Battery recycling has moved decisively beyond its historical role as an end-of-life compliance activity. For stakeholders across the ecosystem i.e. cell makers, cathode/anode suppliers, OEMs, refiners, recyclers, logistics firms, and regulators it is now a strategic supply chain capability that will shape cost position, access to critical minerals, and the ability to sell into increasingly regulated markets.

Two forces are converging:

-

-

- Scale is arriving. Global electric car sales exceeded 17 million in 2024 and expects sales to top 20 million in 2025 with “more than one in four cars sold” expected to be electric.

- Rules are tightening. The EU’s Battery Regulation is converting circularity into a product-market access requirement covering collection, recovery, recycled content, and battery passports.

-

As a result, battery recycling is becoming a competitive differentiator, not just a sustainability claim.

The Strategic Imperative of Battery Recycling

Battery recycling involves systematic collection, disassembly, and reprocessing of end-of-life batteries to recover valuable metals such as lithium, cobalt, nickel, and graphite. This process is essential for reducing reliance on virgin mining, which often entails high environmental costs and geopolitical vulnerabilities. In the year 2025, the global push for circular economies has elevated recycling from a niche activity to a strategic priority, particularly for lithium-ion batteries powering EVs and renewables.

Beyond compliance with tightening regulations, effective recycling can lower production costs by up to 20-30% through material reuse, while addressing supply shortages projected for critical minerals. For instance, EV battery demand could reach over 3 TWh by 2030, underscoring the need for robust recycling to sustain this growth without exacerbating resource depletion.

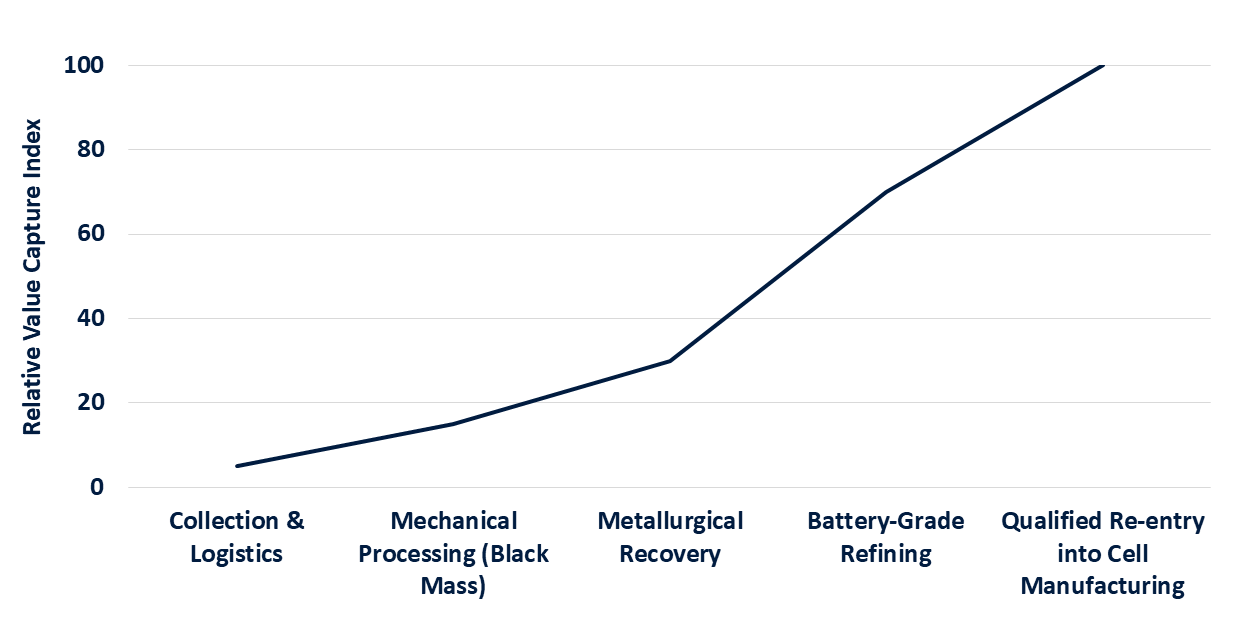

Battery Recycling Value Chain Stages

Evolving Methods and Technological Advancements in Battery Recycling

Recycling technologies have matured significantly, with three primary approaches dominating the landscape: pyrometallurgy (high-heat smelting), hydrometallurgy (chemical leaching), and emerging direct recycling methods. The latter, which regenerates cathode materials with minimal breakdown, is gaining traction for its energy efficiency as it reduces consumption by up to 88% compared to traditional processes. Also, hydrometallurgy has become central to “battery-to-battery” narratives because it can be engineered for battery-grade outputs, but it demands tight process discipline.

In 2025, innovations like AI-optimized sorting and bio-leaching are enhancing recovery rates, with some facilities achieving 99% efficiency for key metals. For example, researchers at Germany’s Fraunhofer Institute developed an AI-integrated sorting system using X-ray technology to detect and remove hazardous lithium-ion batteries from waste streams. This innovation has significantly reduced battery-related fires in recycling plants by enabling precise, automated separation. Early trials showed improved recovery rates for metals, contributing to overall efficiencies nearing 99% in controlled settings.

