Key Takeaways for Senior Executives

-

-

- The smart grid is no longer optional – regulatory pressures, aging infrastructure, and renewable integration mandates demand immediate action.

- Investments are shifting from pilots to full-scale deployments, with North America and Asia-Pacific leading in capital commitments.

- Cybersecurity and interoperability remain critical roadblocks – firms that solve these challenges will dominate the next decade.

- The winners in this space will not just adopt technology but reshape their business models around distributed energy and AI-driven grid optimization.

-

Why This Matters Now

The energy sector faces its most consequential realignment since electrification. Traditional grid systems – designed for one-way power flow and predictable demand – are collapsing under the weight of electrification, renewables, and decentralized generation.

The Hard Numbers Driving Urgency

-

-

- USD 1.8 Trillion in global grid investments needed by 2030 to meet net-zero targets.

- Over 40% of transmission assets across major markets are beyond their 50-year lifespan.

- Smart grid technologies can reduce outage durations nearly by 30%, saving utilities up to USD 5 to 7 billion annually.

-

This isn’t about incremental upgrades. It’s about fundamentally rethinking grid architecture or risking obsolescence.

The coming 18 months will determine:

-

-

- Which utilities capture $420 billion in climate-aligned grid financing

- Whether emerging markets replicate India’s success (18% renewable integration via smart meters) or repeat billion dollars cyberattack losses

-

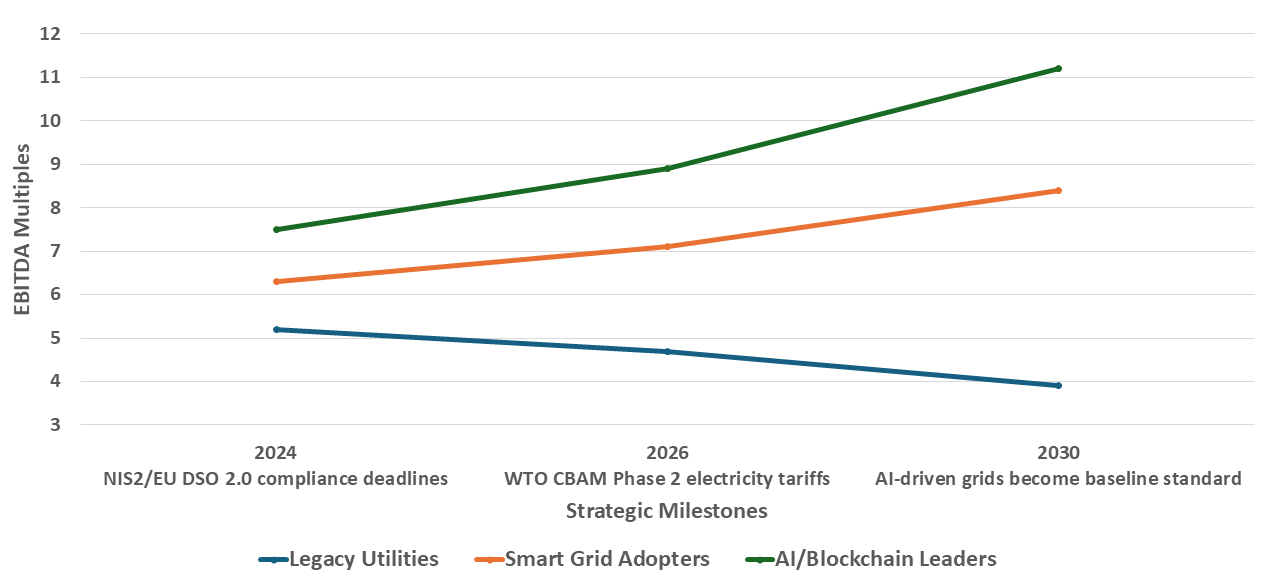

The Smart Grid Value Divide

Three Strategic Levers for Competitive Advantage

1. Modernize with Precision – Not Just for Technology’s Sake

Many utilities fall into the trap of “tech-first” deployments without aligning investments to core business outcomes.

What Leading Firms Are Doing:

-

-

- PSEG (U.S.) used AI-driven predictive maintenance to cut grid failures in two years.

- Enel (Italy) leveraged smart meters + dynamic pricing to reduce peak demand.

-

Our Recommendation:

-

-

- Start with high-impact, low-regret moves:

- Phase 1: Deploy AMI and real-time monitoring (ROI within 3 years).

- Phase 2: Integrate distributed energy resources (DERs) with grid-edge intelligence.

- Phase 3: Transition to autonomous self-healing networks.

- Start with high-impact, low-regret moves:

-

2. Turn Cybersecurity from a Cost Center into a Differentiator

Cyber threats aren’t just operational risks – they’re existential.

The Reality:

-

-

- Energy is now the first target for cyberattacks, surpassing finance.

- Less than 1 in 10 utilities worldwide meet Tier 4 cybersecurity readiness under either NIST, IEC 62443, or EU NIS2 standards.

