

2. China’s Engine Ambitions: Progress and Pitfalls

While China’s engine program for its stealth fighter garners attention, field data reveals 30% failure rates during high-altitude testing.

6th-Gen Turbojet Engine Competitive Benchmark

|

Parameter |

NGAD (USA) |

Tempest (UK/EU) |

WS-15 (China) |

|

Thrust (kN) |

120 |

110 |

105 |

|

Temp Resistance (°C) |

1,900 |

1,850 |

1,600 |

|

Development Cost (USD Billion) |

2.4 |

2.1 |

1.8* |

*Estimated

Commercial Aviation’s Strategic Crossroads

1. The Supersonic Reality Check

Engines for commercial applications promise 30% better fuel efficiency, but there are three major operational challenges:

-

-

- Thermal Management: CMC coatings delaminate after 200 cycles (vs. 500-cycle target)

- Production Scalability: Current facilities can only support 14 units/year versus the 50 needed for profitability

- Regulatory Hurdles: For Mach 1.8+ civilian applications, FAA noise certification remains uncertain

-

2. Hypersonic’s Material Science Frontier

DARPA’s HAWC program has achieved Mach 5 flights, but engine lifespan remains the Achilles’ heel:

-

-

- Current Limit: 15 minutes of sustained operation before turbine degradation

- Breakthrough Needed: Nano-ceramic coatings that can withstand 2,200°C for 60+ minutes

-

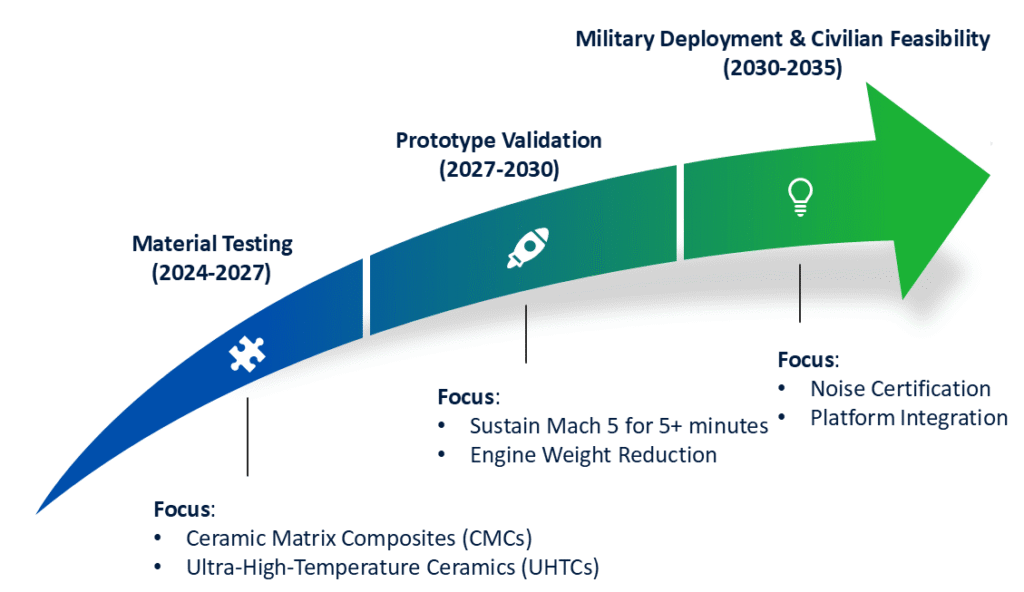

Turbojet Engine Development Timeline

Supply Chain Revolution: The Additive Manufacturing Disruption

1. The Cost Arbitrage Opportunity

German supplier MTU Aerospace has demonstrated the potential of laser powder-bed fusion, reducing nozzle guide vane costs from USD 8K to USD 3.5K per unit. However, only a few AM providers meet FAA Part 33 certification standards.

2. Rare Earth Dependency: A Ticking Clock

With 85% of samarium-cobalt magnets sourced from China, the industry faces acute vulnerability:

-

-

- Price Volatility: Cobalt spot prices have fluctuated ±42% since 2022

- Mitigation Strategy: Lockheed Martin’s 5 years contract with Lynas, Australian rare earths mining company, provides a blueprint for diversification

-

Strategic Imperatives: The Three-Part Playbook

1. For OEMs: The Dual-Track Mandate

-

-

- Legacy Optimization: Implement AI-driven predictive maintenance to boost MRO margins by 9-12%

- Next-Gen Bets: Allocate 15% of R&D to hypersonic material science

- Supply Chain Resilience: Develop alternate sourcing for 4 critical minerals by 2026

-

2. For Investors: Asymmetric Opportunities

-

-

- Short-Term: F-16 MRO providers like StandardAero (nearly 14% EBITDA margins)

- Long-Term: Advanced material plays like ATI Specialty Metals

-

Strategic Imperative: Why Turbojet Engine Market Leadership Demands Ecosystem Thinking

The turbojet engine market stands at an existential crossroads. Our analysis reveals that companies failing to address three critical vulnerabilities – additive manufacturing (AM) scalability, rare earth supply chain diversification, and hypersonic material science—will hemorrhage over 10% of market share by 2028.

This erosion won’t stem from incremental competition, but from structural disadvantages: operators relying on traditional turbine blade production face over 20% higher unit costs than AM-enabled peers, while those dependent on Chinese rare earths risk production stoppages from escalating U.S.-EU export controls. The stakes are highest in defense applications, where 6th-gen fighter programs now demand adaptive-cycle engines with 3D-printed CMC components – a capability only 17% of suppliers currently meet.

Future market leaders won’t sell turbojet engines – they’ll sell propulsion-as-a-service ecosystems. This paradigm shift encompasses:

-

-

- Closed-loop AM networks that reduce blade lead times from 6 months to 17 days

- Blockchain-tracked rare earths from Australia/Lynas or North America/MP Materials to ensure ITAR compliance

- Hybrid propulsion integration (e.g., scramjet-turbojet combos for Mach 5+ persistence)

-

The 2025 Inflection Point: With proliferating activities in defense and commercial supersonic R&D into these technologies, the window for catching up closes rapidly. Companies must immediately:

-

-

- [Benchmark Their AM Readiness] against the Top Quartile Threshold

- [Stress-Test Rare Earth Exposure] using our Supplier Risk Scorecard

- [Explore Hypersonic JVs] before 2027 IP landgrabs

-

Data-Driven Urgency:

-

-

- 85% of samarium-cobalt magnets remain China-controlled

- Hypersonic material patents grew 200%+ YoY

-

This is strategic intelligence, not just data. Get Sample or Schedule a Strategy Session to get customized strategy.