These advancements are not just technical; they represent investment opportunities for stakeholders seeking to integrate sustainable practices into their operations.

Leading Nations and Their Strategic Initiatives

Geographic leadership in battery recycling is concentrated in regions with strong manufacturing bases and policy frameworks. Here’s a breakdown of their initiatives:

1. China

As the undisputed leader, China commands over 80% of global recycling capacity, with a 66% average recovery rate for lithium-ion batteries. In 2025, the country is advancing its “white list” system for certified recyclers, aiming to process 3.5 million tonnes of retired batteries by 2030.

Initiatives include export controls on critical technologies to bolster domestic supply chains, alongside claims of 99.6% material recovery efficiency by leading firms. For stakeholders, this presents collaboration potential in joint ventures to access advanced hydrometallurgical expertise.

2. United States

U.S. is ramping up domestic capabilities through the Bipartisan Infrastructure Law and Inflation Reduction Act, funding facilities like those by Redwood Materials and Li-Cycle. Tariffs on Chinese lithium-iron-phosphate (LFP) cells are increasing to make U.S.-produced alternatives more competitive.

The EPA’s classification of lithium-ion batteries as universal waste streamlines handling, with projections for the EV recycled battery market hitting $300 million this year. This policy environment offers incentives for investments in North American hubs.

3. Europe

The European Union is pioneering regulatory innovation with its battery regulation, mandating 95% recycling efficiency by 2030 and curbing exports of recyclable waste from early 2026. In year 2025, countries like Germany and Sweden are expanding facilities through partnerships, such as BASF’s black mass plant processing 15,000 tonnes annually. The focus on traceability and low-carbon processes aligns with EU Green Deal goals, creating avenues for stakeholders to engage in cross-border supply chains.

Other notable countries such as Japan, South Korea, and India have also proliferated the battery recycling initiatives through incentives and subsidies driven by mineral security and job creation narratives.

The Emerging Global Trade in Black Mass and Recycled Battery Materials

Battery recycling is rapidly evolving from a local waste-management activity into a cross-border commodity trade, with black mass emerging as a globally traded intermediate. As recycling capacity expands faster than local refining capability in many regions, black mass is increasingly shipped to jurisdictions with established hydrometallurgical infrastructure and downstream battery-materials integration. This trade is driven by three structural realities:

1. Asymmetric capabilities across regions

Many countries can collect and mechanically process batteries, but only a limited number possess the chemical refining depth needed to convert black mass into battery-grade salts or precursors. This creates a global arbitrage between collection geographies and refining hubs.

2. Regulatory fragmentation

While Europe is tightening rules around waste shipment and recycled-content traceability, other regions remain more permissive. This has created a transitional window where black mass flows across borders faster than regulatory harmonization.

Battery passports represent a structural shift in how value chains are governed. They transform recycling from a physical process into a data-intensive compliance function. Recyclers must prove where material comes from, how it is processed, and where it goes next. This elevates data infrastructure from a back-office function to a license to operate in regulated markets.

3. Price discovery is still immature

Unlike refined metals, black mass pricing is opaque, chemistry-dependent, and highly sensitive to recovery assumptions. Contracts often embed metal-price indexation, recovery benchmarks, and quality penalties, making trading expertise as important as processing scale.

Strategic Partnerships in Battery Recycling: OEM–Recycler–Material Supplier Models That Work

As battery recycling becomes a strategic pillar of the energy transition, partnership-driven models are replacing standalone or transactional approaches. The battery value chain is inherently interdependent where OEMs require compliance certainty and secure recycled inputs, recyclers need predictable feedstock and plant utilization, and material suppliers must integrate recycled materials without compromising performance or quality. No single player can optimize across these dimensions alone, making structured collaboration essential for scale and bankability.

The most effective OEM–Recycler–Material Supplier partnerships are built around a small set of non-negotiable design principles:

-

-

- Long-term feedstock and offtake commitments that reduce volume risk and enable capital investment

- Joint qualification roadmaps to ensure recycled materials meet battery-grade performance standards, not just chemical purity

- Aligned incentives across the loop, linking cost, sustainability targets, and regulatory compliance outcomes

- Clear governance and data-sharing frameworks to support traceability, audits, and battery passport requirements

-

Increasingly, these partnerships take the form of tri-partite alliances, joint ventures, or equity-linked arrangements and are established alongside gigafactory and vehicle platform planning. The strategic advantage will accrue not to the largest recycler or the lowest-cost operator, but to those who can orchestrate durable, chemistry-resilient partnerships that integrate recycling into the core battery supply chain rather than treating it as an end-of-life afterthought.

Conclusion: From Recycling Capacity to Strategic Advantage

Battery recycling is no longer a downstream sustainability exercise; it is becoming a core determinant of competitiveness, compliance, and supply-chain resilience in the battery ecosystem. The industry is shifting from fragmented pilots to structured, partnership-led ecosystems where execution discipline matters as much as technology.

For OEMs, recyclers, material suppliers, and investors, the immediate challenge is not whether recycling will scale but how to position within the emerging circular battery economy in a way that is economically viable and regulation-ready.