-

Winning Playbook:

-

-

- Embed security into grid design (zero-trust architecture).

- Partner with defense-tech firms (e.g., Dragos, Claroty) for OT-specific solutions.

- Use cyber resilience as a regulatory bargaining chip – demonstrate compliance ahead of mandates.

-

3. Monetize the Data – Beyond Basic Grid Optimization

Most utilities treat smart grid data as an operational tool. The real value lies in commercializing it.

Proven Models:

-

-

- Demand Response as a Service

- Grid analytics for renewable developers (e.g., feeding real-time congestion data to wind farms).

- White-labeling DER management platforms for municipal utilities.

-

Our Take:

If you’re not extracting at least USD 2 to 5 million per year in incremental revenue from grid data, you’re leaving money on the table.

The Global Smart Grid Divide: How Grid Modernization Will Reshape Regional Energy Leadership

The smart grid revolution is unfolding at starkly different speeds across global markets – creating first-mover advantages for some and existential risks for others. Here’s how regional strategies diverge:

1. The Three-Tiered Global Landscape

|

Region |

Strategic Posture | Key Differentiator | Valuation Impact |

|

North America |

Tech-led modernization | Private capital + AI integration | 8-10x EBITDA (DER-heavy utilities) |

| Europe | Regulation-driven overhaul | Cyber-secure, hydrogen-ready grids |

15-20% premium for TSOs with EU DSO 2.0 compliance |

|

Asia |

Leapfrog deployment | State-backed ultra-HVDC + IoT saturation | 30% higher capex recovery in India/ASEAN tariffs |

| Global South | Aid-funded patchwork solutions | Off-grid hybrid systems |

Stranded asset risks up to 40% of grid investments |

2. The Make-or-Break Factors By Region

-

-

- EMEA’s Cybersecurity Mandates: EU’s NIS2 Directive forces €125 billion in grid hardening by 2027 – non-compliant operators face market exclusion.

- Asia’s State Capitalism Advantage: China’s $170 billion Grid Modernization Plan deploys 5G-enabled sensors at 1/3 the cost of Western equivalents.

- Africa’s Bypass Opportunity: Kenyan and Nigerian utilities are skipping traditional SCADA for blockchain-minimalist grids, cutting deployment costs by 60%.

-

3. The 2025 Inflection Point

By next year:

-

-

- First-mover markets (Germany, Texas, Zhejiang) will achieve <2% grid losses vs. 8-12% global average

- Laggard regions face dual crises: 25% higher cost of capital + WTO carbon border taxes on exported electricity

-

Strategic Imperative: Utilities must now choose between:

-

-

- Becoming regional champions

- Commoditized grid operators trapped in regulated returns

-

Immediate Actions for Global Players:

-

-

- Map your exposure to the USD 2 Trillion in grid subsidies flowing to 15 priority markets

- Preemptively restructure legacy cross-border interconnects before EU/ASEAN carbon rules take effect

- Develop dual-track systems – Western-grade security for home markets, lean solutions for Global South JVs

-

The Boardroom Question: How Much Should We Invest and Where?

Prioritizing Capital Allocation

|

Investment Area |

Typical Capex | Payback Period |

Strategic Value |

|

AMI & Smart Meters |

$50-150 million (per 1 million meters) | 3-5 years |

Regulatory compliance, customer insights |

|

Distribution Automation |

$20-80 million (regional roll-out) | 4-7 years |

Outage reduction, DER integration |

|

Cybersecurity Overhaul |

$10-30 million (enterprise-wide) | 2-4 years |

Risk mitigation, regulatory alignment |

| AI/ML Grid Optimization | $5-15 million (pilot to scale) | 1-3 years |

Efficiency gains, predictive capacity |

Our Advice:

-

-

- Under $500 million revenue: Focus on AMI + targeted automation (80% of benefits at 20% cost).

- $500 million to $2 billion revenue: Add cybersecurity + AI pilots.

- $2 billion+ revenue: Go all-in on DER monetization and microgrids.

-

Conclusion: Turning Smart Grid Investments into Competitive Advantage

The smart grid transition is no longer a question of if but how fast and how strategically organizations execute. The coming decade will separate winners – those who leverage smart infrastructure to drive revenue and resilience – from those burdened by stranded assets and regulatory penalties.

Key Takeaways for Leadership Teams

-

-

- Prioritize High-Impact Pilots: Focus on AI-driven grid optimization and cybersecurity hardening to achieve quick wins while scaling long-term infrastructure upgrades.

- Monetize Data Now: Unlock new revenue streams by commercializing grid analytics, demand-response programs, and DER integration services.

- Future-Proof Regulatory Compliance: Proactively align with evolving cybersecurity and decarbonization mandates to avoid costly penalties.

- Reevaluate Asset Portfolios: Identify and modernize high-risk infrastructure before depreciation erodes shareholder value.

-

The time for incremental upgrades is over. Leading utilities are already treating smart grids as profit engines, not just cost centers.

Contact our energy practice to pressure-test your smart grid strategy against 2030 market realities.